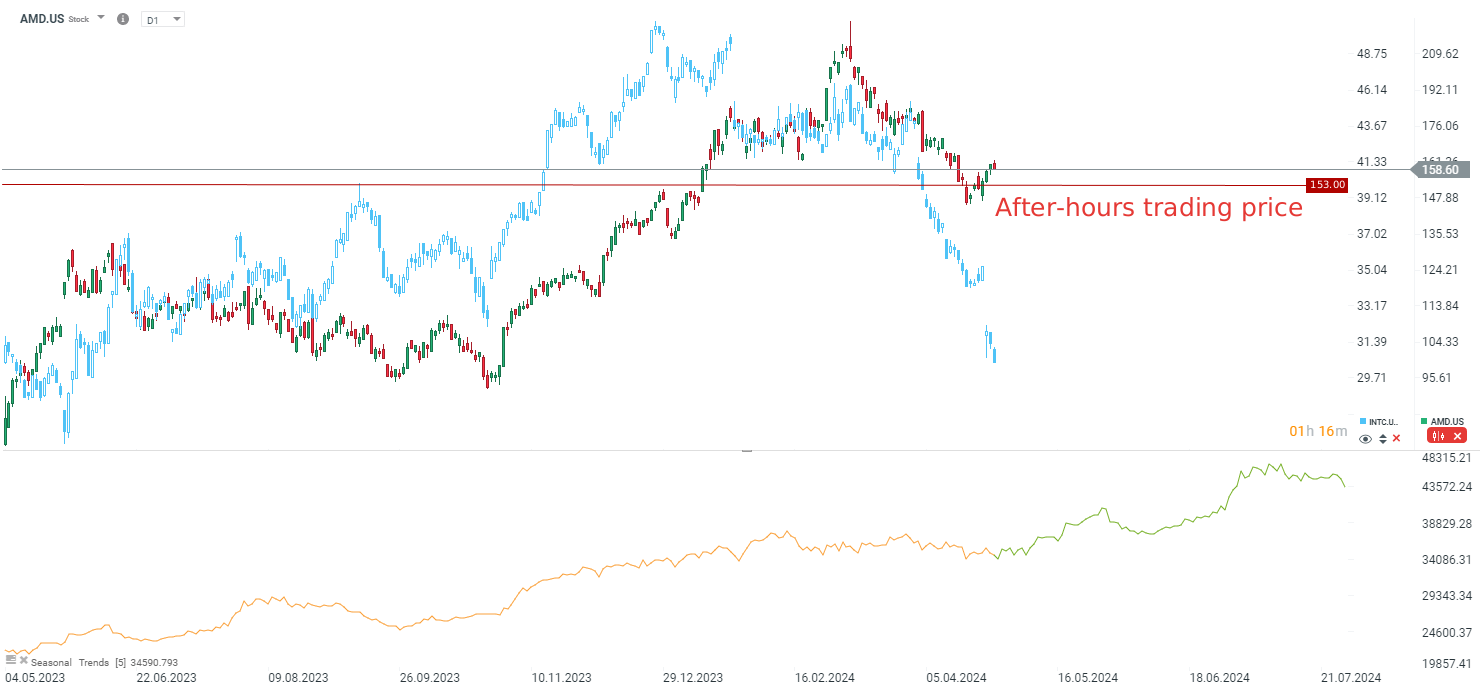

AMD announced results for the first quarter of 2024, which were mostly in line with analyst expectations. The company's revenue was $5.47 billion, up 36% from last year. Earnings per share (EPS) were $0.62, beating expectations of $0.61. On the other hand, the company presents rather mixed guidance. Results in line with expectations and rather weak guidance show that the company is not able to grow like Nvidia at the moment, which may suggest that despite a strong correction, the company's stock declines may not be over yet. AMD loses approximately 3.6% in after-market quotations. Moreover, SMC shows weaker results (mainly in terms of revenues and guidelines), which also worsens the mood in the chip sector.

Key Points:

- AMD reported Q1 2024 revenue of $5.47 billion, up 36% YoY, meeting analyst expectations.

- EPS of $0.62 beat expectations of $0.61.

- Data Center segment revenue grew 80% YoY to $2.3 billion, driven by strong demand for MI300 AI accelerators and Ryzen and EPYC processors.

- Client segment revenue grew 85% YoY to $1.4 billion but declined 6% sequentially.

- Gaming and Embedded segment revenues declined 48% and 46% YoY, respectively.

- Q2 revenue guidance of $5.4-$6.0 billion below analyst expectations.

- AMD continues to invest heavily in R&D, spending $1.53 billion in Q1.

- The company expects data center demand to remain strong as AI adoption grows.

- AMD faces stiff competition from Intel and Nvidia in data centers, PCs, gaming, and embedded systems.

- The stock is down about 3.6% in after-hours trading, following Intel's downward trend.

Quantum Computing after Earnings: Quantum Breakthough?

Alibaba sell-off extends amid White House national security concerns📌

US Earnings Season Summary 🗽What the Latest FactSet Data Shows

US Open: US100 initiates rebound attempt 🗽Micron shares near ATH📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.