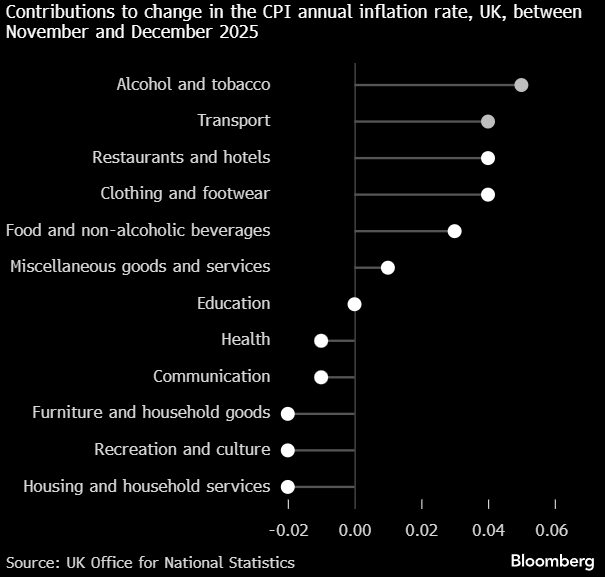

Inflation in the United Kingdom accelerated for the first time in five months, reaching 3.4% y/y in December, compared to 3.2% in November, slightly above economists' forecasts (3.3%). The rise in prices was mainly driven by an increase in tobacco excise duty and higher airfares. Services inflation, a key indicator for the Bank of England, rose to 4.5% from 4.4%, but weaker than expected. The Bank of England predicts that inflation will approach its 2% target in the spring, supported by government measures, including freezing rail fares and reducing energy bills. Despite this, the central bank is approaching the end of its cycle of interest rate cuts, monitoring the labour market for signs of a slowdown. The pound lost slightly in value after the data was released, but is currently hovering around USD 1.3440, and expectations for future rate cuts remain largely unchanged.

In December, tobacco prices rose by 3% month-on-month due to the postponement of tax increases, and airfare prices jumped by 28.6% m/m, leading to the highest inflation rate in transport since 2022. Food prices rose by 4.5% y/y, mainly due to bread and cereals, with declines recorded in categories such as recreation, games and sports equipment. At the same time, the data indicate a decline in cost pressures in industry – factory gate prices remained unchanged, while raw material and fuel prices fell. Bloomberg economists estimate that December's inflation rise will not change the Bank of England's policy, as the overall disinflationary trend continues. The labour market shows signs of weakening, with the lowest wage growth since 2020 and unemployment at 5.1%. signs of weakness, with the lowest wage growth since 2020 and unemployment at 5.1%, although the number of job vacancies rose slightly. In November, GDP surprised with a positive result of +0.3% m/m, suggesting some resilience in the economy.

Chart showing contributions to CPI inflation in the United Kingdom. Source: ONS, Bloomberg Financial Lp

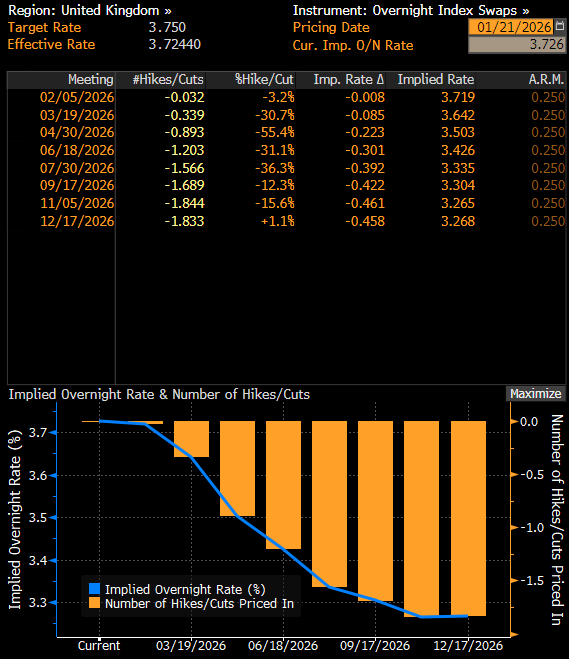

The futures market currently indicates that the Bank of England will decide on one interest rate cut in 2026 (fully priced in) with an 83% chance of a second such move at the end of the year. Source: Bloomberg Financial Lp

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.