The dovish rate cut in the US has shaken up the mood in the global economy. While money markets had been righteously betting on a more decisive 50 bp cut, the economists surveyed for Bloomberg found themselves against all odds, opting in vast majority for standard 25 bps. With tension partially released in the US, all eyes are turning to the Bank of Japan, set to make their policy announcement tomorrow.

What to expect from BoJ?

Bank of Japan is widely expected to leave its policy rate unchanged, with a target rate remaining at its current 0.25 percent level. Money market is currently confident that BoJ will remain on track with its current rates, leaving almost no room for any move in policy.

Money markets pricing in 1% chance for a rate cut, virtually indicating no policy change upon the next meeting. Source: xStation5

Not so hawkish Ueda

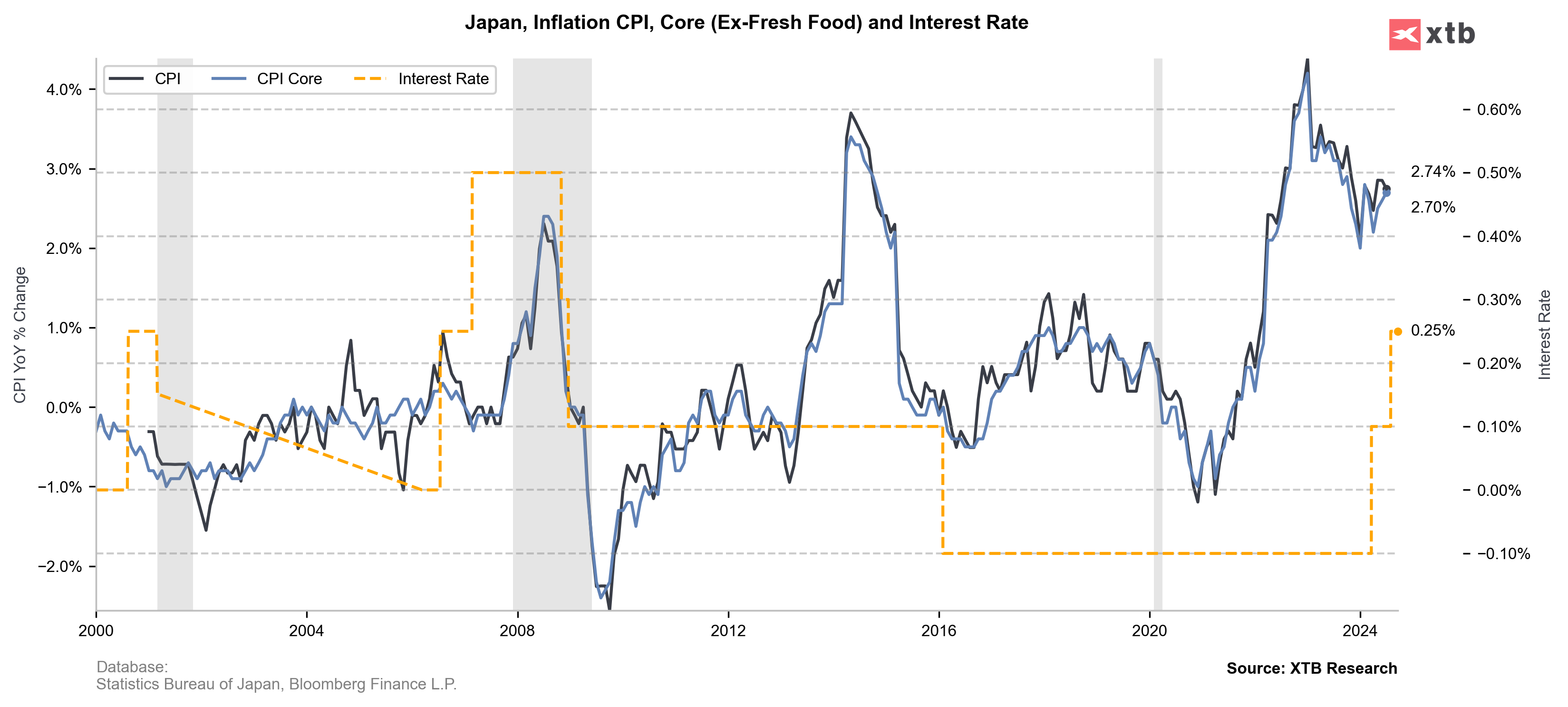

A recently unexpected rate hike in Japan caused widespread anxiety on financial markets, due to the sharp turn in direction of monetary policy in Japan and the US. While July’s labor data exercised significant pressure on Fed to cut interest rates more aggressively, BoJ’s Ueda underlined the central bank’s readiness to raise interest rates, if the inflation keeps going up. However, despite CPI for July being slightly above the expectations (2.74%, exp.: 2.7%, previous: 2.85%) there’s a firm consensus that BoJ will postpone potential adjustments further into the year, as it first wants to see the effects of the recent 0.15 bp hike.

Interest rate in Japan is at its 16-year high. BoJ’s monetary policy has already brought the inflation down from its recent peaks, while upcoming CPI readings remain crucial for additional policy adjustments. Source: XTB Research / Bloomberg Finance L.P.

At the moment, the market is pricing that the BoJ will raise interest rates by 22 basis points over the next 12 months. This means that effective interest rates will remain in the 0.25% region in the near term. This could result in renewed downward pressure on the yen in the long term against banks (and the currencies they represent) maintaining “more hawkish” policies. Source: Bloomberg Finance L.P.

USDJPY gains despite Fed’s 50 bp cut

Muted expectations towards BoJ’s policy has helped dollar to gain against yen, while appreciating against all of the other major currencies. We could expect a potential reversion around 143-143.100 rate once the Japan central bank’s decision sinks in and CPI data set the mood for the upcoming month.

From a technical point of view, however, the USDJPY pair continuously remains in a dynamic downtrend, as evidenced by the downward skewed moving averages. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.