-

Dogecoin failed to benefit from ongoing hype surrounding Bitcoin

-

Transaction volume and social media sentiment remains subdued

-

Potential network updates could potentially initiate bullish rally

Dogecoin benefited from yesterday's upbeat moods surrounding the launch of the first US bitcoin futures exchange-traded fund from ProShares and price surged 15% during the Monday session, outperforming nearly all major projects. At the moment half of the recent gains has been erased, but bulls show resilience in maintaining a stable trading range above the support at $ 0.20. Still it seems that despite the prevailing hype on Bitcoin, Dogecoin and a large part of the other major cryptocurrencies failed to capitalize on this phenomenon.

From a broader perspective, Dogecoin has been trading in a downward move since mid-August, while Bitcoin's price began to rapidly recover from the May sell-off initiated by Chinese authorities. This bearish outlook is partly driven by the recent surge in popularity of DOGE competitor Shiba Inu, which has rallied roughly 300% since mid-September. This sudden increase in Shiba popularity resulted in the migration of DOGE users which translated to small transaction volume and lower interest among social media users, which very often reflects the market sentiment towards a given cryptocurrency.

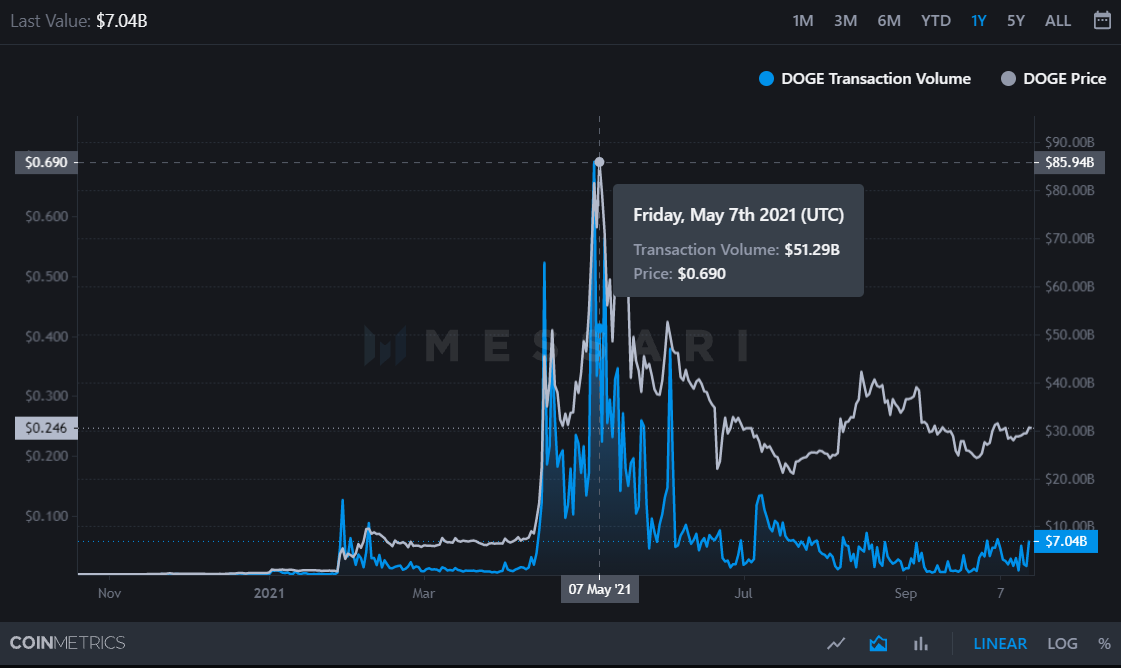

Transaction volume decreased significantly from May highs and still did not managed to recover. Source: Coinmetrics via Messari

Transaction volume decreased significantly from May highs and still did not managed to recover. Source: Coinmetrics via Messari

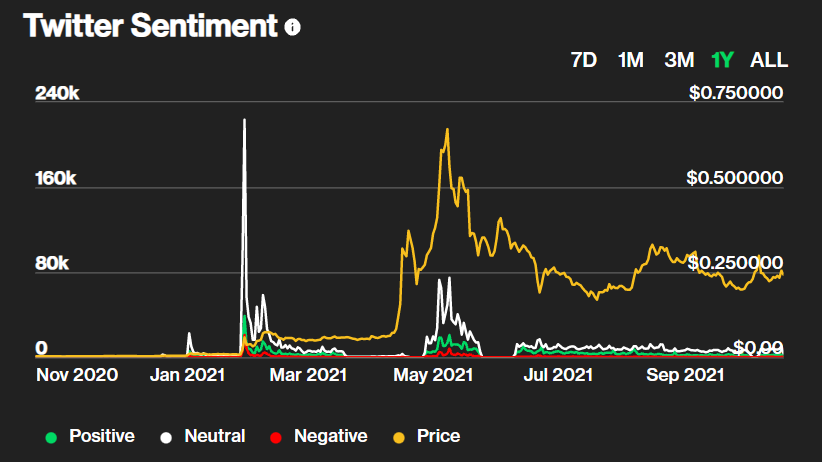

Social media sentiment towards Dogecoin cooled down in the recent months. Intotheblock via Coindesk

Social media sentiment towards Dogecoin cooled down in the recent months. Intotheblock via Coindesk

Still Dogecoin has exceeded Bitcoin, Ripple, Ethereum and Cardano in year-to-date returns, offering over 4500% gains since the beginning of 2021. Currently, many investors are wondering if this trend can continue in the near future given the growing competition in the cryptocurrency market. One of the factors that may lead to further price increases is the continued expansion of the network and the support of Elon Musk who recently expressed his backing for Billy Markus, the co-founder of Dogecoin, in his effort to allow community members to operate their individual nodes. Markus had stated that once DOGE nodes upgrade to 1.14.4, there will be a reduction in transaction fees on the Dogecoin network. Proponents expect fee reduction to boost DOGE utility and trigger a rally. Also developers are currently working on the Dogecoin-Ethereum bridge, however no launch date has been announced yet.

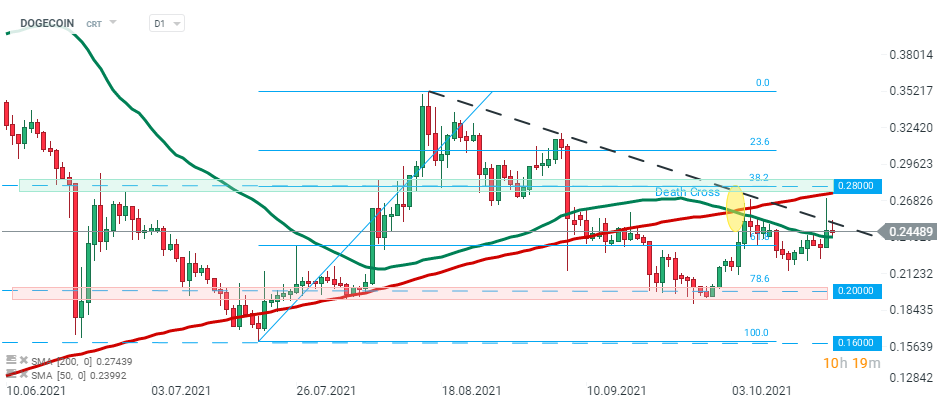

DOGECOIN – price broke above the downward trendline during yesterday’s session , however buyers failed to push the price above major resistance at $0.2800 which coincides with 38.2% Fibonacci retracement of the last upward wave and 200 SMA (red line). However, as long as the price sits above the support at $0,20 it is too early to talk about a bigger sell-off. Currently market sentiment remains upward and if buyers manage to break above the aforementioned $0.2800 handle the next resistance to watch can be found at $0,3080, where the next Fibonacci retracement is located. Source: xStation5

DOGECOIN – price broke above the downward trendline during yesterday’s session , however buyers failed to push the price above major resistance at $0.2800 which coincides with 38.2% Fibonacci retracement of the last upward wave and 200 SMA (red line). However, as long as the price sits above the support at $0,20 it is too early to talk about a bigger sell-off. Currently market sentiment remains upward and if buyers manage to break above the aforementioned $0.2800 handle the next resistance to watch can be found at $0,3080, where the next Fibonacci retracement is located. Source: xStation5

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.