Bitcoin managed to recover in a flash and after yesterday's plunge to $48,000 caused by a slightly higher-than-forecast CPI reading from the US, it is trading at new local highs at $51,500. The strong U.S. dollar has not prevented Bitcoin from rising from $48,000, to over $51,000, in a matter of hours. Ethereum is similarly in great spirits, approaching $2,700, a level not seen since May 2022. More than 94% of Bitcoin's wallets are in profit, historically in line with bull market momentum.

- A higher inflation reading signaling likely Fed cuts only in the second half of the year (probably June or July, expectations for May fell to nearly 30% from 52% previously) and a stronger dollar (USDIDX index at levels seen in the fall of 2023) did not dampen cryptocurrency market sentiment for long.

- It seems that crypto market sentiment could be dampened by further higher-than-forecast inflation readings, while this is not the baseline scenario and the market expects price pressures to continue to weaken (although the decline will not necessarily be as large as Wall Street expects).

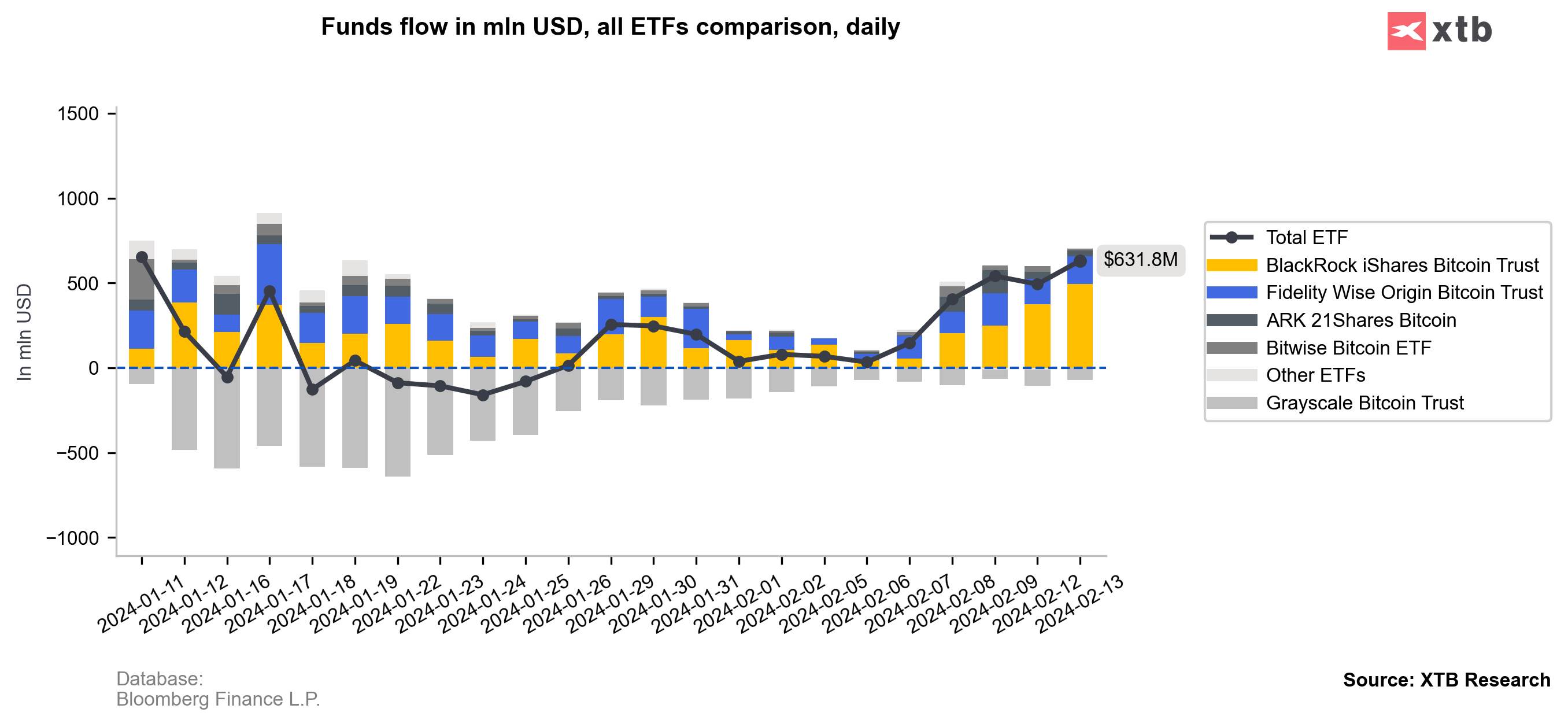

- Total positive net inflows into Bitcoin ETFs, since January 11, are already over $3 billion. In terms of year-to-date inflows, the BlackRock Bitcoin Trust (IBIT) ETF ranked 4th among all ETFs tracked by Bloomberg

- Data from Coinbase Advanced, known for its institutional activity, signals that a massive amount of Bitcoin outflows from the exchange into external portfolios, signaling a reluctance to sell despite record price levels and Bitcoin's spectacular rally

- Franklin Templeton has joined the ranks of institutions requesting the creation of a spot Ethereum ETF. Expectations are growing for SEC approval of ETF (ETC) applications for Ethereum, this summer.

Recent days have brought higher investor activity in bitcoin ETFs. The value of daily inflows is hovering around $600 million, at a time when outflows from Grayscale are consistently lower. Source: Bloomberg Finance L.P.

Gold saw a sharp decline yesterday. Bitcoin (gold chart), in contrast, managed to reverse the supply reaction very quickly. Source: xStation5

Bitcoin charts (D1, M30)

Source: xStation5

Source: xStation5

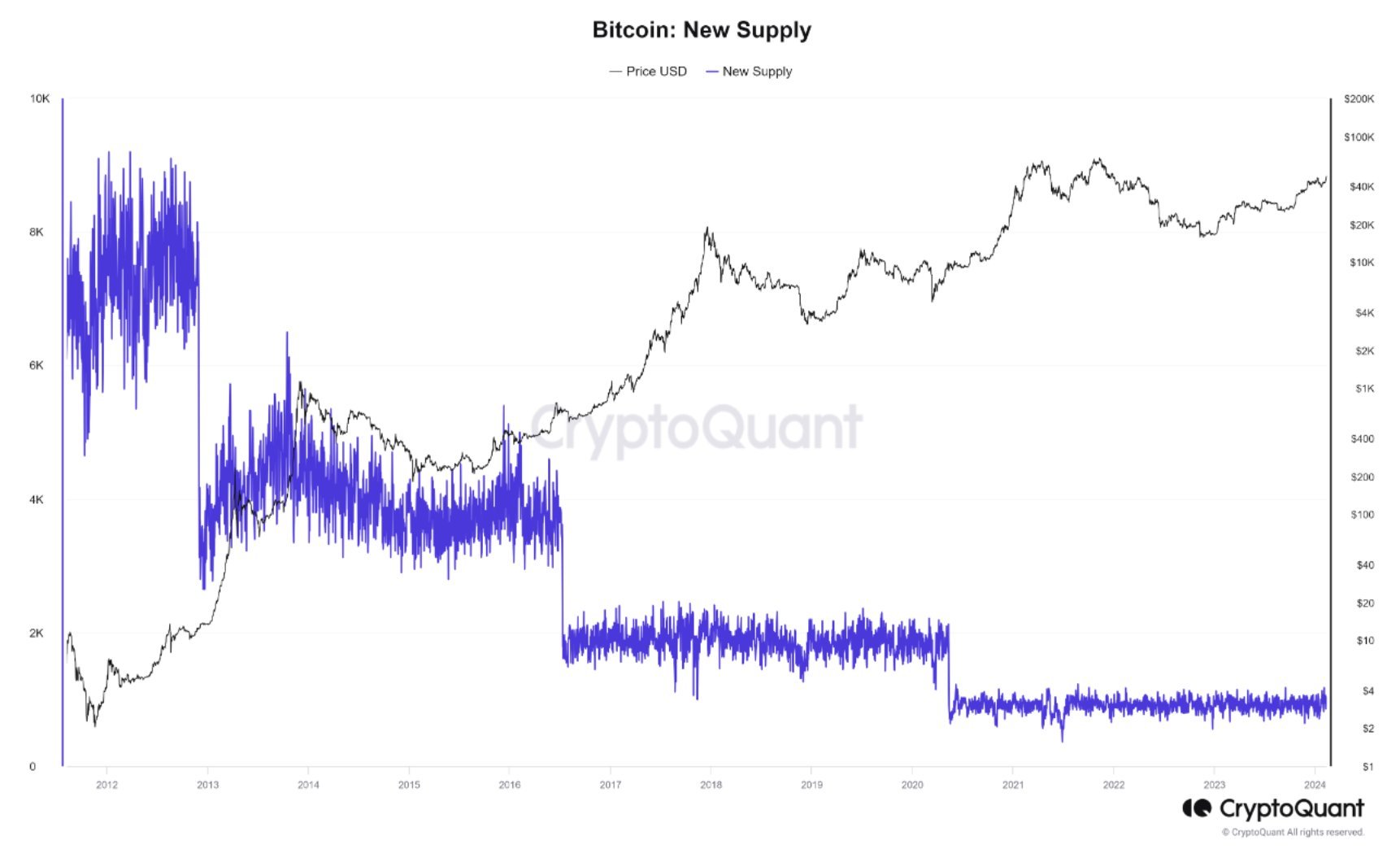

Bitcoin's supply is decreasing with each halving. In addition, the creation of ETFs has increased medium- and long-term demand for the cryptocurrency. The next halving will take place in April, this year. Source: CryptoQuant

Daily Summary: Middle East Sparks Oil Market

Crypto up 4 % despite tension📈

Crypto news: Bitcoin gains despite sell-off on global markets amid oil spike 📈

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.