Alphabet (GOOGL.US) is scheduled to report Q2 earnings report today after close of the Wall Street session. It will be the first earnings release from a major US tech company during this season and may have a big impact on sentiment towards a tech sector. What analysts expect from Alphabet's release and what to focus on? Take a look at our quick preview!

What analysts expect for Alphabet's Q2 earnings?

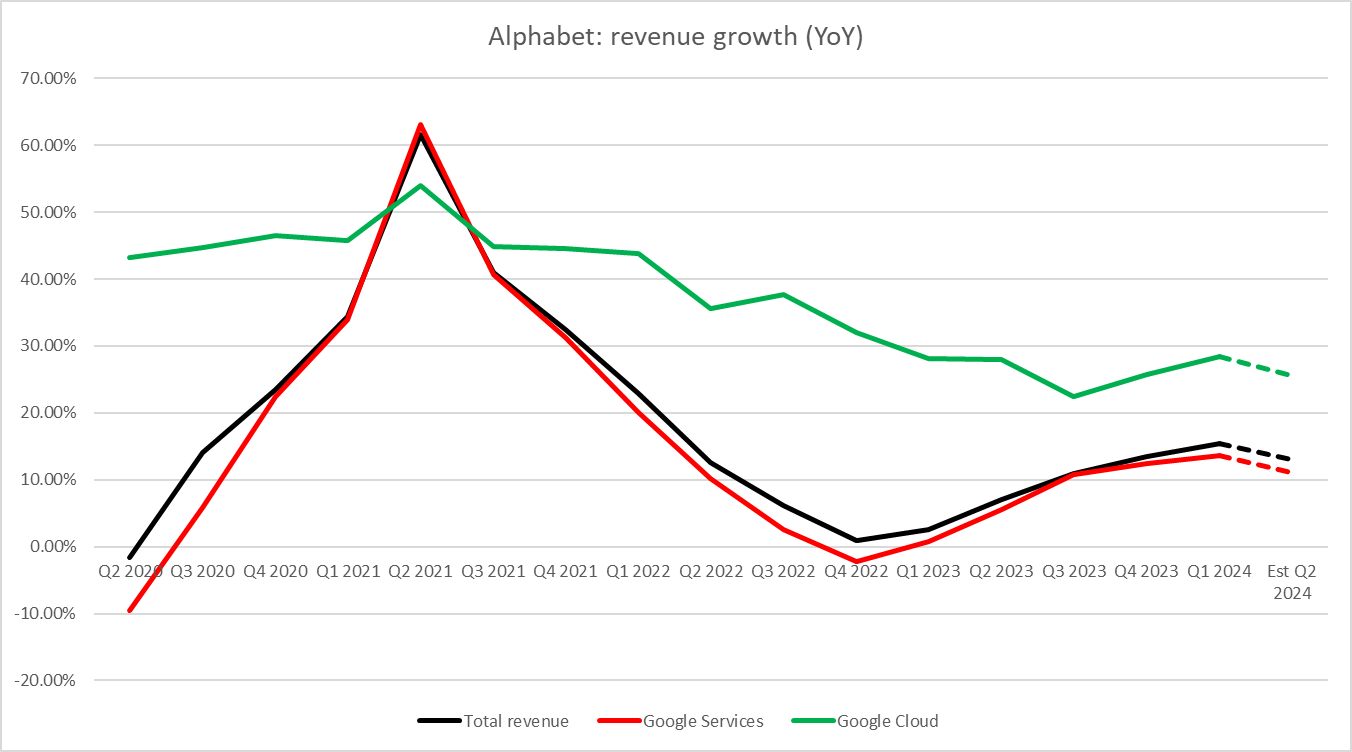

Alphabet will report earnings report for Q2 2024 today after close of the Wall Street session. Company is expected to report a 13.1% YoY growth in total revenue, what would mark a deceleration from around 15.4% YoY reported for Q1 2024. A slowdown in growth compared to Q1 2024 is expected in both major segments - Google Services (which includes ad revenue) and Google Cloud. Nevertheless, growth in cloud business is expected to remain strong at around 25% YoY.

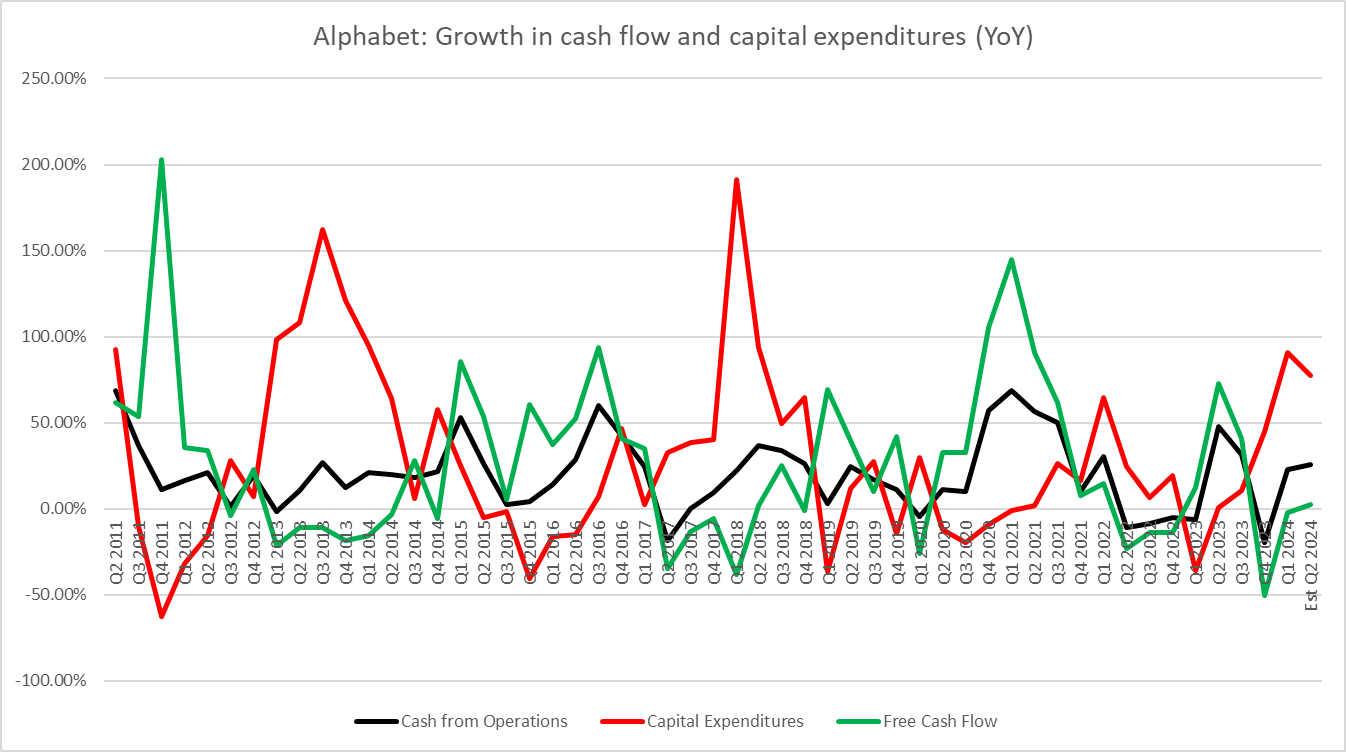

However, growth in gross profit, operating income and net income are all expected to exceed revenue growth, what hints at improved cost controls. While gross margin is expected to stay unchanged compared to a year ago quarter, operating margin is expected to improve by around 250 basis points and net margin is expected to see an 160 basis points expansion. Free cash flow is expected to be just slightly higher amid a big increase in capital expenditures.

Options market implies an around 4.6% post-earnings move in company's share price - a slightly lower volatility than suggested by historical average of absolute post-earnings price moves (5%).

Alphabet Q2 earnings expectations

- Revenue: $84.35 billion (+13.1% YoY)

- Google Services: $73.58 billion (+11% YoY)

- Google Advertising: $64.52 billion (+11% YoY)

- Google Cloud: $10.09 billion (+25.6% YoY)

- Other Bets: $390 million (+36.7% YoY)

- Hedging Gains: $138 million

- Google Services: $73.58 billion (+11% YoY)

- Revenue ex-Traffic Acquisition Costs: $70.67 billion (+13.8%)

- Gross Profit: $48.73 billion (+14.1% YoY)

- Gross Margin: 57.2% (57.2% a year ago)

- Operating Expenses: $22.42 billion (+7.5% YoY)

- Operating Income: $26.36 billion (+20.7% YoY)

- Google Services: $28.13 billion (+19.9% YoY)

- Google Cloud: $982 million (+149% YoY)

- Other Bets: -$1.07 billion (-$813 million a year ago)

- Hedging Gains: -$1.50 billion (-$1.2 billion a year ago)

- Operating Margin: 31.8% (29.3% a year ago)

- Net Income: $22.95 billion (+25% YoY)

- Net Margin: 26.2% (24.6% a year ago)

- EPS: $1.83 ($1.45 a year ago)

- Diluted EPS: $1.84 ($1.44 a year ago)

- Capital Expenditures: $12.23 billion (+77.5% YoY)

- Free Cash Flow: $22.25 billion (+2.2% YoY)

Analysts expect a slowdown in Google Services revenue growth, which includes ad revenue, as well as in Google Cloud revenue growth. Source: Bloomberg Finance LP, XTB Research

What to focus on?

What investors will focus on when Alphabet releases its earnings report? They will focus primarily on three things and it isn't hard to guess which ones. The first one is advertisement revenue, which is a key source of revenue for the company and an important company-specific measure. The second thing investors will focus on is Alphabet's cloud business, which has been the fastest growing segment of the company, but which has seen a noticeable slowdown in growth in recent quarters. Last but not least, investors will also look for hints on the ongoing market craze - Artificial Intelligence.

However, all three of those are intertwined. Rollout of AI features increases time spent on Alphabet's website, which in turn boost ad revenue. Moreover, Alphabet's Vertex AI offering is expected to boost growth in Google Cloud revenue. Alphabet is spending heavily on AI, leading to an increase in capital expenditures. This increase in CapEx is likely to limit growth in free cash flow, which is expected to be little changed in Q2 2024 compared to Q2 2023.

However, as one can see on the chart below, periods that saw an acceleration in CapEx growth were often followed by periods of an acceleration in free cash flow growth.

Periods that saw an acceleration in Alphabet's CapEx growth were often followed by periods of an acceleration in free cash flow growth. Source: Bloomberg Finance LP, XTB Research

Periods that saw an acceleration in Alphabet's CapEx growth were often followed by periods of an acceleration in free cash flow growth. Source: Bloomberg Finance LP, XTB Research

A look at the chart

Alphabet (GOOGL.US) has been trading in a strong upward move for over a year and a half now, and has gained over 100% since late-2022 lows. The move higher accelerated in March 2024, with the stock gaining around 40% since. A pullback occurred recently amid a sell-off in tech sector, but it looks to have been halted already and it was halted in an important area. The $177.50 zone, which halted the correction, is marked with the 50-session moving average (green line) as well as 23.6% retracement of the upward impulse launched in March 2024. This is a positive development for bulls from a technical point of view and may herald a return to the all-time highs. However, a lot will depend on today's earnings release. If company disappoints with results or guidance, it may cause pressure on the share price. In case of a break below the aforementioned $177.50 area, the next support to watch can be found in the $168.50 area, where the lower limit of the Overbalance structure and 38.2% retracement can be found.

Source: xStation5

Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.