The largest contract semiconductor manufacturer, Taiwan Semiconductor Manufacturing (TSM.US) will report its financial results tomorrow, probably around 6:30 AM GMT, as the earnings conference call has been scheduled for 7 AM GMT. The report is likely to prove to be the main stock market event of the week and answer more questions for the market about the growth trajectory of technology companies and the AI trend. The market expects the company to report earnings growth, driven mainly by the AI trend and orders from Nvidia. It appears that TSMC's report could prove pivotal to the broader technology stock sector, with quite a few BigTech companies reporting earnings in April. The question is, will the overall weakness in the smartphone market (Apple shipments fell 9.6% in Q1 2024) be offset by strong demand for AI chips? The company's shares, during today's session in Taiwan, rose nearly 2.5% and sales it's Q1 sales was very strong on YoY measures (but lower than 20% company's FY 2024 forecasts).

Q1 2024 results expectations:

- Revenue: NT$592.64 billion (US$18.26 billion, 16.5% year-on-year increase)

- Earnings per share (EPS): NT$8.3 vs NT$9.21 in Q4 2023 and NT$7.96 in Q1 2023

- Net earnings: NT$214.91 billion (US$6.71 billion, 5% y/y increase)

- CAPEX: NT$29 billion vs. NT$28-$32 billion of company forecasts

What to expect?

- The company has provided monthly revenue figures for many years. TSMC's revenue in March alone rose 34% YoY (the fastest pace since November 2022) and 7.5% MoM. Revenues were up 16.5% for the entire Q1; they totaled $18.26 billion.

- Wall Street expects gross margin to remain unchanged QoQ 53%, and to decline to 52.8% in Q2 2024. The company had indicated in the previous quarter that it expected 20% revenue growth in 2024. Revising these forecasts in either direction could increase volatility

- According to IDC's updated forecasts, AI spending is expected to reach $400 billion by 2027, 250% above International Data Corporation's (IDC) previous forecasts, which definitely has the potential to support Taiwan Semiconductor's growth in the long term.

- TSMC's valuation remains close to the median of the past five years, at less than 20 times future earnings. At the same time, the broad Philadelphia Semiconductor Index is trading at an average of 28 times future earnings (a 15-year high).

- Slowing iPhone sales poses some 'tail risk' for the company as a whole, but despite on that, Apple has had a great four quarters. It's worth considering that weaker smartphone sales may be offset by Apple itself's implementation of AI across its product range with, among other things, M4 chips in MAC computers, in 2024-2025.

The company will focus on high-end, more profitable products with larger 'moat' for data centers, AI accelerators. Source: TSMC

What will the market pay particular attention to?

- Turning to TSMC's chip production, with 3nm technology by companies such as MediaTek and Qualcomm, is also noteworthy, although revenues may be limited by stagnant iPhone sales growth

- Investors will also pay attention to the company's investment in Arizona, which is expected to bring it unprecedented support of $11.6 billion (loans, grants) in funding from the US Chips and Science ACT - perhaps the company will share more precise timelines for the delivery of the investment

- Capex could be very important, as the company, which expects demand to grow, should increase capital expenditures. Their further stagnation could be a big question mark for the market; on the other hand, it is uncertain to what extent their increase (and the consequent decline in free cash flow, caused also by moving production outside Taiwan) will be offset by margins and profits;

- Bloomberg Intelligence believes that TSMC's performance will be driven by high demand for advanced process and chip-casting technology; by which the company may increase capital expenditures from the planned $28-32 billion to maintain its dominant position and meet growing demand for AI chips.

- Analysts at Morningstar suggested that the company is still undervalued, given its 'wide moat' and dominance in manufacturing cutting-edge chips - a perception that may be partly driven by geopolitics and the risk of a potential Chinese invasion of Taiwan

- Saxo Bank expects demand and revenue growth to be higher for a longer period of time than the current valuation of TSMC's shares would suggest. In addition, the company plans to produce state-of-the-art 2nm chips, in the US.

AI momentum will stay?

The last quarter (especially March) for the company was very good, and if nothing has changed over the past few months, it seems that TSMC may be willing to raise its sales and capital spending forecasts, which could provide evidence that strong AI-driven growth will be sustained and perhaps offset the company's more cyclical, uncertain demand for electronics and smartphones. The company's stock could gain due to the systemic importance of the company in the long-term AI trend, similar to Nvidia - as long as companies continue to increase budgets to invest in artificial intelligence

- Fubon Securities suggested that while TSMC has indicated that artificial intelligence could account for several percent of its revenue by 2026, based on the fund's own calculations, this target known for its conservative forecasts could be reached earlier, in 2025. Recently, analysts at Nomura and Goldman Sachs have raised their forecasts for TSMC's shares, also citing weakness in competition from Intel (INTC.US).

- Nomura expects AI revenue to grow between 12 and 16% between 2024 and 2025. According to analysts, orders from Intel and the deeper need to understand 2-nanometer products for TSMC's key customers, including AMD, could serve as key catalysts for future growth. Intel Nova Lake processors will use TSMC's 2nm technology, and Intel itself has already confirmed that Arrow Lake chips will also be based on N3 technology from TSMC.

TSM chart (D1 interval)

As we can see TSMC's shares have more than doubled since the October 2022 bottom, its market capitalization increased by $340 billion. We saw similar growth in the rebound from the Covid-19 crash to the peak of the euphoria in 2021, although it was much steeper then. In the scenario of a somewhat disappointing report, $135 per share (SMA50, 23.6 Fibonacci retracement of the 2022 surge) may prove to be a significant support level, but the main support level runs at $120 and is marked by the consolidation of 2021-2022 and the 38.2 Fibo levels. Also in the 2020-2022 cycle was an important support point, the breakthrough of which resulted in a drastic discount. The main resistance runs at $160 per share (record levels in March). The ratio of sell, to buy trades has fallen from its March peak, which may suggest that there has been more activity on upside forecasting options than bearish bets, according to Bloomberg data. The average expectation in the options market implies roughly 6% volatility in stock prices after the report.

Source: xStation5

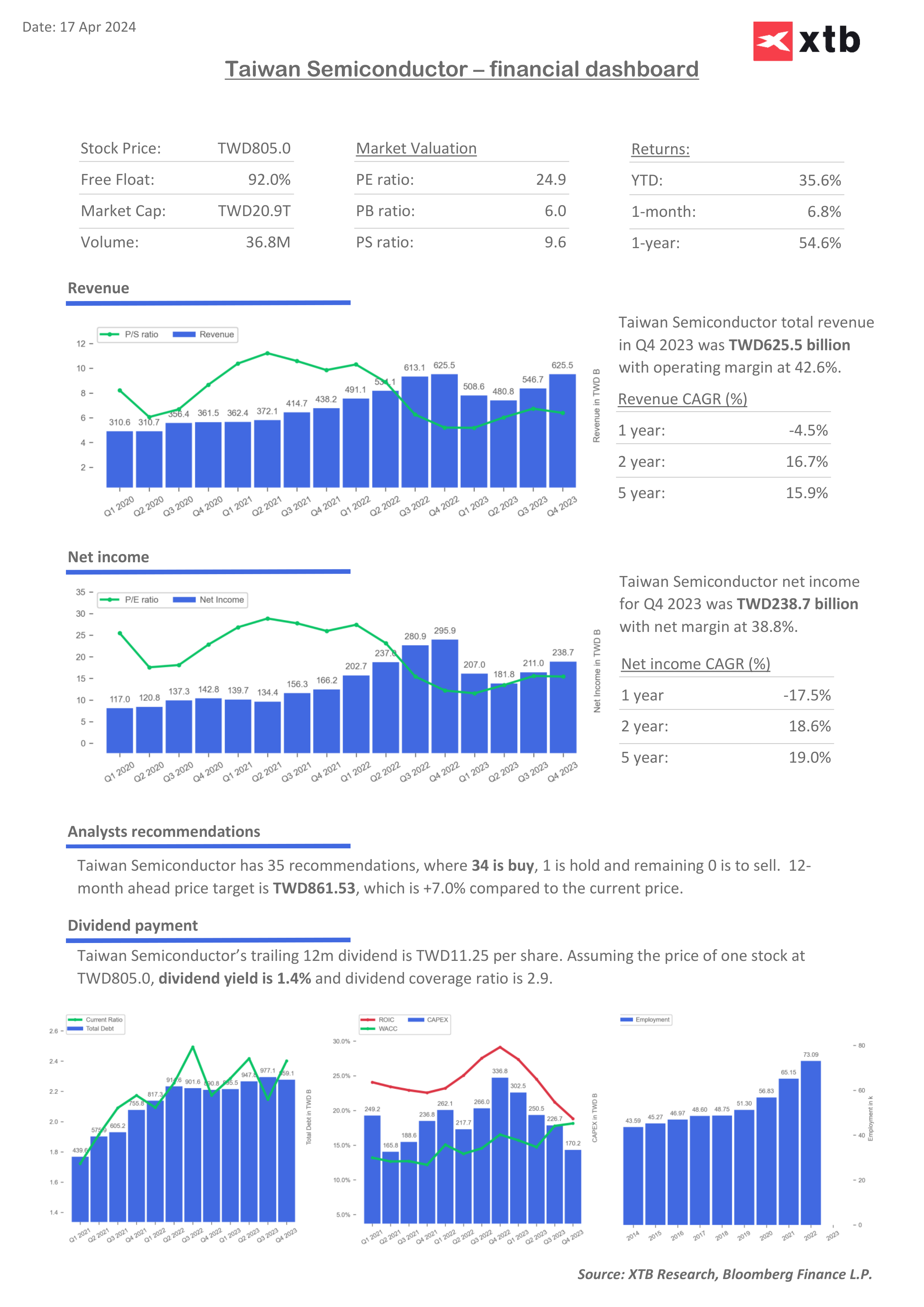

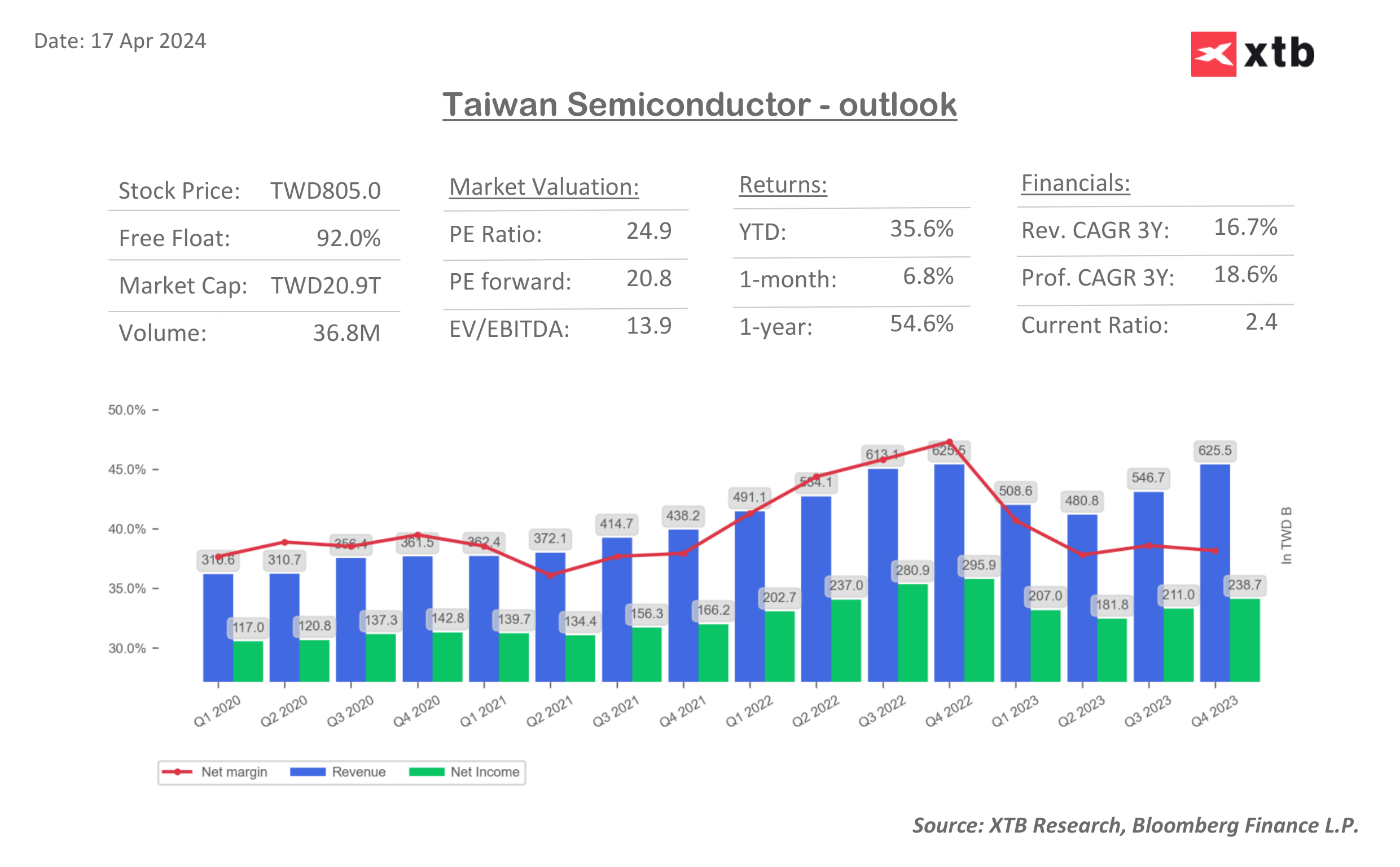

TSMC valuation multiples and ratios

The Current Ratio is more than satisfactory, and the market is valuing the company with a forward PE, 20% lower than the current one, indicating a potential positive mid-term reaction to earnings rebound.

Source: XTB Research, Bloomberg Finance LP

Source: XTB Research, Bloomberg Finance LP

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.