American Express (AXP.US) stock jumped 8% during today's session after the credit card service company posted upbeat quarterly results and record card spending. American earned $2.18 per share, well above analysts’ projections of $1.87 on revenue of $12.15 billion, up from $9.35 billion last year. In the U.S., average basic card member spending rose by 27% to $6,351 from $4,983 last year. Customers spent $368.1 billion on their cards in the quarter, compared with $285.9 billion spent on cards in 2020.The company is seeing particular traction with younger spenders. Looking at the U.S., the company saw fourth-quarter millennial and Gen-Z spending levels climb 50% above where they were in the fourth quarter of 2019, Chief Financial Officer Jeff Campbell told MarketWatch.

Similar to its competitors, American Express recorded higher expenses this quarter. Total expenses increased 29%, as the company paid out additional rewards to its customers but also because of higher compensation expenses for its employees. Company’s management team expects that the pandemic will subside and the return to travel will have a positive effect on revenues in a range of 18% to 20%. The company also expects full-year earnings this year between $9.25 and $9.65 a share.

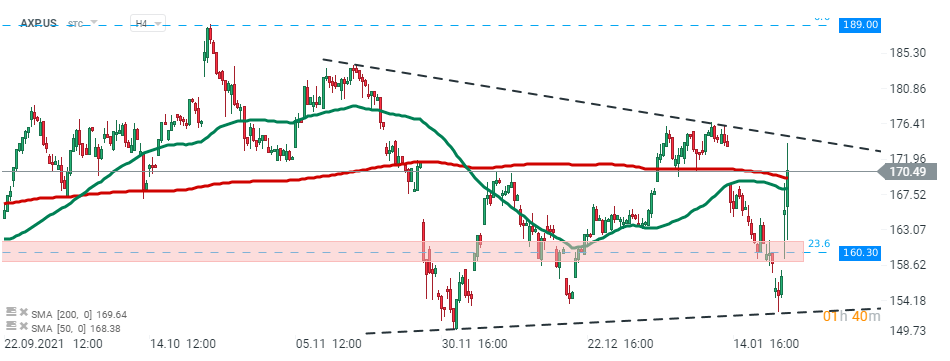

American Express (AXP.US) stock rose sharply during today's session, however it struggled to break above the upper limit of the wedge formation. In case buyers manage to push the price higher, then the next target lies at $189.00 where the all-time high is located. However if sellers manage to regain control, then nearest support is located at $160.30 and coincides with 23.6% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

American Express (AXP.US) stock rose sharply during today's session, however it struggled to break above the upper limit of the wedge formation. In case buyers manage to push the price higher, then the next target lies at $189.00 where the all-time high is located. However if sellers manage to regain control, then nearest support is located at $160.30 and coincides with 23.6% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Morning wrap: Tech sector sell-off (06.02.2026)

Amazon shares tumble 10% as investors recoil at the price of AI dominance

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.