Apple (AAPL.US), the third-largest company in the U.S., reported its Q4 2025 results today. The stock rose modestly after the release — by just under 2%. Both revenue and earnings per share beat Wall Street expectations. The biggest surprise by far was the strength of iPhone sales in China and, more broadly, the very strong growth in iPhone revenue overall. Notably, Apple’s China sales had been weak over the past three years, making the current rebound an outright surprise for analysts. Outside of Apple’s report, Visa (V.US) also released results, with its shares down about 1.5%, while storage and data media maker SanDisk (SNDK.US) is up nearly 14%.

Apple Q4 2025 results

-

EPS: $2.84 (+18% YoY, a new all-time EPS record); $42.1B net income

-

Products revenue (total): $113.74B vs $107.69B est. (+16% YoY)

-

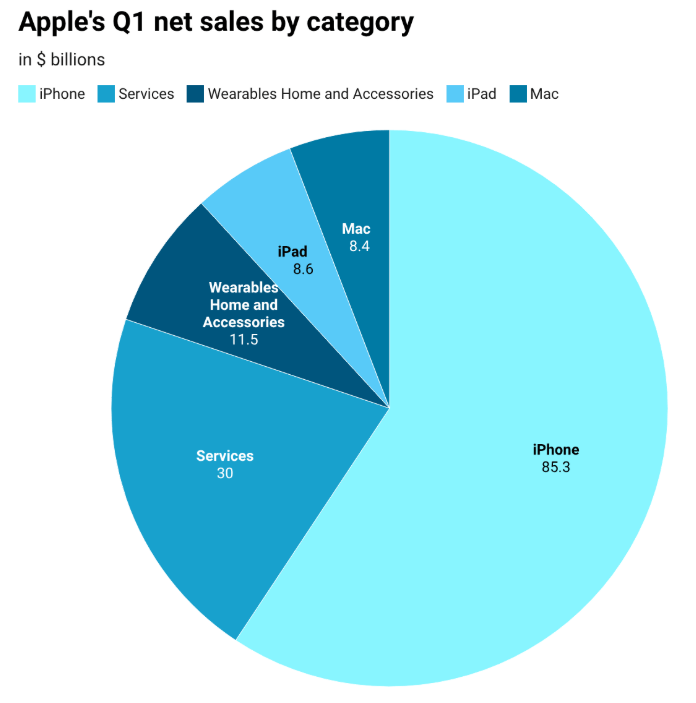

iPhone revenue: $85.27B vs $78.31B est. (+23% YoY)

-

Services revenue: $30.01B vs $30.02B est. (+14% YoY)

-

iPad revenue: $8.60B vs $8.18B est.

-

Mac revenue: $8.39B vs $9.13B est.

-

Wearables, Home & Accessories revenue: $11.49B vs $12.13B est.

-

Americas revenue: $58.53B vs $59.06B est.

-

Greater China revenue: $25.53B vs $21.82B est. (+38% YoY)

-

Operating expenses: $18.38B vs $18.18B est.

-

Operating cash flow: approx. $54B

-

Installed base: over 2.5B active devices

-

Dividend: $0.26 per share

Outlook

-

Apple expects 13–16% YoY revenue growth in the current quarter (Q1 2026).

Apple stock (D1)

Apple shares are trading around $262 in after-hours. In its commentary, the company said it is pleased with record iPhone sales (with demand described as the strongest in its history across the markets where Apple operates) as well as strong Services performance.

Source: xStation5

iPhone and Services revenue together exceeded $115B in Q4.

Source: Apple, Datawrapper

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.