- Earnings well above consensus

- Record contract from Poland

- Margin expansion

- Company split into segments

- Earnings well above consensus

- Record contract from Poland

- Margin expansion

- Company split into segments

Kongsberg Gruppen (not to be confused with Kongsberg Automotive), a Norwegian defence manufacturer, published its results today, after which the company is posting a fantastic gain of around 15% in a single session. The Oslo-listed company had been stuck in place in terms of valuation for quite some time, despite strong gains across the entire European defence sector driven by large-scale rearmament. It is possible that today’s results mark the end of this price stagnation.

The Q4 results leave little doubt:

Revenue rose to NOK 16.8bn, beating market expectations, and operating profit reached NOK 2.46bn, exceeding consensus by 5% and 22%, respectively. The operating margin increased from 12.7% to 14.7%.

The company’s core business, "Defence and Aerospace”, increased sales by 44% year on year, while also lifting the margin to 18.7%.

Kongsberg specialises primarily in air-defence systems and airspace surveillance. In the face of the persistent threat from Russian drones, these products are in greater demand than ever. This is reflected in a bill-to-book ratio of 2.8. A major part of the large order intake comes from Poland. Kongsberg has been selected as one of the companies expected to deliver the “San” system, designed to protect Polish airspace and the eastern border. The total value of the project is approx. PLN 15bn (around NOK 40bn), although it is not yet known what share of this amount may accrue to Kongsberg.

The company’s management also shared a number of highly important points for shareholders:

- The company committed to a generous dividend policy on the back of record profits.

- In addition, the company’s “Maritime” segment, which has lower margins, is to be carved out of the company.

- Company representatives also assure that ongoing rearmament efforts will continue to benefit Kongsberg and its shareholders.

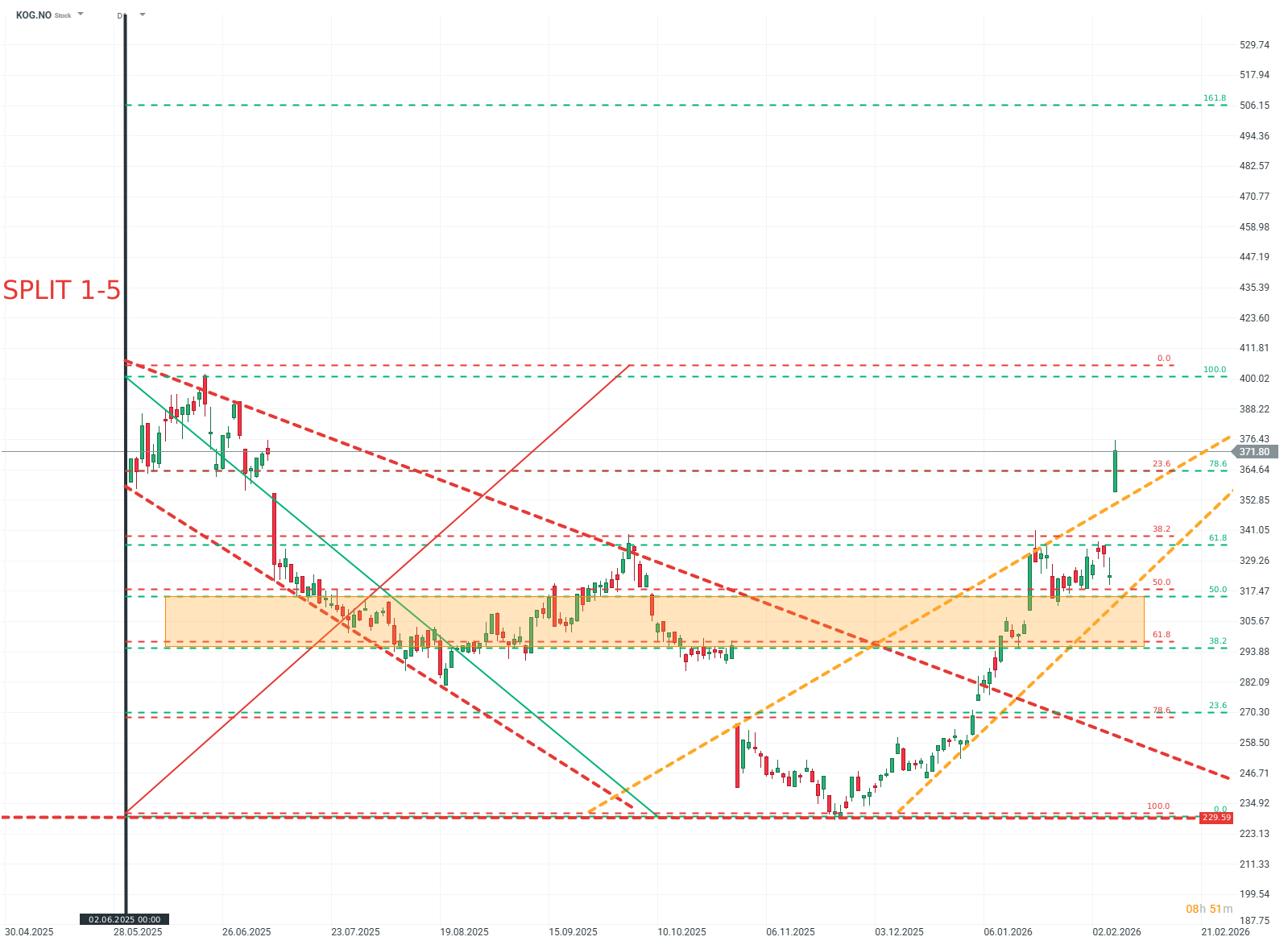

KOG.NO (D1)

After reaching local lows at the turn of 2025/2026, the valuation rebounded from the 230 level and has been rising steadily, with an observable acceleration of the trend in recent weeks. Source: xStation5

Daily summary: The beginning of the end of disinflation?

Wheat at its highest level in 8 months 📈

Jane Street: Legendary market maker in the court

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.