-

Bank of England to announce monetary policy decision at 12:00 pm BST

-

Economists expect a 50 bp rate hike

-

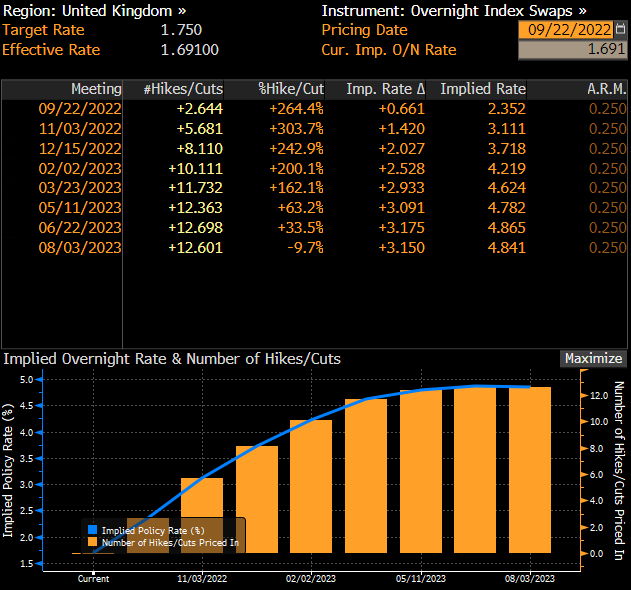

Market prices in a 60% chance of a 75 basis point rate hike

-

Markets awaits BoE views on new fiscal package

-

Decision on active bond sales also on watch

-

EURGBP trades in an upward channel

The Bank of England was originally set to announce its monetary policy decision last week on Thursday, 12:00 pm BST. However, the decision was delayed by a week due to the passing of Queen Elizabeth II and a period of national mourning. The Bank of England has already warned at its previous meeting that it expects the UK economy to go into recession in the final quarter of 2022 and that such possibility will not discourage it from hiking rates to combat inflation.

What to expect from the Bank of England today?

There are no clear expectations for today's rate move from the Bank of England. Consensus among economists is for a 50 basis point rate hike. However, money markets price in a 60% chance of a large move - a 75 bp rate hike. As such there is a headline risk and a scope for wild moves on GBP market following the announcement. However, a lot of attention will be paid to details - distribution of MPC votes and future outlook.

It is expected that the decision will not be unanimous. While all BoE members agree that tightening is needed, some say it should be a 50 bp move and some see a 75 bp as appropriate. However, there are also more dovish members, like Silvana Tenreyro, who are seen inching more towards a 25 bp hike. Also guidance, if offered, will be on watch. According to current pricing, markets see BoE rates at 3.75% at the end of 2022 - or 200 bps higher than now. With only 3 meetings remaining, including today's, this means that BoE will have to deliver at least one 75 bp or bigger rate hike.

Market sees an over-60% chance of 75 bp rate hike at today's meeting. Source: Bloomberg

Market sees an over-60% chance of 75 bp rate hike at today's meeting. Source: Bloomberg

Views on fiscal policy

A lot has changed in case of fiscal policy since the previous BoE meeting. A change of Prime Minister led to the announcement of massive fiscal programmes, aimed at supporting households and businesses during the upcoming winter of shortages. How does the central bank see it? Will it result in lower peak inflation or will it provide more fuel for price growth? The Bank of England expects the UK economy to enter recession in Q4 2022 so attention will also be on whether this view changed. However, it looks unlikely that the new fiscal package will prevent an economic downturn but may lower its severity.

Bond sales

Bank of England said at its previous meeting that it plans to begin active government bond sales shortly after its meeting in September. Are those plans still in place? There is still no certainty how a new fiscal package will be funded. UK yields dropped recently amid expectations of increased fiscal spending and beginning active bond sales would exert upward pressure on those. This means that the cost of borrowing in the UK would increase, what would be a rather unwelcome development for the government that needs to finance increased spending. As such, there is a chance that BoE will delay the start of bond sales until more clarity on fiscal measures is provided.

A look at the market

GBP has been underperforming as of late with GBPUSD dropping to levels not seen since the 1980s. Situation looks a bit better on the EURGBP market but even in this case a break to fresh 19-month highs occurred recently. EURGBP has been trading in an upward channel since mid-August and has recently broken above the mid-June high at 0.8720. The pair retested this level as a support yesterday but no break below occurred, thus confirming the bullish bias in the market. A near-term resistance level to watch can be found at recent high of 0.8787.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.