The Wendy's Company, on August 9, 2023, announced its unaudited results for the second quarter ending July 2, 2023. The company showcased significant sales and profit growth, with a notable increase in the US company-operated restaurant margin. The breakfast and late-night segments experienced substantial growth, and the company's digital strength persisted. Wendy's also reported 80 global restaurant openings in the first half of the year. The company's president and CEO, Todd Penegor, expressed confidence in achieving their short and long-term growth outlooks. Todd Penegor also highlighted the company's progress against their strategic growth pillars, emphasizing the significant profit expansion supported by strong same-restaurant sales momentum.

Operational Highlights:

- Systemwide sales growth: US at 6.1%, International at 12.7%, and Global at 6.9%.

- Same-restaurant sales growth: US at 4.9%, International at 7.2%, and Global at 5.1%.

- Systemwide sales: US at $3,185 millions, International at $461 millions, and Global at $3,646M.

- Restaurant openings: Wendy opened 80 new global restaurants, but in net figures it was 14 restaurants in the US and 14 restaurants internationally

Financial Highlights:

- Total revenues increased to $5,616M, a 4.4% growth.

- US company-operated restaurant margin increased by 2.3%.

- Operating profit rose to $1,093M, a 13.5% growth.

- Net income surged to $596M, a 23.7% increase.

- Adjusted EBITDA stood at $1,445M, marking an 8.7% growth.

- Reported EPS was $0.28, a 27.3% growth.

- Free cash flow was reported at $1,335M, a 40.2% increase.

For the year 2023, The Wendy's Company has provided the following projections:

- Global systemwide sales growth is expected to be between 6 to 8%.

- Adjusted EPS are projected to be between $0.95 to $1.00.

- Cash flows from operations are anticipated to be between $340 to $360 million.

- Capital expenditures are expected to range from $75 to $85 million.

- Free cash flow is projected to be between $265 to $275 million.

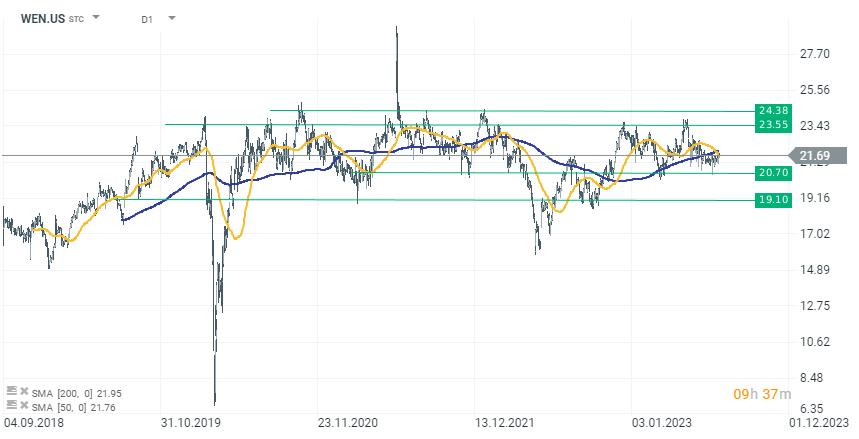

WEN.US - Wendy's shares have essentially been moving in a sideways trend since 2019, limited within the range of 19.10 and 24.38 dollars per share. After announcing the results, the stock price is down 0.41% in pre-market trading, source xStation 5

WEN.US - Wendy's shares have essentially been moving in a sideways trend since 2019, limited within the range of 19.10 and 24.38 dollars per share. After announcing the results, the stock price is down 0.41% in pre-market trading, source xStation 5

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.