OPEC+ will decide on the fate of the "output cut" agreement during its meeting this week (August 3-4, 2022). Current output levels (for August) are in line with reference values therefore it is rich to say that the agreement is limiting supply.

Moreover, it is said that OPEC+ is already struggling to reach production quotas and daily production at world's largest producers may be around 4 million barrels short of target.

OPEC+ seems to be concerned about possibility of the global economic slowdown and is reluctant to boost production. In fact, only a few OPEC+ countries still have spare production capacity. Among those one can find Saudi Arabia, United Arab Emirates or Iraq. Even Russia is very limited in terms of increasing production and, above all, exports.

In theory, agreement may remain in place with a speculation that a 100k output increase will be agreed for September this week. Such an increase would be largely symbolic and would not change much. Saudi Arabia and United Arab Emirates are likely to keep increasing production but at moderate pace and without major announcements. However, "likely" is a key word here. Media reported that United States reached an agreement with Saudi Arabia and UAE on arms sales. This could lead to an announcement that production will increase significantly or that even a whole "output cut" agreement may be scrapped. Such a scenario would surely be accompanied with a bigger oil price drop.

However, it is not a base case scenario. Oil market remains tight and is likely to remain so. The latest data from JODI and IEF showed that oil and fuel demand is close to pre-pandemic levels. Additional supply is lacking, however, and it may keep prices near or above $100 per barrel.

What if the global economy falls into a recession? In such a scenario, a demand drop of 2-5% is possible. Such a drop would balance the market with prices dropping towards the $60-70 range. Without a recession and new production investments, a big drop in oil prices is unlikely.

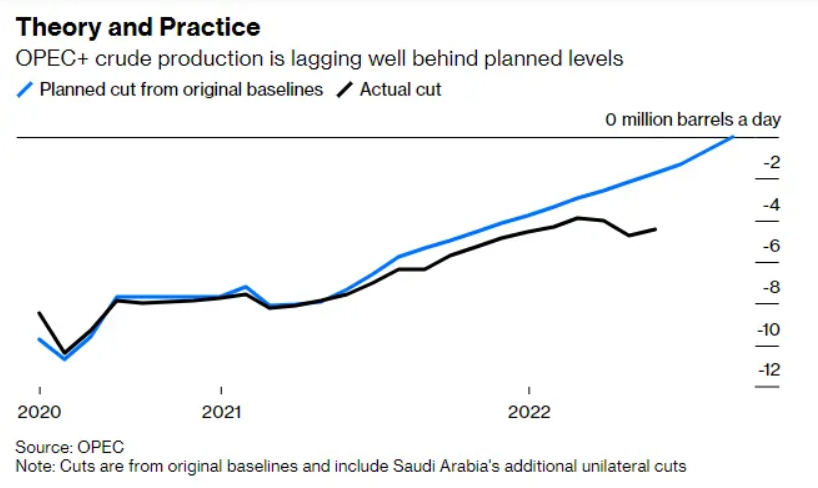

Bloomberg shows that OPEC+ is way below its production goal. This is why this week's decision is of little importance. Source: Bloomberg

Bloomberg shows that OPEC+ is way below its production goal. This is why this week's decision is of little importance. Source: Bloomberg

Oil prices are recovering today, mostly because of an expected decision to increase output by merely 100k barrels per day. On the other hand, oil remains in a downtrend that was sparked by fears over global economic slowdown. Source: xStation5

Oil prices are recovering today, mostly because of an expected decision to increase output by merely 100k barrels per day. On the other hand, oil remains in a downtrend that was sparked by fears over global economic slowdown. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.