US labor market data is usually the most important monthly data for most investors. It would seem that after the recent assurances from the Fed about the strength of the labor market, attention should be focused on wages, which will have a greater impact on inflation and possible interest rate hikes. However, taking into account the terrible ADP reading and the weak NFP reading in December, one gets the impression that Friday's data may change a lot when it comes to market expectations.

Low expectations

The expectations for tomorrow's NFP report are rather weak - they point to an increase in employment at the level of 150,000, against the previous equally weak reading of 199,000. However, the moods deteriorated significantly after the publication of the ADP report, which showed a decline in employment at the level of 301,000! The decline in employment should not come as a surprise, however, given that Omikron already had an impact on the labor market in December. ADP showed that the leisure and hospitality sector recorded the largest decline in employment (154,000). The industrial sector also lost a lot, with a decline in employment of 21,000. Almost all sectors showed employment decline. The exception is the oil and gas sector, where 4,000 new jobs were added. new employees. Yesterday's ADP report showed the first decline since December 2020 and the largest decline since mid-2020.

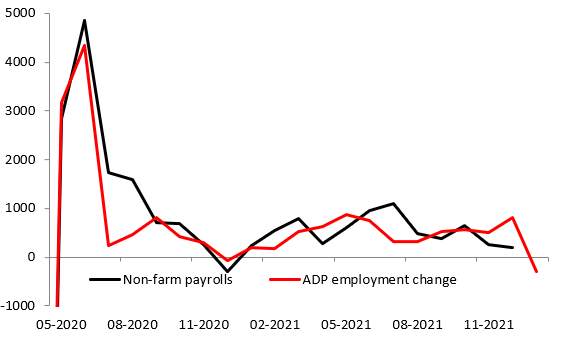

The ADP report clearly differed from the NFP report in the last dozen or so months. In the previous month, a private report showed a figure above 800,000, while NFP was below 200,000. Additionally, it is worth noting that at times when ADP showed sharp decline, NFP usually did not follow up, at least for the same month. Source: Macrobond, XTB

The ADP report clearly differed from the NFP report in the last dozen or so months. In the previous month, a private report showed a figure above 800,000, while NFP was below 200,000. Additionally, it is worth noting that at times when ADP showed sharp decline, NFP usually did not follow up, at least for the same month. Source: Macrobond, XTB

The labor market remains strong

It is worth noting that the unemployment rate has recently dropped to 3.9%. Before the pandemic, the minimum was 3.5%. The Fed has announced that it has at least partially achieved full employment, so the decline in employment amid unchanged unemployment rate should raise no doubts for investors. This is why the unemployment rate and the participation rate appear to be a more important reading than the employment change itself, which is heavily affected by what is happening in terms of the pandemic.

Key focus on wages

The most important part of Friday's report will be the wage growth. This figure will determine whether inflation can stay with us for longer. In Europe, the inflation outlook is weaker, mainly due to lower wage dynamics. In the US, in turn, an increase above 5.0% in annual terms is expected! Analysts expect wages at 5.2% YoY compared with December reading of 4.7% YoY. The monthly dynamics is expected at 0.5% MoM against the previous level of 0.6% MoM. It is worth noting that we have a relatively high base from last year. Therefore, strong wage growth may increase expectations of interest rate hikes.

What will the Fed do?

There is a high probability that the NFP report will surprise negatively, but it is worth remembering that it is related to extraordinary factors, which should subside later in the year. Therefore, the focus will be on wages and the unemployment rate. If these figures turn out to be better than expected, thn dollar should strengthen and gold may take a hit. However, if the NFP confirms the decline in unemployment and wages growth will be limited, the Fed may slightly ease its hawkish tone, which may lead to a continuation of the recent short-term trends. Despite the recent turmoil, the market is still pricing-in almost 5 hikes this year, although 3 hikes until mid-year have become somewhat less certain.

EURUSD

EURUSD is trying to resume a downward move after posting a 200 pips correction. Strong wage growth should cause both the markets and the FED to focus on inflation again. However, if it turns out otherwise, pair may return to the area of 1.1350-1.1380, where January highs are located. Source: xStation5

GOLD

Thanks to lower bond yields, gold has returned above $ 1,800, which is a good sign for the bulls. Break above $1815 on Friday could lead to a bigger upward move, however a lot will depend from bond yields. Sellers will try to push gold below support at $ 1,790. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.