Summary:

-

Conservatives hold strong lead in polls

-

GBP remains near 6-month highs

-

Is there potential for a surprise?

As we begin the final two weeks of the UK election campaign the Conservative party continue to hold a strong lead in the polls. A majority for the party that has been in power for the past 9 years is seen as positive for the pound in the near-term, and the continued strength in their showing has kept the currency supported towards the upper echelons of its 6-month range against both the US dollar and the Euro.

In recent days there’s been the release of the manifestos for both of the main parties, as well as two televised debates involving the respective leaders and overall this seems to have changed little. This will no doubt be pleasing for the Conservatives who will be hoping that the coming weeks remain uneventful as they likely grow increasingly confident that this election is theirs to lose.

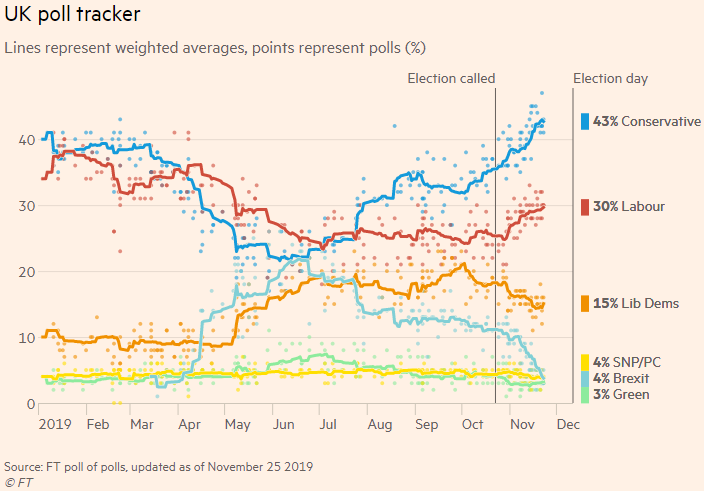

According to opinion polls, there’s been an increase in popular support for both the main parties since the election was called, but more importantly the gap between the Conservatives and Labour has remained fairly steady at around 10-15%. Source: FT poll of polls

According to opinion polls, there’s been an increase in popular support for both the main parties since the election was called, but more importantly the gap between the Conservatives and Labour has remained fairly steady at around 10-15%. Source: FT poll of polls

The better than expected performance at the 2017 election from Labour and the under performance of the Conservatives was characterised by a surge in support for the former during their respective campaigns. The gap between the Conservative and Labour party was even more marked when the last election campaigns began and while support for the Conservatives didn’t change too much, Labour made huge strides. They will need to start making a move soon if they are hoping for a repeat. Source: FT poll of polls

The better than expected performance at the 2017 election from Labour and the under performance of the Conservatives was characterised by a surge in support for the former during their respective campaigns. The gap between the Conservative and Labour party was even more marked when the last election campaigns began and while support for the Conservatives didn’t change too much, Labour made huge strides. They will need to start making a move soon if they are hoping for a repeat. Source: FT poll of polls

It’s worth pointing out that due to the first past the post electoral system in the UK there can be large discrepancies between the level of popular support and the number of seats won in parliament. Bookmakers are currently suggesting the Conservatives are on track for 348 seats. Worth noting 326 seats needed for a majority. Source: Sporting Index

Potential sources for a surprise

However, elections rarely go exactly as expected and we only need to look at the surprise results of the 2015 and 2017 general elections - never mind the 2016 EU referendum - to realise there is obviously scope for a shock. In addition, given that this is the 1st December election in almost a century there are several factors at play which could be seen to increase the chances of a possible upset.

Turnout

A key determining factor of all election results is the level of turnout and in general there is a belief that the higher the turnout, the worse it would be for the Conservatives. Along these lines, those hoping to see the Conservatives not secure a majority will take heart from a recent surge in voter registration. If you don’t count deadline days, Friday 22nd November saw the largest number of voters register in history, and even if you do, the 300,000 figure was still the 4th largest on record. Approximately two-in-three of these were under the age of 35, representing a demographic that is traditionally the lowest in terms of support for the Conservatives. The deadline to register is Tuesday November 26th and after that we will have an even better indication as what turnout could be expected.

The time of year could also impact turnout, with the increased chance of adverse weather on polling day. The Conservatives typically enjoy a higher level of support amongst older voters and some believe a Winter ballot could dissuade some of these from turning out.

NHS winter health crisis?

After Brexit, the National Health Service (NHS) frequently tops polls of what voters care about most in this election and given the differing approaches on this adopted by the two main parties it could prove important. Labour have made pledges for a large increase in NHS spending a cornerstone of their campaign and while the Conservatives promise more funds on this front it is clear that this topic is a potential source of strength for Labour and weakness for the Conservatives. Furthermore, there are questions surrounding the future of the public body should the Conservatives strike a trade deal with the US and any big developments on the NHS could see a late swing in support.

The run-up to the 2017 election was impacted by the tragic terror attacks in Manchester which brought a heightened level of scrutiny on the austerity measures implemented by the Conservatives, with cuts blamed for reduced police numbers amongst other things. Fortunately the terror risk isn’t a big talking point this time around, but the attacks serve as an example of how unexpected events running up to election day can have a tangible impact. Winter crises for the NHS have become a disappointingly regular occurrence in recent years and should there be another one in the coming weeks it will likely shine a bright spotlight on the differing stances taken by both the leading parties and be seen as a boon for Labour.

The GBPJPY is typically the most volatile sterling pair around big political events and the market has been in a remarkably narrow range for the past 5 ½ weeks. The 61.8% fib retracement of the declines from the Sep ‘18 highs to the lows seen in August this year comes into play around 140.85 and has capped attempted advances in recent trade. A daily close above this could be seen to confirm a breakout. Source: xStation

The GBPJPY is typically the most volatile sterling pair around big political events and the market has been in a remarkably narrow range for the past 5 ½ weeks. The 61.8% fib retracement of the declines from the Sep ‘18 highs to the lows seen in August this year comes into play around 140.85 and has capped attempted advances in recent trade. A daily close above this could be seen to confirm a breakout. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.