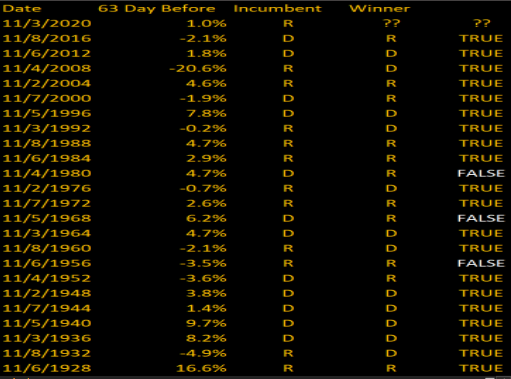

Bloomberg came out with an interesting insight into how S&P 500 behaves in the run-up to US presidential elections and whether this year's performance can tell us something about who is going to win the White House. A three-month period preceding US presidential elections was analyzed (63 trading sessions). Researchers concluded that positive S&P 500 return during the period leading up to Election Day has favoured candidates of the incumbent party while negative return advocated for a shift towards the challenger party. While it is impossible to develop a golden rule that would always perfectly predict the election outcome, the one proposed here has a decent track record - it has correctly predicted the outcome of 20 out of 23 elections held since 1928. Moreover, the last time this rule provided a false signal was in 1980, when Republicans took over White House in spite of a 4.7% price gain registered in the 63-session period leading up to elections. What does it tell us this time? S&P 500 has gained 1% over the 3-month period leading up to November 3, signalling that Trump could be heading for re-election tonight.

However, a caution is needed with such rules. This one is based on the assumption that good stock market performance reflects good performance of the economy and, in turn, reflects optimism of the society over incumbent party's policies. Nevertheless, one should keep in mind that we are still in the midst of coronavirus pandemic and while stimulus measures pushed US indices towards pre-pandemic levels, economic output and employment levels are still lower year-to-date. Apart from that, sample size in the study (23 elections) is too small to draw far-reaching conclusions.

3-month S&P 500 return hinting at Trump re-election? Source: Bloomberg

3-month S&P 500 return hinting at Trump re-election? Source: Bloomberg

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Strong Service ISM Reading as activity expanded most since 2022

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.