Futures on CBOT Wheat (WHEAT) are dropping below $580 today after recent rally, when grain failed to rise above $600 psychologically resistance zone. Despite on that, fundamentals for higher wheat prices seems to be still solid, due to a global supply and demand concerns, with dried out soils in Russia and Ukraine, which are threatening plantings for 2025 wheat harvest.

- Director of Moscow IKAR, highly tracked by global grain traders signalled that "Most of European Russia is experiencing tremendous dryness (...) Farmers were hesitant to sow in the dust (...) If the European part of Russia gets good rains before mid-October and the weather remains warm, then ‘it’s not very dangerous yet,’A huge part of land of top wheat exporters, Ukraine and Russia are too dry for planting crops, which may trigger deficits in 2025.

- Dry weather in Eastern Europe signals rising risk of shortening the sowing window for winter wheat. Markets are also concerned by potential Black Sea escalation, as Ukraine-Russia war is still far from the end, with NATO declaring stronger support for Ukrainian army.

- As for now, CBOT wheat is well below Ukraine-Russia war peak, however Ukraine production is a third below pre-war levels, with Russia crop dropping 10% YoY after dryness. Short-term raining is not enough to improve dry weather impact, with farmers waiting for October/November for plantings. However, if the weather will remain dry until October, wheat on CBOT may rise well above $600.

- September USDA Report reported that wheat finished harvest in the EU and crops are 'disappointing and delayed especially in the northwest Europe' due to excessive rainfall, stopping farmers from work, with increasing plant diseases preventing grain crops.

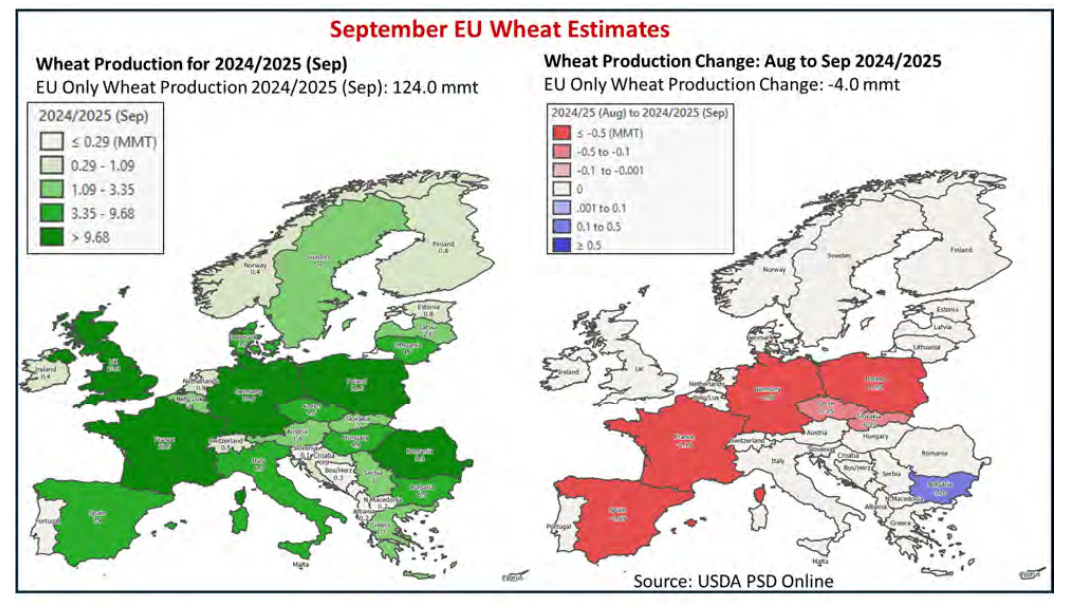

- Germany production in September is estimated down 1.5 mmt this month to 18.8 mmt and France, the EU’s largest wheat producer, has also battled excessive rainfall this season. Production came in lowered again at 27.5 mmt, down 1.1 mmt from August. France’s production is estimated to be the lowest production since 1987/88 season.

- European production this season is estimated at 124 mmt, down 4 mmt since August, and 10.9 mmt below last season and 8% below 5-year average. USDA lowered also harvested area to 23 million hectares, down 100k since August; 5% YoY and 4% below 5-year average. The agency expects now 5.39 tons per hectare (t/ha) yields, down since 5.54 t/ha in August; well below last year 5.55 t/ha and 4% below 5-year average

Source: USDA PSD European Production Estimates

Source: USDA PSD European Production Estimates

WHEAT (H1 interval)

Wheat prices are still moving above key momentum EMA200 average (red line); dropping below $570 - 568 would be a signal for a potential short-term trend reversal. However, rising above $590 may trigger another bullish impulse above $600 per bushel. Fundamentals with hurricanes and rainfall impacts, drought in Ukraine and Russia as well as Black Sea conflict may signal still stronger support for further, rising trend on CBOT wheat. Amid the recent rally, Managed Money (large speculators and hedge funds) reporting in Commitment of Traders (CoT) significantly trimmed net short position on wheat, with open interest dropping to December 2023 levels.

Source: xStation5

Source: xStation5

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Three Markets to Watch Next Week (16.01.2026)

Cocoa bear market? 📉 Weak European grindings and solid African harvests drive prices

🚨Silver slides 1.5% - is the uptrend at risk?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.