Salesforce (CRM.US) is scheduled to report fiscal-Q4 2024 earnings report (calendar November 2023 - January 2024) today after close of the Wall Street session. Stock jumped over 50% off the late-October 2023 low and around 14% year-to-date higher. Options pricing implies an over-10% post-earnings share price move.

What analysts expect from Salesforce earnings?

Fiscal-Q4 2024

- Total revenue: $9.22 billion (+10% YoY)

- Subscription and support revenue: $8.62 billion (+10.7% YoY)

- Sales: $1.97 billion (+10.2% YoY)

- Services revenue: $2.14 billion (+11.3% YoY)

- Platform & other revenue: $1.73 billion (+11% YoY)

- Marketing & commerce revenue: $1.28 billion (+8.8% YoY)

- Data revenue: $1.5 billion (+11.6% YoY)

- Professional services and other revenue: $604.2 million (+1.6% YoY)

- Subscription and support revenue: $8.62 billion (+10.7% YoY)

- Total billings: $15.83 billion (+7.8% YoY)

- Unearned revenue (end of period): $18.95 billion (+9% YoY)

- Adjusted gross profit: $7.33 billion (+10.1% YoY)

- Adjusted gross margin: 79.2% vs 79.45% a year ago

- Adjusted operating income: $2.9 billion (+18.8% YoY)

- Adjusted operating margin: 31.4% vs 29.2% a year ago

- Adjusted net income: $2.23 billion (+34.4% YoY)

- Adjusted net margin: 24.2% vs 22.3% a year ago

- Adjusted EPS: $2.27 vs $1.68 a year ago

- Remaining performance obligations: $54.01 billion (+11.1% YoY)

- Current remaining performance obligation: $27.1 billion (+10.1% YoY)

- Non-current remaining performance obligation: $26.7 billion (+21.4% YoY)

- Free cash flow: $2.29 billion (-10.9% YoY)

Fiscal-Q1 2025 forecast

- Revenue: $9.16 billion

- Adjusted EPS: $2.19

Full fiscal-2025 forecast

- Revenue: $38.62 billion

- Adjusted EPS: $9.63

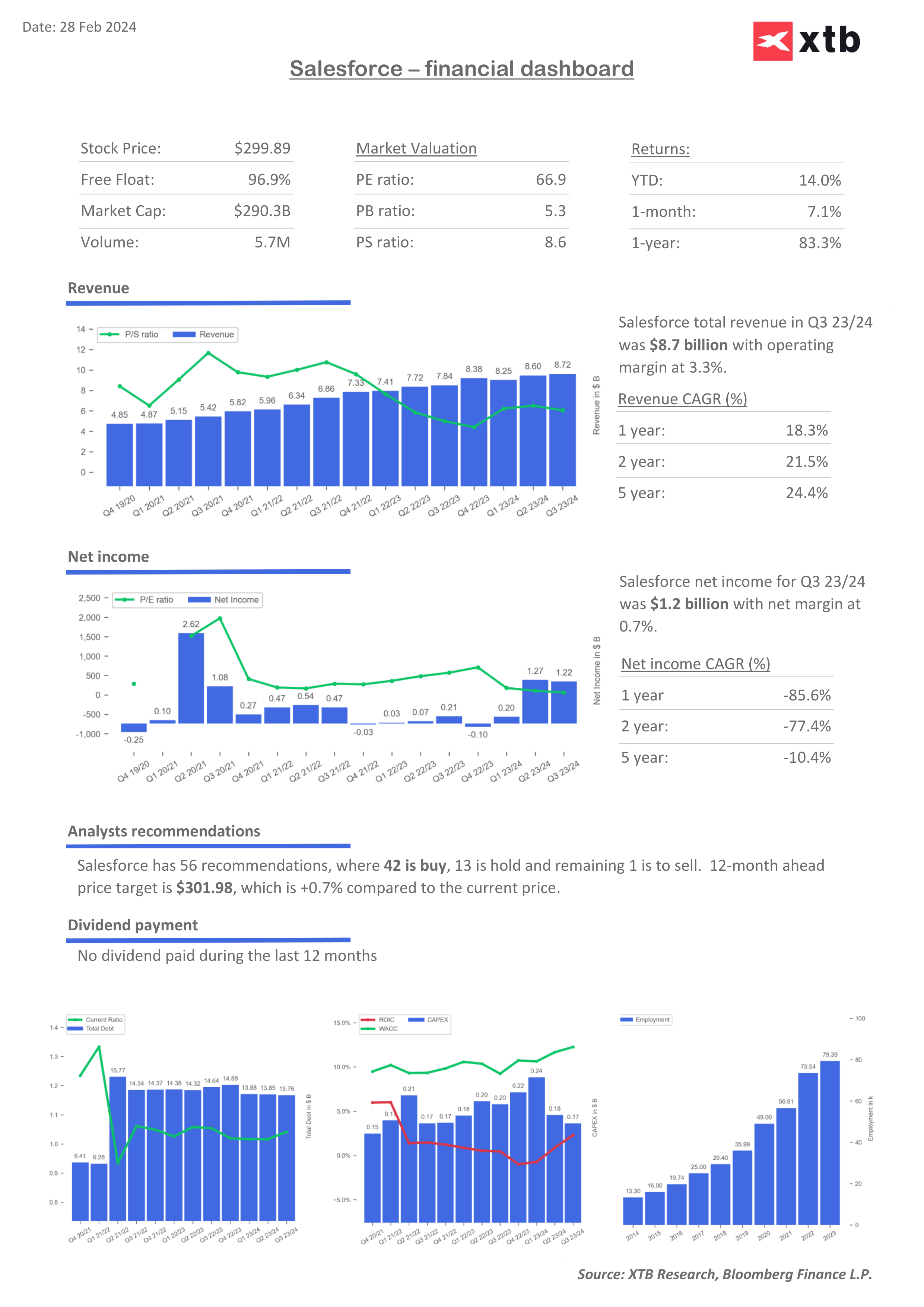

Financial dashboard for Salesforce. Source: Bloomberg Finance LP, XTB Research

What to focus on?

There are few things to focus on in Salesforce's fiscal-Q4 2024. Of course, result for the fourth quarter will play a role in market's reaction. However, more attention may be paid to what has driven those results and what the company expects for the future. Given we are in the midst of AI revolution, there will be a lot of attention on this technology. Salesforce unveiled its conversational generative AI tool this week. While it is unlikely that generative AI will have a meaningful impact on results now, any guidance on impact on future growth will be closely watched.

Salesforce has embarked on a quest to adjust its cost structure in order to improve its profitability. While it has managed to greatly improve in the first three quarters of fiscal-2024, investors are eager to know whether this improvement will continue into fiscal-2025.

A look at the chart

Salesforce (CRM.US) broke above the $300 mark earlier this week for the first time since late-2021. However, stock has erased part of the gains amid pre-earnings uncertainty. Options market pricing is suggesting that investors are expecting a massive volatility spike. Currently, options imply a 10.4% post-earnings share price move. This means that there is a high likelihood that sales will reached fresh all-time highs if earnings release is seen as a positive. Stock trades less than 4% below all-time highs reached near $311.50 mark back in early-November 2021.

Salesforce (CRM.US) at W1 interval. Source: xStation5

Salesforce (CRM.US) at W1 interval. Source: xStation5

Daily summary: Sentiments on Wall Street stall at the end of the week🗽US Dollar gains

AbbVie near 1-month low after earnings report 📉

Wall Street optimism tempers amid falling odds of December Fed rate cut

DE40: Decline of sentiment in Europe

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.