Bank of Canada is scheduled to announce its next monetary policy decision tomorrow at 3:00 pm BST (Wednesday, September 6). Market expects Canadian central bankers to keep rates unchanged at a meeting this week, with the main Canadian interest rate staying at 5.00% - the highest level since the first half of 2001.

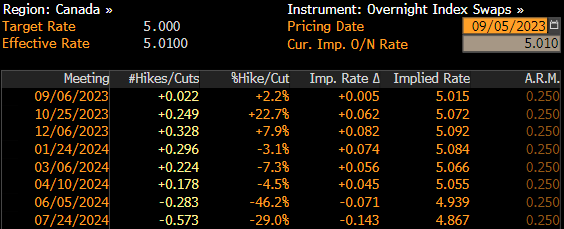

- Markets price almost 100% chance for BoC to keep rates unchanged at tomorrow's meeting, after hiking rates by 25 bp in June and July

- Canadian GDP unexpectedly contracted by 0.2% annualized in the second quarter of 2023. Market was expecting a 1.2% annualized expansion

- Canadian CPI inflation accelerated more-than-expected in July, from 2.8% to 3.3% YoY. Markets was expecting an acceleration to 3.0% YoY

- Core retail sales for June dropped 0.8% MoM while market expected a 0.3% MoM increase

Marktes see virtually no chance for a rate hike at the Bank of Canada meeting tomorrow. Source: Bloomberg Finance LP

Weak Q2 GDP data has been crucial in shaping expectations for the upcoming BoC decision. While markets 25 bp rate hike was never a base case scenario for September meeting, markets saw an around 20-25% chance of such a move prior to release of the downbeat GDP report last Friday. Moreover, other data from the Canadian economy also does not support increasing rates with consumer spending remaining weakish. While CPI data came in above market expectations, rate hike would further deteriorate the situation in the Canadian housing market. Not to mention that drop in demand coming from weakish consumer spending would likely be enough to bring inflation down to the target without a need for more rate hikes.

A look at USDCAD chart

USDCAD enjoyed strong gains between June 2021 and October 2022, gaining over 15% over the period. However, the advance was halted in the final quarter of 2022 and the pair has traded largely sideways since. Recent USD strengthening allowed the pair to bounce off 10-month lows in the 1.3100 area and climb towards the upper limit of the trading range at 1.3650. An attempt to break above this zone was made today but so far, bulls failed to deliver a breakout. Decision from Bank of Canada tomorrow could be crucial for whether the pair breaks above this zone or pulls back from it. Should we see a strong hint that incoming data doesn't support rate hikes at future meetings, CAD may find itself under pressure with USDCAD potentially breaking above 1.3650 area.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.