Bank of England is set to announce its next monetary policy decision tomorrow at 12:00 pm BST. Economists seem unanimous in their expectations and point to BoE delivering a 25 basis point rate hike tomorrow, bring the main UK rate to 4.50% - the highest level since October 2008. Moreover, it would be the 12th consecutive rate hike from the UK central bank. Money market almost fully price in a 25 bp rate hike and suggests a very slim chance of any other outcome. However, the real question is what comes next.

UK inflation remains elevated with headline CPI coming in at 10.1% YoY in March. While this was a slowdown from the 10.4% YoY report in February, a deceleration off the October 2022 peak of 11.1% YoY has been very slow. Core gauge remained unchanged in March at 6.2% YoY. Persisting inflation as well as rather solid macroeconomic data - economists expect the UK economy managed to avoid contraction and grew at a pace of 0.1% QoQ in Q1 2023 (release - Friday, 7:00 am BST) - give BoE some room to continue tightening. Money markets currently expect rates in the UK to peak at 5.00% in November 2023, requiring two additional 25 bp rate hikes after one we are likely to see tomorrow.

Investors should keep in mind that a clear and direct guidance on rate levels is unlikely to be offered. Instead, BoE would likely offer a vague statement that the current macroeconomic situation may warrant more tightening. Traders should therefore pay attention to how votes in the Monetary Policy Committee (MPC) split. If 7 MPC members vote in favor of a hike and 2 vote for rates to stay unchanged - no change in composition from previous meeting - market may take it as BoE continuing on its course. However, an increase in the number of MPC members voting for a cut could be seen as highly dovish and may exert pressure on GBP. GBP is also likely to react to new set of economic projections - a higher inflation forecast may boost rate hike odds and therefore support the British pound.

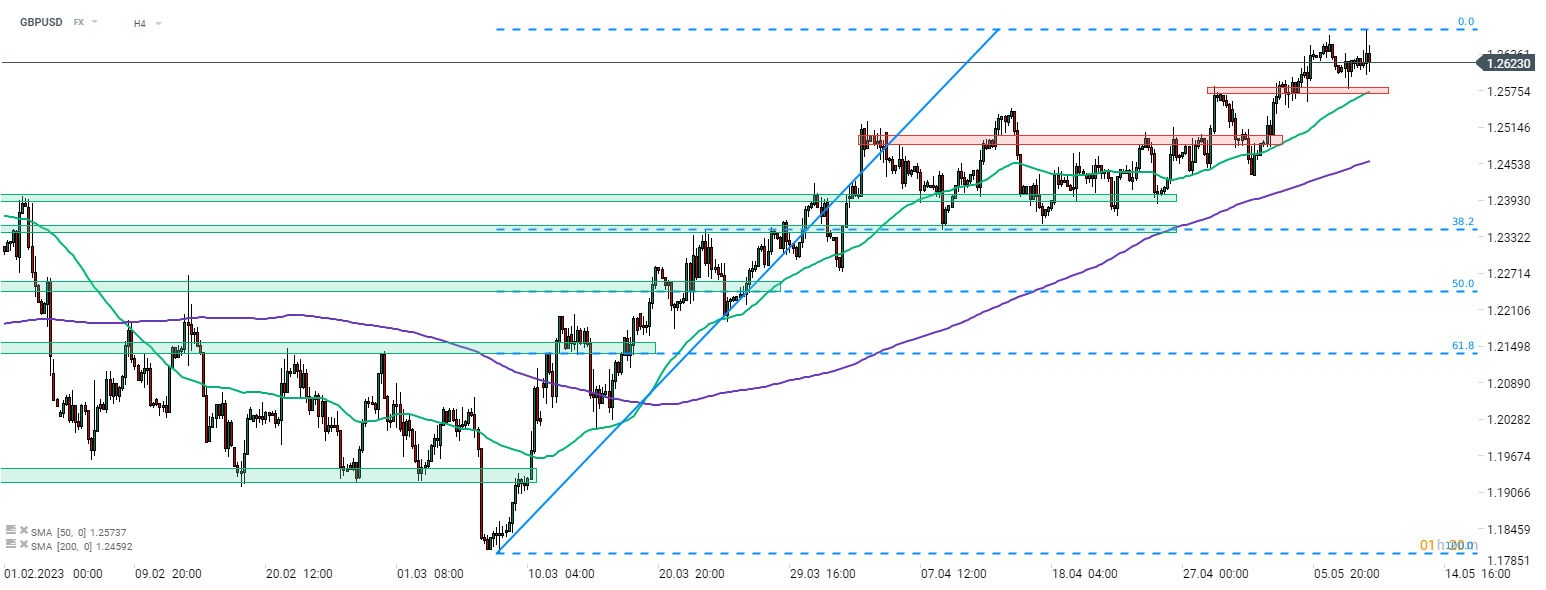

GBPUSD jumped to a fresh 1-year high after US CPI data release earlier today. However, USD regained ground later on and the whole post-CPI upward move was erased with the pair now trading more or less unchanged compared to preannouncement levels. Future of the GBPUSD rally will likely depend on what the Bank of England does tomorrow - growing number of MPC doves may put further gains under question while upward revision in CPI forecast could provide more fuel for the rally. Source: xStation5

GBPUSD jumped to a fresh 1-year high after US CPI data release earlier today. However, USD regained ground later on and the whole post-CPI upward move was erased with the pair now trading more or less unchanged compared to preannouncement levels. Future of the GBPUSD rally will likely depend on what the Bank of England does tomorrow - growing number of MPC doves may put further gains under question while upward revision in CPI forecast could provide more fuel for the rally. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.