Alphabet recently announced that it is developing its own TPU processors to train AI models, and now reports indicate that Meta is seriously considering using these chips in its data centers. This development could have significant implications for the AI hardware market and directly impact Nvidia’s position, which has so far practically monopolized the GPU segment in data center infrastructure.

Data centers are a key pillar of Nvidia’s business, accounting for approximately 90 percent of the company’s revenue. Nvidia’s dominant GPUs have been used to train and operate AI models in the largest cloud environments worldwide, providing a stable and high-margin source of revenue. Meta’s decision to shift part of its infrastructure to Google’s TPUs means that Nvidia could start losing key clients in this strategic segment. Even a small reduction in computing power in data centers could have a measurable impact on the company’s financial results and growth rate in its most profitable business area.

At the same time, Alphabet is expanding its TPU infrastructure and, in collaboration with Broadcom, is developing chips that offer higher performance with lower energy consumption. The flagship Gemini 3 model, trained primarily on TPUs, demonstrates that Google is actively testing and monetizing its processors in real-world AI scenarios, giving the company a technological edge and potentially new revenue streams. For Nvidia, this translates into growing competition not only in raw computing power but also in energy efficiency and cost effectiveness, which are critical factors for scaling data centers.

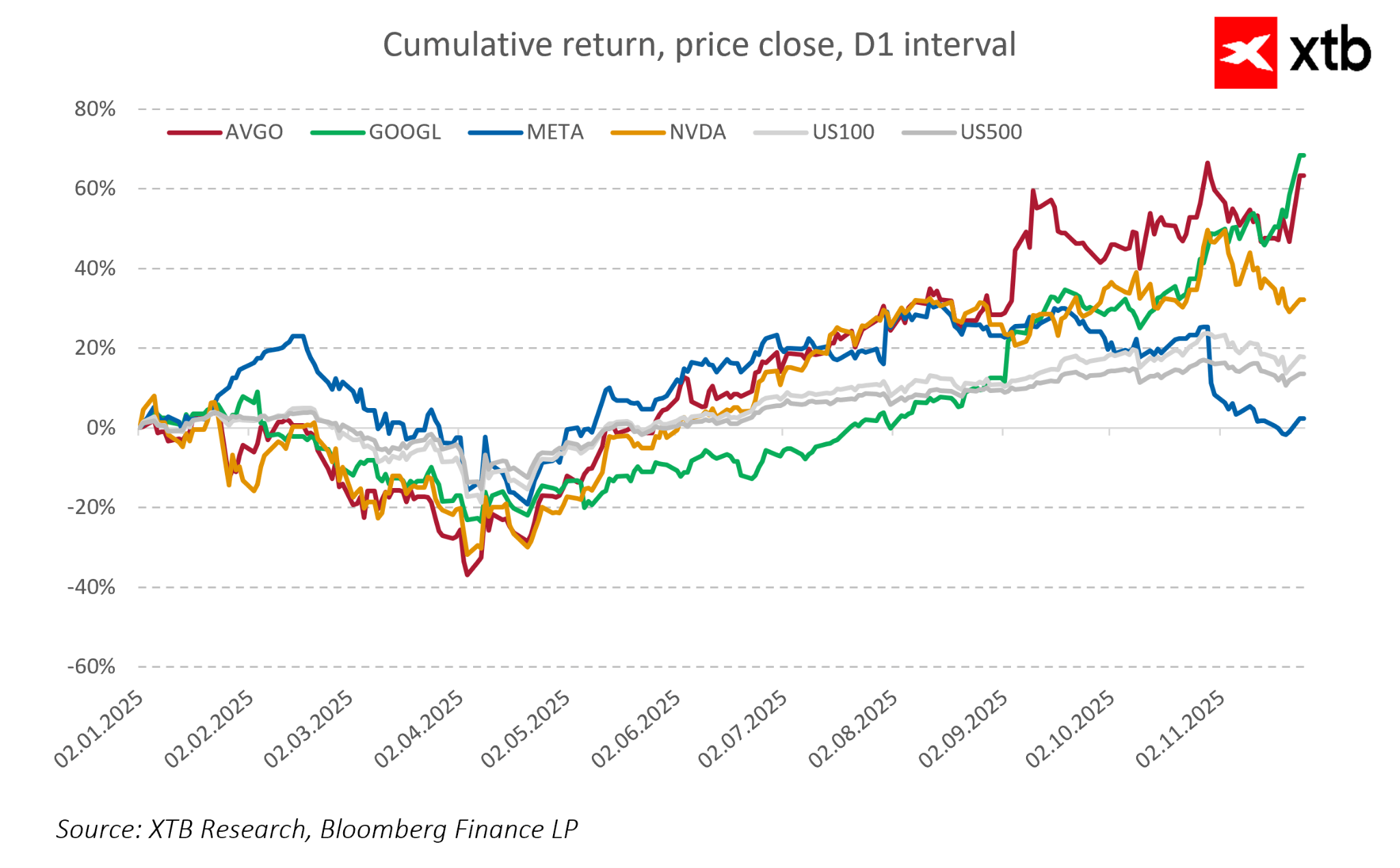

The market has already reacted to these developments. Alphabet’s stock rose in after-hours trading, while Nvidia’s shares declined, reflecting investor concerns about potential threats to GPU dominance in data centers. Broadcom, as Google’s partner in TPU production, received an additional boost, with its stock climbing more than ten percent, highlighting the increasing importance of the ecosystem surrounding the new AI chips.

For investors in the markets, Nvidia’s situation is becoming particularly significant. As Meta and other technology leaders potentially adopt TPUs on a larger scale, Nvidia may need to reconsider its pricing strategy and accelerate investment in new GPU generations to maintain its edge in the most profitable segment of data centers. Such actions could directly affect both margins and revenue growth in this critical area.

The potential collaboration between Meta and Google on TPUs signals a major reshuffling of power in the AI industry. Alphabet and Broadcom are strengthening their positions, while Nvidia faces a real risk of losing market share in a strategic data center segment that accounts for nearly ninety percent of its revenue. In the coming months, the pace of TPU adoption by large companies and further development of Gemini 3 could determine how the balance of power in the AI hardware market evolves.

Daily summary: Markets capitulate under the influence of the Persian Gulf

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.