Wells Fargo (WFC.US) announced its results for the fourth quarter of 2025, which fell short of analysts' expectations. Revenue was $21.29 billion against a forecast of $21.65 billion, and earnings per share (EPS) were $1.62 against an expected $1.67. Nevertheless, net profit rose to $5.36 billion from $5.08 billion a year earlier, driven by a 4% increase in interest income to $12.33 billion, which was below the bank's own upper target range of $12.4-12.5 billion.

The dynamic results stem from expansion in the consumer and commercial segments, where the bank recorded impressive growth. CEO Charlie Scharf noted that operational savings are financing investments in infrastructure and development, visible, among other things, in a 20 per cent increase in new credit cards and a 19 per cent increase in car loans. After the asset cap ($1.95 trillion) was lifted in June, assets exceeded $2 trillion for the first time, enabling further expansion. The bank closed seven regulatory orders related to the fictitious account scandal, leaving only one from 2018. WFC shares, after a 32.7 per cent increase in 2025, fell by about 2 per cent today before the session.

Key Q4 results vs expectations:

-

Revenue: $21.29 billion (lower than the forecasted $21.65 billion)

-

Net profit: USD 5.36 billion (+5.5% y/y); excluding one-off items: USD 5.8 billion and EPS USD 1.76

-

Net interest income (NII): $12.33 billion (lower than the expected $12.46 billion, but close to the bank's targets)

-

Provisions for credit losses: USD 1.04 billion (down from USD 1.10 billion y/y)

-

ROE: 12.3%

-

Deposits: USD 1.38 trillion (higher than the forecasted USD 1.36 trillion)

-

Restructuring cost: $612 million ($0.14 per share) for workforce reduction.

Forecasts for 2026:

-

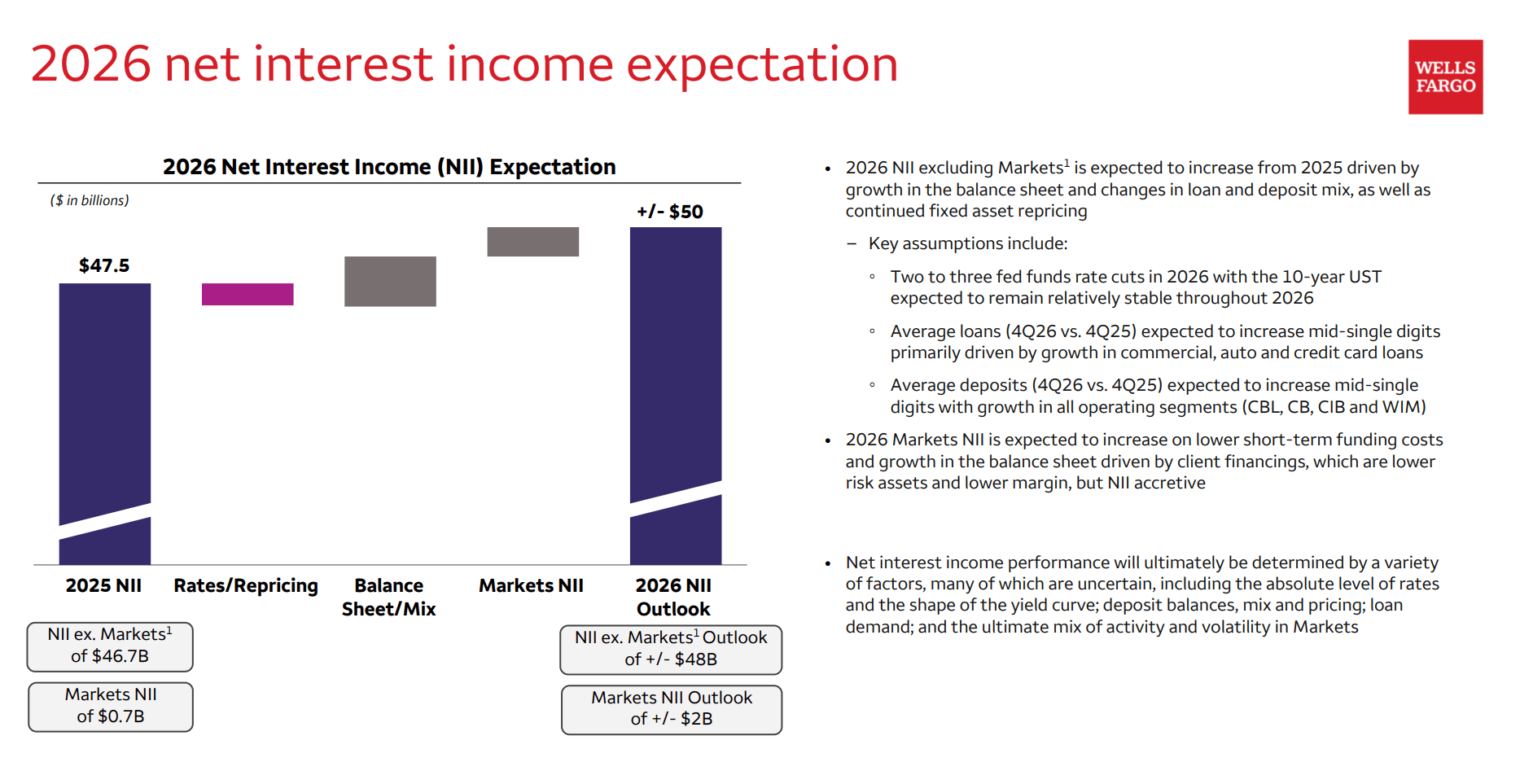

Interest income (NII): +/- USD 50 billion (up approx. 5% y/y from USD 47.5 billion in 2025; analysts expected USD 50.21 billion); excluding the Markets segment: +/- USD 48 billion compared to USD 46.7 billion in 2025

-

Total expenditure: approx. USD 55.7 billion (stable or minimal increase of 1–2% y/y from 2025, thanks to savings and AI)

-

NII in Markets (division covering trading in equities, bonds, currencies and commodities): +/- USD 2 billion (increase due to lower financing costs and balance sheet growth; in 2025 it was only USD 700 million)

Wells Fargo enters 2026 in a strong position, focusing on artificial intelligence to improve efficiency. Wells Fargo interest rate forecasts above. Source: Wells Fargo

Summary:

Wells Fargo announced its Q4 2025 results, which disappointed analysts – revenue and earnings per share were weaker than forecast, despite year-on-year net profit growth thanks to higher interest income. The bank praised its expansion in consumer and commercial lending, exceeding the $2 trillion asset threshold after the regulatory cap was lifted, and closing most of the orders related to the fake account scandal. Deposits exceeded market expectations, and loan loss provisions decreased. For 2026, management expects stabilisation of expenses and growth in interest income, particularly in the Markets segment with stock and commodity trading.

Although the Bank's shares are losing ground today before Wall Street opens, in the long term they continue to move in an upward trend determined by exponential moving averages. Particular attention should be paid to the 100-day EMA (purple curve), which repeatedly provided price support for WFC.US shares in 2025. Source: xStation

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈

Paramount Skydance shares under pressure after S&P warning

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.