-

Start of U.S. bank earnings season: Major U.S. banks are reporting results at a crucial moment marked by the government shutdown and limited recent economic data. Analysts are expected to seek clues about the outlook for the U.S. economy.

-

Pressure on Net Interest Margin: The Federal Reserve’s rate cuts (-75 bps since last September) have reduced profitability in traditional lending and deposit activities. However, resilient economic growth and stronger home sales provide some support.

-

Rebound in Investment Banking and Trading: Investment banking revenues could exceed $9 billion, up 13% year-over-year, driven by a recovery in debt issuance and M&A activity. Trading divisions are expected to generate around $31 billion, roughly 8% higher than last year thanks to elevated market volatility.

-

Supportive environment from deregulation: The planned relaxation of capital rules could free up as much as $2.6 trillion in lending capacity, strengthening large Wall Street banks, enabling greater investment in AI and data centers, and allowing higher shareholder returns through dividends and buybacks.

-

Start of U.S. bank earnings season: Major U.S. banks are reporting results at a crucial moment marked by the government shutdown and limited recent economic data. Analysts are expected to seek clues about the outlook for the U.S. economy.

-

Pressure on Net Interest Margin: The Federal Reserve’s rate cuts (-75 bps since last September) have reduced profitability in traditional lending and deposit activities. However, resilient economic growth and stronger home sales provide some support.

-

Rebound in Investment Banking and Trading: Investment banking revenues could exceed $9 billion, up 13% year-over-year, driven by a recovery in debt issuance and M&A activity. Trading divisions are expected to generate around $31 billion, roughly 8% higher than last year thanks to elevated market volatility.

-

Supportive environment from deregulation: The planned relaxation of capital rules could free up as much as $2.6 trillion in lending capacity, strengthening large Wall Street banks, enabling greater investment in AI and data centers, and allowing higher shareholder returns through dividends and buybacks.

Today marks the start of earnings presentations for the U.S. banking sector, at a crucial moment, now more important than ever due to the government shutdown. Given the lack of published economic data in recent weeks, analysts are expected to take this opportunity to ask about forecasts and possible clues regarding the U.S. economy. What can we expect from banks this quarter?

Net Interest Margin

This is the classic source of income for banking institutions and the most important item on their income statements: the bank earns interest on the loans it grants (mortgages, consumer loans, corporate loans) and pays interest on the funds it raises (deposits, debt, other liabilities). The difference between what it receives from interest-bearing assets and what it pays for its liabilities is the net interest margin. This line item tends to be the most stable, and often the largest, in commercial banks.

The difference between the 2-year and 10-year U.S.Treasury yields. Source: XTB

In last quarter’s earnings presentations, net interest income raised some concerns, falling short of market estimates in most cases. Particularly worrying were the figures from Wells Fargo, an institution less tied to other sources of income such as fees or investment banking, and more dependent on traditional commercial banking activities. We do not rule out that this trend may continue. The Federal Reserve already cut interest rates by 50 basis points in September of last year and by another 25 basis points just a few weeks ago, leaving less room to generate higher income in this category.

Even so, the U.S. economy continues to show resilience, and both economic growth and home sales have surprised to the upside in recent weeks, offering some hope of improvement in this area.

Investment Banking

Revenues from the investment banking divisions of Wall Street’s largest banks are expected to surpass $9 billion in the third quarter for the first time since 2021. Corporate transactions have shown signs of growth under the Trump administration after months of subdued activity caused by the trade war.

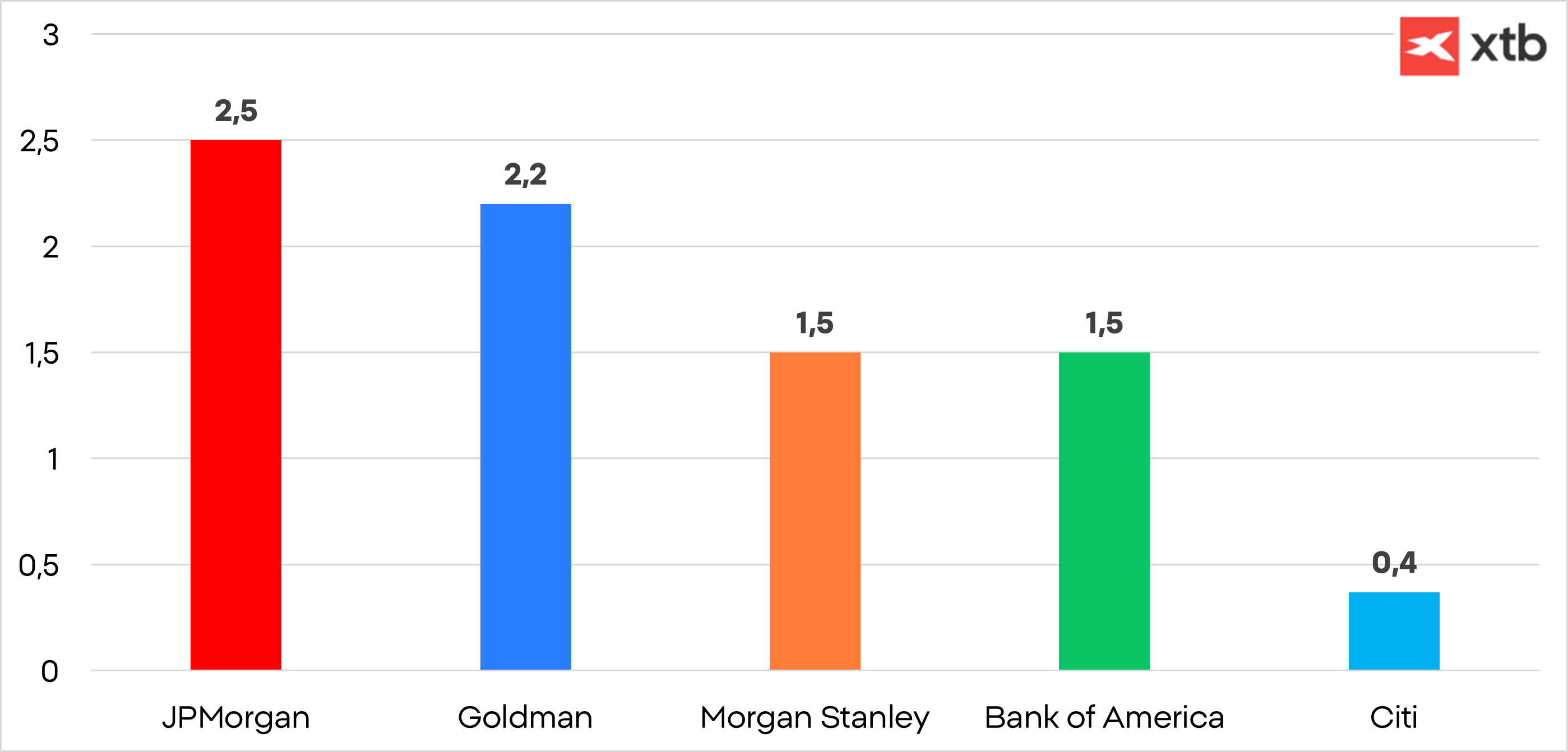

Analysts expect that the quarterly revenues reported this week from advisory and equity/debt underwriting activities at JPMorgan, Bank of America, Citigroup, Goldman Sachs, and Morgan Stanley will total around $9 billion.

Investment banking results for the second quarter of the year. Source: XTB.

That would represent a 13% increase compared to last year, with Goldman Sachs and JPMorgan expected to lead this growth. In fact, in the previous quarter, these two were the biggest positive surprises, beating the most optimistic estimates. Debt issuance rose 12%, and M&A advisory fees climbed 8%, both defying analysts’ expectations of a year-over-year decline. Equity underwriting revenues fell 6%, while analysts had forecast a 29% drop The outlook for the third quarter reflects growing optimism on Wall Street that the surge in new corporate acquisitions, leveraged buyouts, and stock listings predicted after Donald Trump’s return to the White House may now be materializing..

Trading

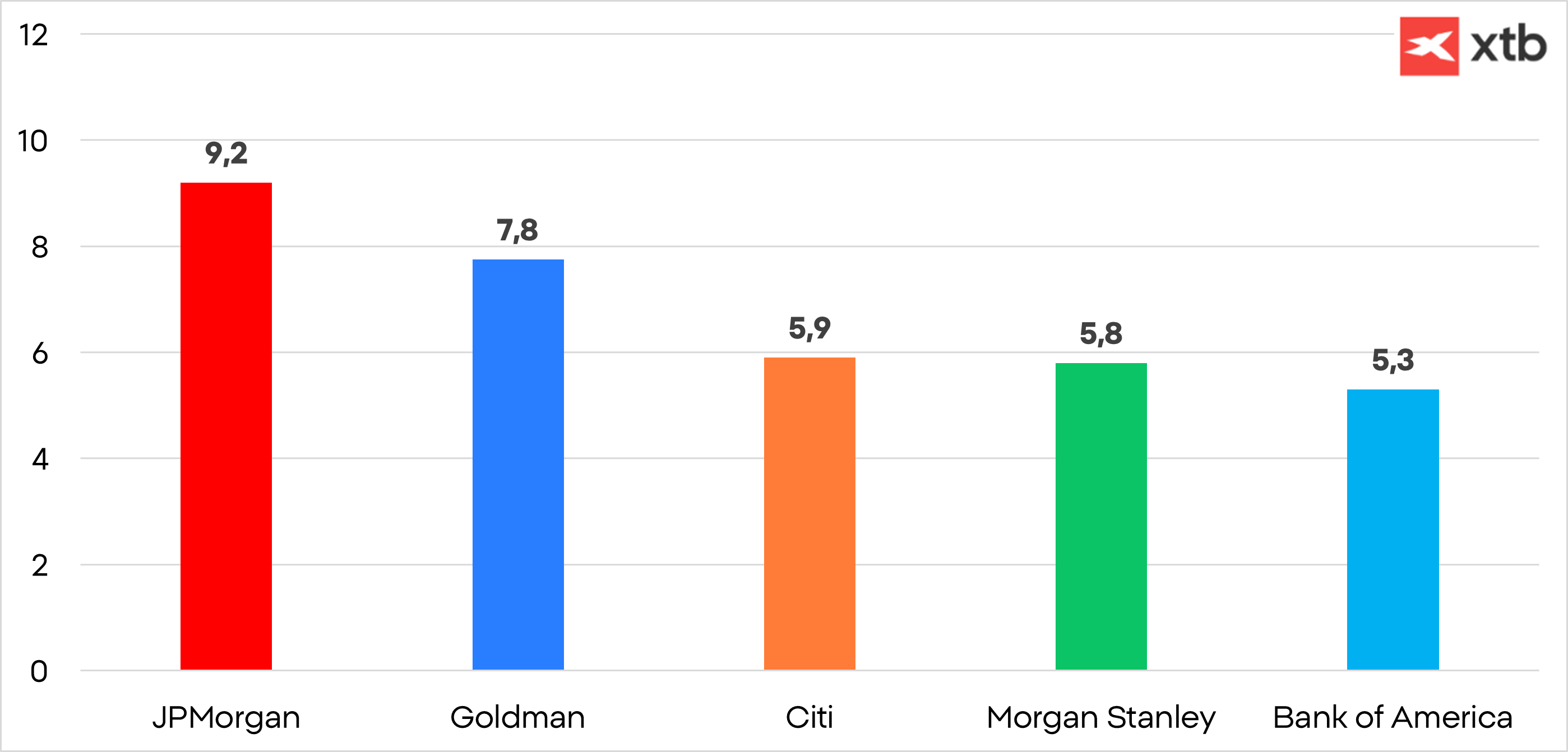

Trading divisions have generated higher-than-expected revenues over the past few years, particularly in the last quarter, thanks to the high market volatility resulting from Donald Trump’s trade policies However, forecasts suggest that equities and fixed-income trading operations in the five major banks will be about 8% higher than a year earlier, totaling around $31 billion.

Earnings generated from trading activities in U.S. financial institutions. Source: XTB

Deregulation

U.S. banks are preparing for unprecedented capital rule relaxation, which, according to new research, could free up $2.6 trillion in lending capacity.

The reduction in capital requirements will reinforce the dominant position of the large Wall Street groups, increase their ability to finance massive investments in artificial intelligence and data centers, and allow them to return more capital to shareholders through buyback programs and dividends.

It will also help finance new U.S. government debt issuances, at a crucial time when demand from foreign buyers has fallen — a factor that has been used as leverage in the ongoing trade negotiations.

With all these factors combined, we expect a positive earnings season, especially for those institutions with greater exposure to investment banking and trading activities.

How to Invest in the Sector

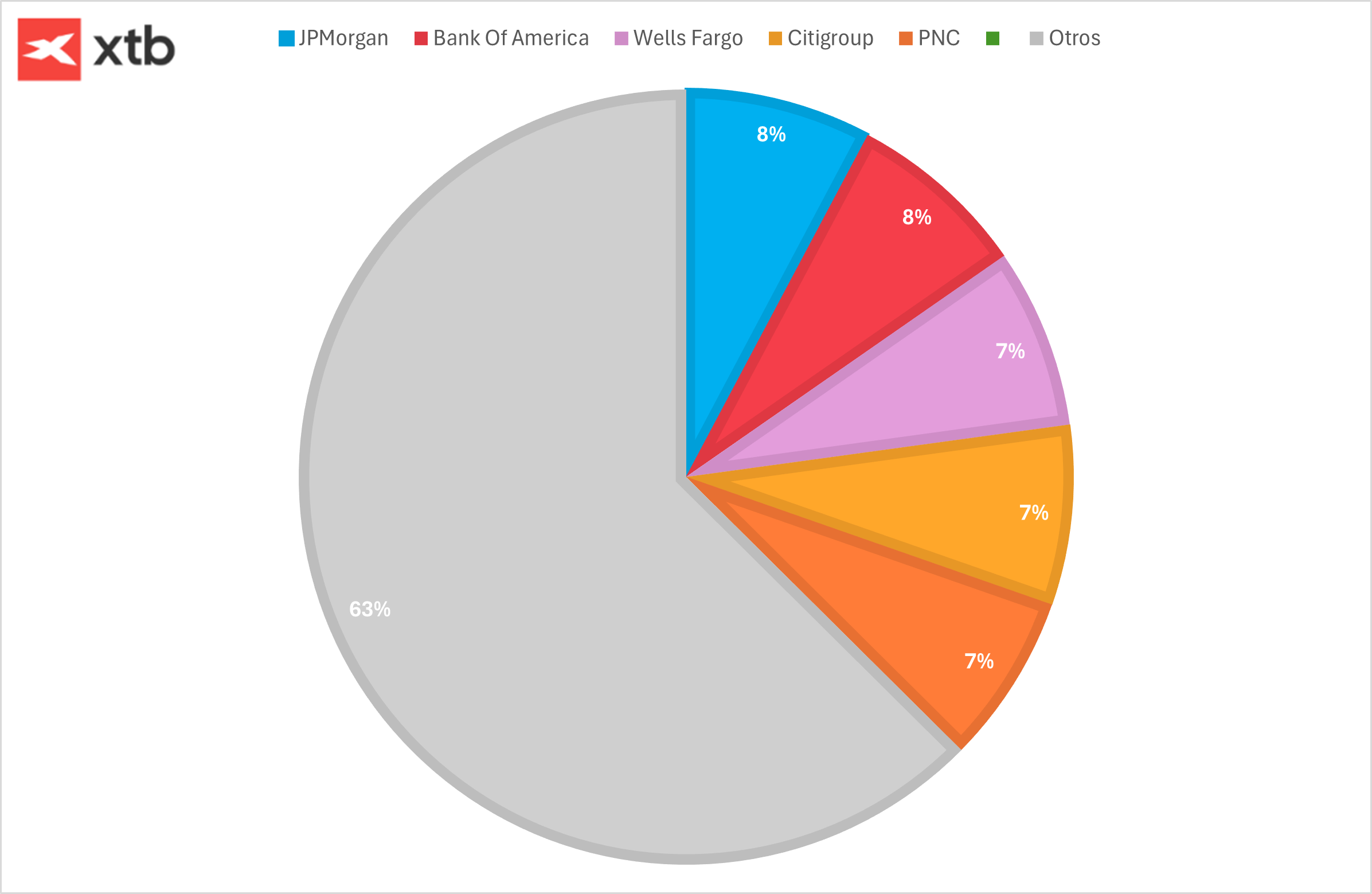

Clients can invest in individual stocks like the ones mentioned above, or alternatively through an ETF that replicates the overall performance of the sector.

In this case, one option is the S&P U.S. Banks ETF (ticker: IUS2.DE), whose main holdings include Citigroup, Bank of America, JPMorgan, and PNC.

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.