Just days after the August non-farm payrolls (NFP) report, the Bureau of Labor Statistics (BLS) is set to release its annual revision of employment growth for the period from April 2024 to March 2025. This revision will cover only two months of Donald Trump’s presidency. The report could further intensify expectations for a rate cut, with some even pointing to the possibility of a 50-basis-point (bp) reduction. Initial economist expectations suggest one of the largest declines in employment compared to original estimates, although it is likely to be a smaller drop than last year.

The mechanism and scale of the expected revision

The annual NFP revision is a standard process in which the BLS validates its monthly estimates against more complete data from the Quarterly Census of Employment and Wages (QCEW), which is derived from unemployment insurance records and covers over 95% of all jobs. This process allows for the inclusion of more accurate data on new business formations and closures, which are not available when the monthly reports are first published.

Economists forecast a significant downward revision in employment for the April 2024 to March 2025 period. According to a Bloomberg Intelligence report, market expectations range from approximately 500,000 to 800,000 jobs, though some forecasts even suggest a downward revision of 1 million jobs. Bloomberg Economics suggests a slightly smaller correction.

Market Expectations:

-

Bloomberg Economics: -555,000 jobs (range of -475,000 to -714,000)

-

Wells Fargo: -475,000 to -790,000 jobs

-

Nomura Securities: -600,000 to -900,000 jobs

-

Bank of America and Royal Bank of Canada: Up to -1 million jobs

An analysis by Bloomberg Economics indicates that the first quarter of 2025 saw an improvement, with a reduction in business closures and an increase in new business formations. This accounts for the more moderate downward forecast compared to some market consensus figures.

What's behind the employment revision?

Reasons for the revision: The main reason for the predicted correction is the BLS's "birth-death" model, which likely overestimated the number of jobs created by new businesses. High-frequency indicators suggest that the rate of new business creation hit its lowest point in the second quarter of 2024 before improving in the first quarter of 2025.

Improvement in Q1 2025: A key takeaway is that data for the first quarter of 2025 may show a stabilization of the labor market. Bloomberg Economics expects that QCEW employment growth in Q1 2025 (relative to Q4 2024) will not be significantly slower than the CES survey, which explains their more moderate revision forecast compared to the market consensus.

Historical implications: After the revision, employment in October 2024 may have actually fallen by 3k jobs, which, in retrospect, would justify the Fed's decision to cut rates by 50 basis points in September 2024.

A repeat of 2024?

In August 2024, the BLS published a revision showing that the economy had created 818,000 fewer jobs than originally estimated for the April 2023 to March 2024 period. The final revision, released in February 2025, was lowered to 598,000 jobs. In response to this revision and other weakening labor market data, the Fed opted for a 50-basis-point rate cut in September 2024. However, it is important to note that the revision at the time did not lead to significant recessionary fears, as a downward revision of over 1 million jobs had been anticipated.

Current market expectations for a rate cut

Following a weak August 2025 NFP report, which showed an increase of only 22,000 jobs—well below the already low expectation of 75,000—markets are fully pricing in a rate cut at the Fed's meeting next week. The unemployment rate has risen to 4.3%.

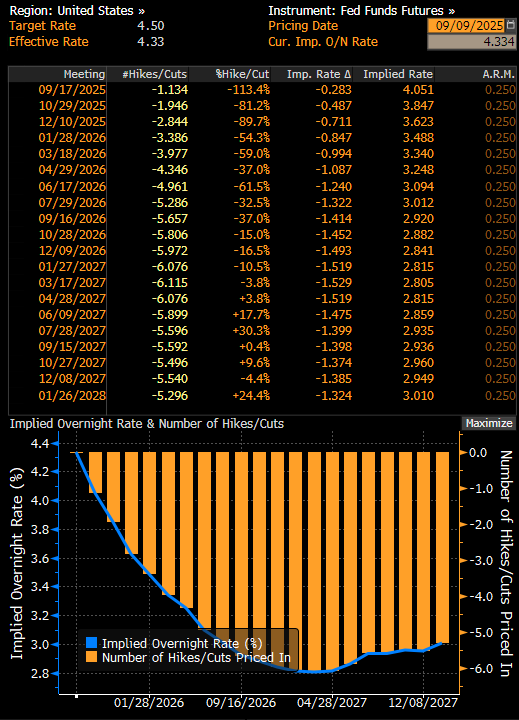

The market is currently pricing in not only a full 25-bp cut on September 17, but also a 13% chance of a 50-bp cut. Another full cut is expected in October, with a third nearly fully priced in for December. Standard Chartered anticipates that a significant negative NFP revision could tip the scales toward a larger 50-basis-point cut.

Source: Bloomberg Finance LP

Sectors most affected by the revision

Based on analyst expectations and the precedent from 2024, the largest negative revisions are expected in professional and business services, where last year's revision reached almost 360,000 jobs. The next key sector is leisure and hospitality, which saw a revision of 150,000 jobs last year. On the other hand, positive revisions are anticipated in private education, healthcare, and even government employment.

What about the markets?

A significant negative NFP revision would strengthen the narrative of a weakening labor market. However, Bloomberg Economics' analysis suggests a more moderate view. If the data confirms improvement in the first quarter of 2025, the Fed may interpret the situation as a temporary softening that is nearing its end. On the other hand, the latest data from recent months has already been revised significantly downward, and we experienced a decline in employment in June.

For markets, a strong revision, larger than last year's, could mean a clear weakening of the dollar, a drop in yields, and a continued rise in gold prices. The reaction in the stock market is not as clear-cut; while a decline in employment would mean rate cuts—which are good for stocks—recessionary signals are not as positive for the market.

Gold has reached historical highs due to rising expectations for cuts. Source: xStation5

Gold has reached historical highs due to rising expectations for cuts. Source: xStation5

Political context and data credibility

The revision also has a political dimension. President Trump has previously questioned the credibility of BLS data, and in August 2025, he fired BLS commissioner Erika McEntarfer following the release of weak data for July. Trump accused the BLS of "falsifying" the data, though economists emphasize that revisions are a normal part of the process of refining economic data.

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.