Prices reversed some of the previous week's gains—which were driven by expectations of a Chinese recovery and supply uncertainty from Russia—as the new week began. Last week, prices peaked near $70 per barrel, reaching their highest level in nearly two months, although gains were significantly curtailed by the end of Friday's session.

OPEC+ Strategy and Supply Overhang Risk

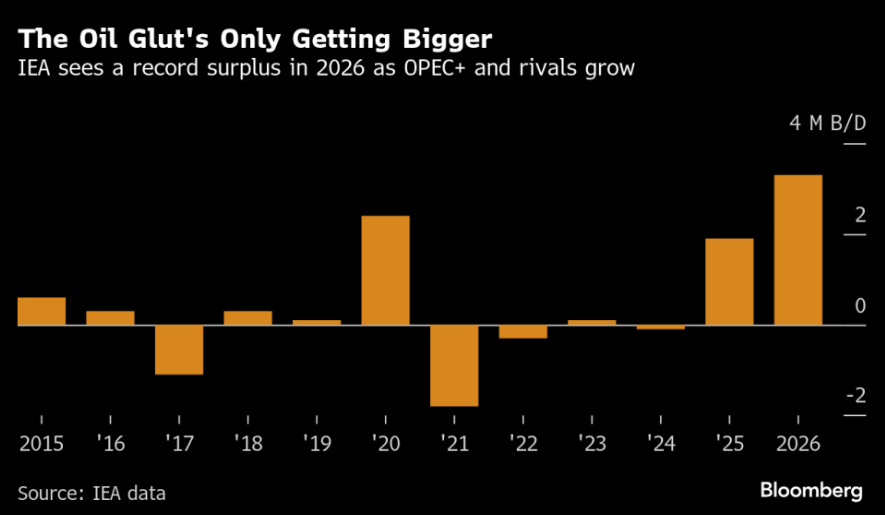

Unofficial reports over the weekend suggested that OPEC+ is considering another production increase from November, potentially exceeding the previously announced 137,000 barrels per day. Such a decision would continue the alliance's strategy to regain market share at the expense of its traditional role as a price regulator, raising concerns about a further surge in the global supply overhang. The IEA estimates that the surplus could reach as high as 3 million barrels per day next year. Under this scenario, Goldman Sachs estimates Brent and WTI could fall to the $50-$60 per barrel range.

IEA anticipates a massive supply overhang next year. Source: Bloomberg Finance LP

IEA anticipates a massive supply overhang next year. Source: Bloomberg Finance LPThis week, the statement from the Saudi Arabian Oil Minister on Wednesday will be crucial, as will the cartel's upcoming meeting scheduled for October 5. If plans to increase production limits are confirmed, a further decline in prices is possible, especially given the current period of seasonal inventory build-up.

Russian Risks Remain a Counterbalance

It is important not to overlook the persistent supply risks related to Russia. Over the weekend, Ukraine launched further attacks on Russian oil infrastructure, which could entrench domestic fuel shortages. However, reduced crude processing in Russia could also necessitate an increase in the export of crude oil itself—a negative factor for the market. Currently, up to 30% of Russia's refining capacity is offline, and storage capacity is limited. Therefore, to avoid shutting down production, Russia may be forced to increase its crude exports.

Furthermore, speculation suggests that Donald Trump has unofficially granted Ukraine permission to use US-supplied equipment for strikes deep inside Russia. This move implies potentially greater pressure on Russia. Trump is known to desire that countries like India and China cease purchasing Russian commodities.

Key Market Focus Points for Investors

-

Confirmation of the OPEC+ production increase decision at the meeting in the first week of October.

-

API and EIA data on inventory changes, which could reinforce or alleviate current supply pressure.

-

The pace of economic recovery in China and Europe as signaled by central banks.

Technical Outlook

Oil is currently testing the 50-period moving average near $64 per barrel. Should the price close today at current levels or lower, it would complete an Evening Star formation, indicating a continuation of the decline. However, if the price rebounds in the latter part of today's session, a retest of the $65-$66 per barrel range is possible. Source: xStation5

Oil is currently testing the 50-period moving average near $64 per barrel. Should the price close today at current levels or lower, it would complete an Evening Star formation, indicating a continuation of the decline. However, if the price rebounds in the latter part of today's session, a retest of the $65-$66 per barrel range is possible. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.