-

The consensus estimate for the NFP in June is 700k against 692k shown by the ADP data.

-

The difference between ADP and NFP figures has been significant since the beginning of Covid-19 pandemic, lately the gap has been particularly huge.

-

The report is critical in terms of economy’s outlook and building inflationary pressures.

-

The US dollar and US500 are likely to be the most affected markets.

Recent months were rather poor in terms of US employment data. Despite easing Covid-19 pandemic, Americans do not want to reenter the labour market as they benefit from generous fiscal support. Are there any signs of improvement? What about rising wages which might show that elevated inflation is set to stay with us for a longer period of time? Will the NFP report affect the US dollar and Wall Street, given that the fiscal and monetary stimulus is still gigantic?

Expectations

Markets expect the headline NFP print of 700k (vs previous 559k). Private nonfarm payrolls are expected to reach 600k. The ADP data showed 692k, a higher-than-expected result, but one has to keep in mind that there has been a significant gap between both reports since the pandemic started. Moreover, the NFP data missed expectations in recent months.

If we treat the ADP prints as the “smoothed average” for the NFP figures, we should finally witness an improvement. Source: Macrobond, XTB

Signs from the economy

The recent job openings reading reached a high of 9.3 million! That is two times more than 4.6 million in the low during the pandemic. As one can notice, the record-number of job vacancies does not mean that everybody reenters the job market. What is more, employees leave their jobs at record pace! High unemployment benefits may be the obstacle for the labour market to recover. On the other hand, US jobless claims have already returned below 400k which should suggest that at least the unemployment rate may be set for a fall.

The record number of job openings in the US. Such number would be enough to reduce the unemployment gap which is still a huge problem for the US economy. Soure: Bloomberg

US wages have been rising steadily for a year now and this trend is likely to continue. Employees do not only have higher financial expectations, but employers also struggle with finding skilled workers, which is pushing wages even higher. This could be crucial factor as far as building inflationary pressures are concerned.

Wages are rising faster than before the pandemic, which will impact the building inflationary pressures in the long-term. Source: Macrobond, XTB

Is the data important?

On one hand - yes! If the US labour market does not recover, economic forecasts will be unrealistic to fulfil. Obviously this will impact companies and their ability to generate earnings. However, investors and consumers have currently record levels of disposable cash. This would be a threat should elevated inflation persist for a longer period of time with the Fed maintaining low interest rates due labour market problems (the Fed has the goal of maximum employment). It is also worth to remember that the NFP data should give the full picture of the labour market in autumn as most unemployment benefit programmes will expire by then. Therefore, wage pressures are expected to decrease by then as well.

Markets that might be affected

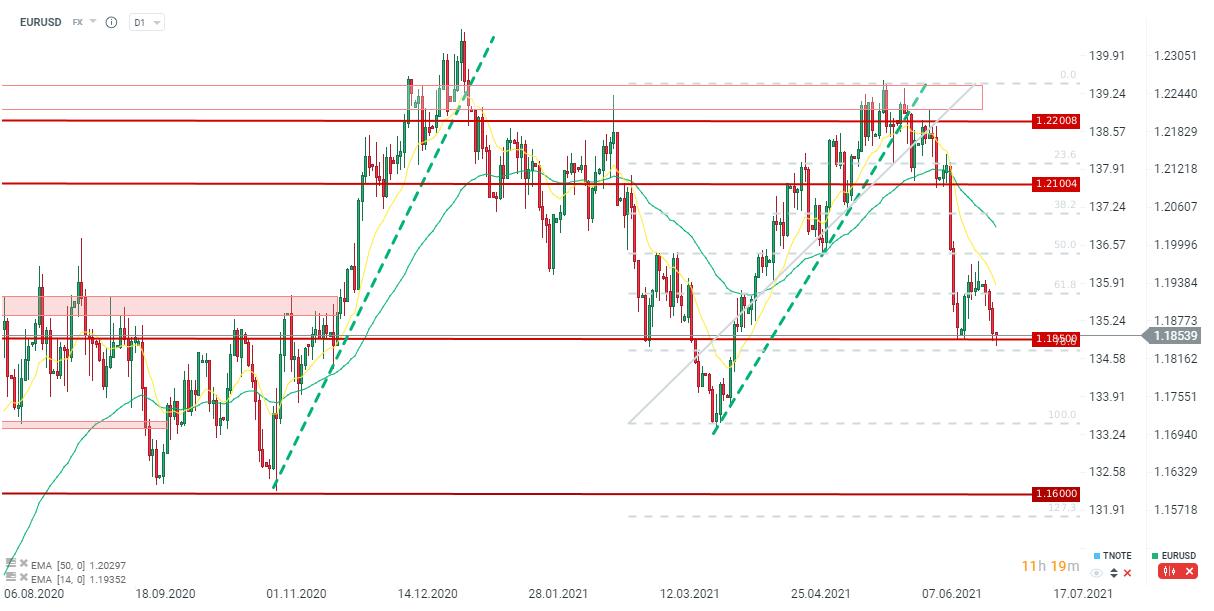

EURUSD

Better-than-expected NFP report (or data at least in-line with expectations) and high wage pressures should definitely support the US dollar. In such scenario, the Fed will be under pressure to take action earlier than anticipated. At the same time, a poor report will be a sign that there is still a long time until the Fed starts the real tightening. After breaking below the 61.8% Fibonacci retracement the sentiment on the main currency pair is negative. on the other hand, EURUSD is defending the key support at 1.1850. Source: xStation5

US500

A strong report will be favourable for the US economy, but there will be a risk of even bigger inflationary pressures. Wall Street would like the monetary stimulus to continue. VIX at record-low levels may herald a market correction. However, the pullback should not be a deep one. If the positive sentiment prevails, investors may aim at 4,350 pts area near the 161.8% retracement. Source: xStation5

A strong report will be favourable for the US economy, but there will be a risk of even bigger inflationary pressures. Wall Street would like the monetary stimulus to continue. VIX at record-low levels may herald a market correction. However, the pullback should not be a deep one. If the positive sentiment prevails, investors may aim at 4,350 pts area near the 161.8% retracement. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.