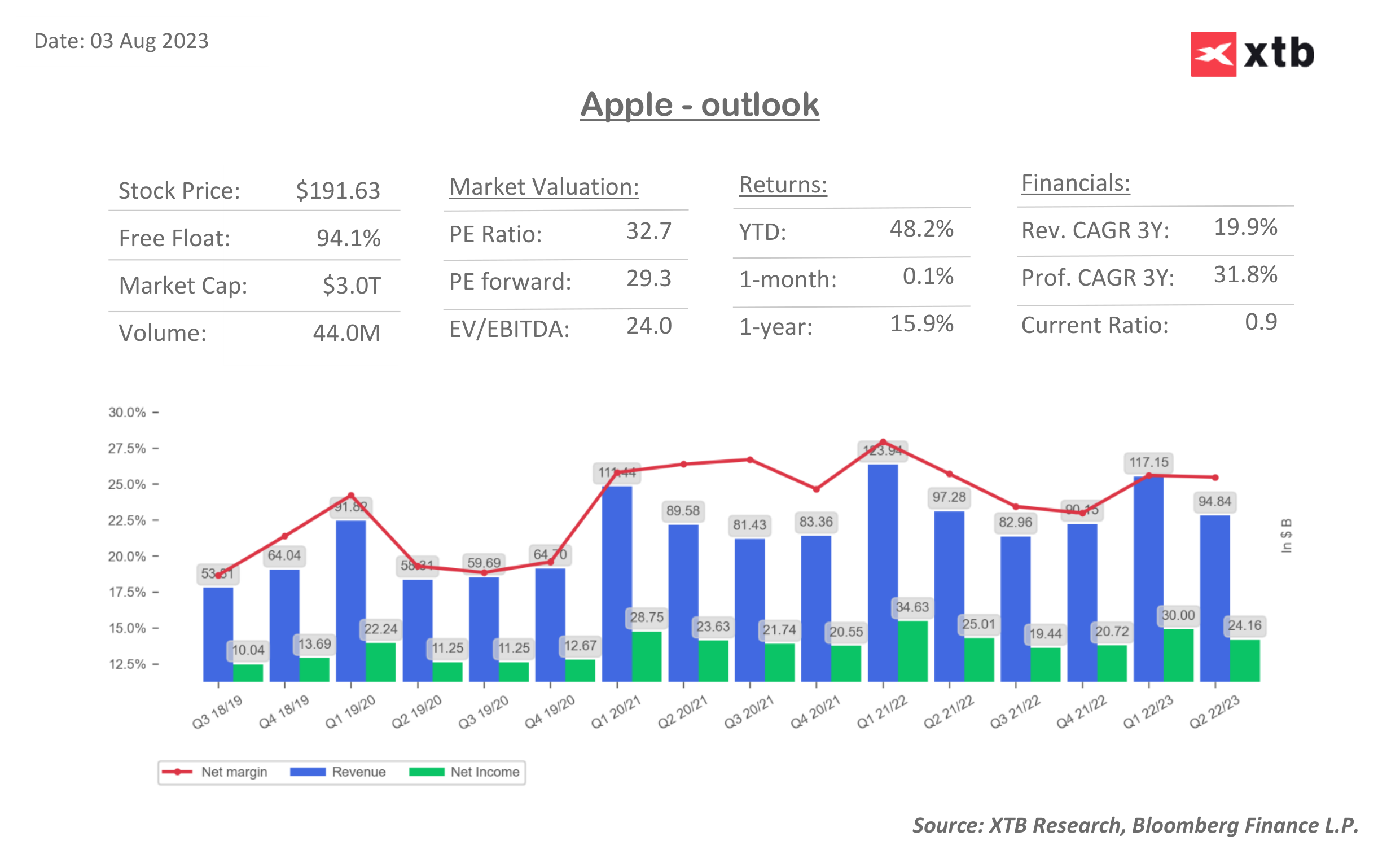

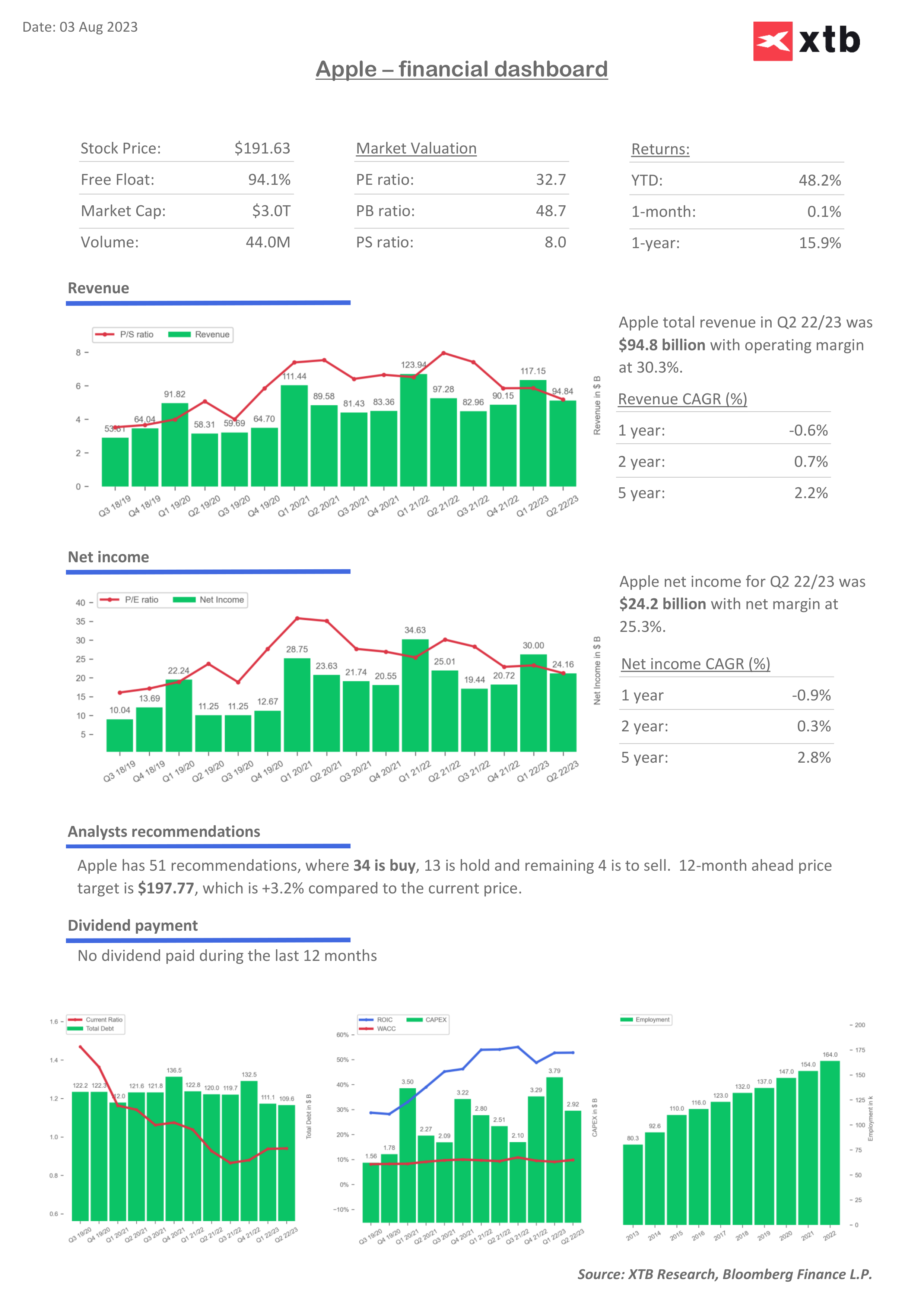

Apple (AAPL.US) is the world's highest valued company with more than $3 trillion in capitalization and one of Wall Street's main drivers. After today's session, it will report its Q2 earnings report. In 2022, it showed considerable resilience and lost relatively little against the backdrop of tech giants. In contrast, this year it is gaining nearly 55% against a 40% rally in the Nasdaq. The market in recent months has been excited by the company's stated expansion into VR technology in the fall and the release of the iPhone15 in September. At the same time, strong consumer in the U.S., Europe and better y/y consumer sentiment in China have not led markets to expect revenue growth. Wall Street expects a third consecutive quarter of y/y revenue declines and single-digit declines in iPhone and MacBook sales. However, forecasts may prove key, here they are:

- Revenue: $81.7 billion vs. $94.48 billion in Q1 (2.3% y/y decline) (FactSet)

- Earnings per share (EPS): $1.19 vs. $1.52 in Q1 and $1.20 in Q2 2022 (FactSet)

- iPhone sales revenue: $39.0 billion vs. $51.33 billion in Q1 2023 (down 2% y/y)

- MacBook revenues: $6.3 billion vs. $7.17 billion in Q1 2023 (down 2% y/y).

- iPad revenues: $6.2 billion vs. $6.67 billion in Q1(down 11% y/y)

- Services revenue: $20.7 billion (up more than 5% y/y)

Seasonally, Q2 is the weakest for Apple. The main threats to sentiment are cautious forecasts and lower sales of flagship iPhones. Recently, technology agencies have reported and weaker smartphone-related business. It is indirectly affected by higher interest rates. The company does not give detailed forecasts from 2020 through which the market will have to rely on comments on sales and the general narrative around the report. Given the size and global reach of Apple's products, markets are also waiting to see if the company will expect higher demand in future quarters. Such a scenario would make a positive 'soft landing' for economies more likely.

Key - emerging markets?

- Apple reported a y/y decline in sales in China in the previous two quarters - from this side there will probably be no positive catalyst and revenues from the Apple third largest market will decline y/y - however, Piper Sandler analysts expect a slight decline in iPhone sales in China;

- Investors will react positively if the company points to the stabilization of the tight situation in the Chinese supply chain (the main place of production) - these have caused lower sales in recent years;

- The market will turn its attention to increasing shares in India, which as the world's most populous country became the company's 5th largest market in Q2 - as a growing market, it can cushion weakness in China. Morgan Stanley estimates that Indian revenues could reach $40 billion over a 10-year horizon;

- Apple's growth in India has been recent and in March it surprised with a record $6 billion in revenue from the country where Android dominates. Analysts stress that the company's positive growth in emerging markets is encouraging long-term investors along with the emerging middle class there.

Services, AI and VR - material for a positive surprise?

- The market may positively receive higher-than-forecast revenue growth from the high-margin services segment (AppStore, ApplePay, AppleMusic, AppleCare) - Detusche Bank points to improvements in the online advertising sector as a possible positive prognosticator;

- With the development of VR technology (VisionPro), which will compete mainly with Oculus (META.US), the market also expects the company to increase its competitiveness with other tech in the shadow of speculation that indicates Apple is developing its own AI model similar to GPT from Microsoft and OpenAI. Wells Fargo, however, expects comments in this regard to be perfunctory.

Apple (AAPL.US) shares are maintaining an uptrend, however, they have broken an almost vertical trend line and if the results surprise negatively - in a situation of extremes, they could look for support at the SMA200 level (red line) near $182. A positive report and forecasts could lift the stock above psychological resistance - up to $200 (record levels). Source: xStation5

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.