This Thursday at 5 PM GMT markets will learn the WASDE report from the USDA, with the penultimate report on the 2023/2024 season. The previous March report showed slightly better wheat data, but now the market consensus points to a renewed increase in ending stocks, which could theoretically be a negative factor for prices.

On Thursday, important data for wheat. Investors should pay attention to ending stocks and exports. There is the potential for worse export data due to the cancellation of wheat shipments to China and lower grain inspections. Source: Bloomberg

In addition, Monday's winter wheat crop quality data are worth noting. The share of wheat rated best rose to 56% at the start of the season, the best rating since 2020 and well above the 27% rating a year earlier. Theoretically, the good quality of the crop suggests possible higher yields, which could be a negative factor for prices. However, it is worth noting that the high share of winter wheat in the past was at the same time also an indication that the price hole is near. There is a very high probability that the grain quality rating will deteriorate during the summer, if temperatures are higher than expected and moisture remains at lower levels than standard.

High grain quality at the beginning of the season gives a high chance of deterioration of this rating during the season. Source: Bloomberg Finance LP

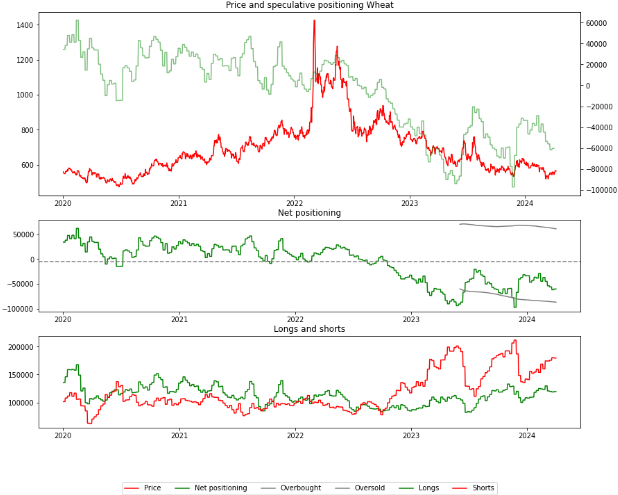

Moreover, we have recently seen an increase in speculative short positions in the market, which means positioning for low commodity prices at the start of the new season.

Source: Bloomberg Finance LP, XTB

The price has broken above the upper limit of the downward price channel, but has reacted to the area of 570 cents per bushel at the Fibonacci retracement of 38.2 of the last downward wave. It appears that the price may fall into consolidation in the near term, as it did after breaking through a similar downward channel in October. Seasonality does not give a definite signal in the near term.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.