Boeing shares are down nearly 9% ahead of the cash session on Wall Street, after the FAA (U.S. Federal Aviation Administration) grounded some MAX 9s following the fuselage failure of an Alaska Airlines plane on Friday. As media outlets have determined, the torn-out section of the Alaska Airlines plane's fuselage was a plug - covering the spot where some airlines place an additional emergency exit.

Source: Bloomberg Financial LP

Source: Bloomberg Financial LP

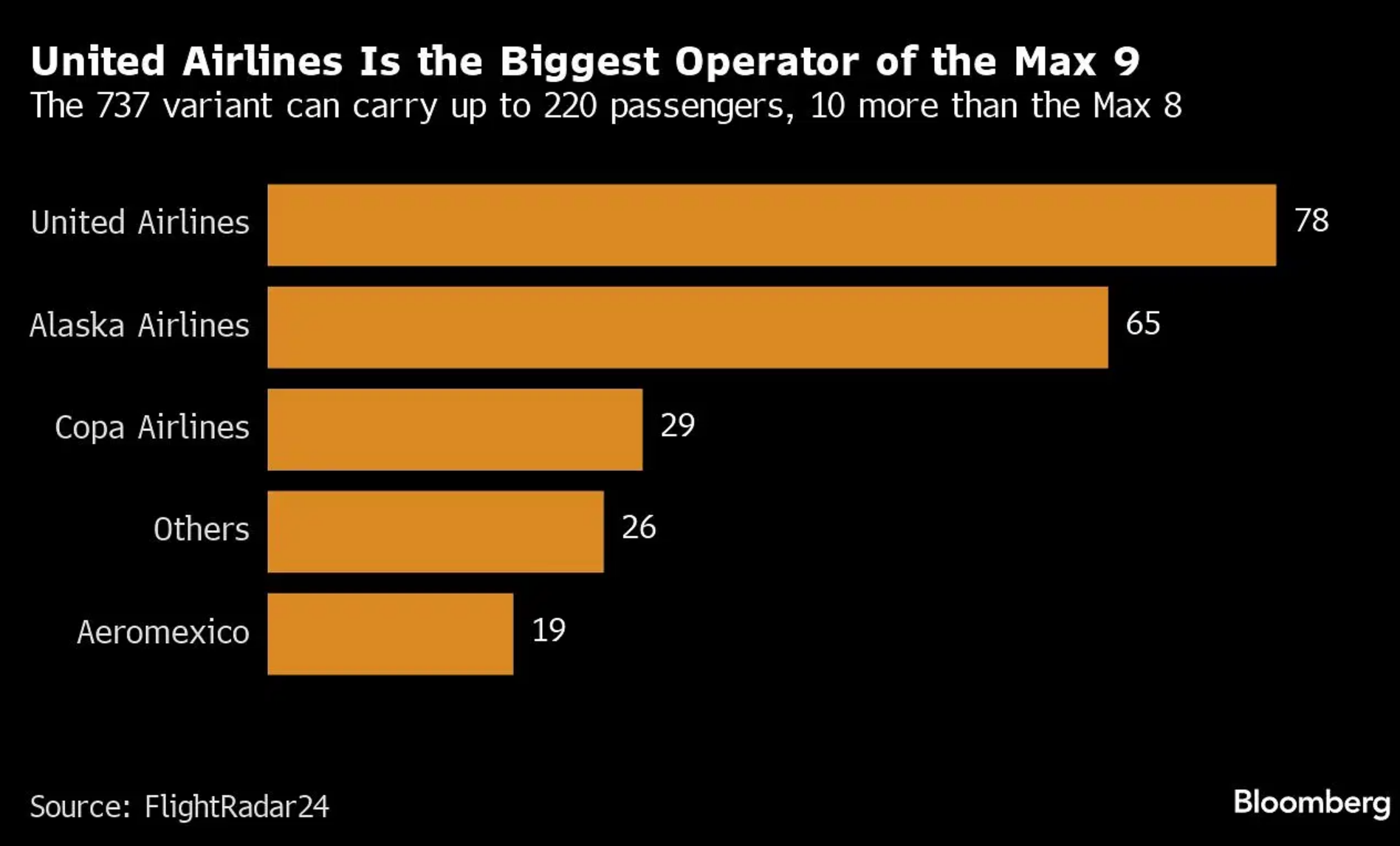

The U.S. aviation regulator said 171 Boeing 737 Max 9s must be grounded for inspection. Alaska said the flight disruptions will last until next week. United Airlines grounded 79 planes.

Source: Bloomberg Financial LP

Source: Bloomberg Financial LP

The disruption is likely to primarily affect flights in the U.S., EASA, or the European Union's aviation safety agency, has communicated that flight disruptions on the Old Continent will be minimal due to the fact that, in its view, no European airlines operate these aircraft models. The required inspections will take about four to eight hours per aircraft, the FAA reported.

Source: xStation

Daily summary: The beginning of the end of disinflation?

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US Open: Rising oil and PPI pressure Wall Street 📉 Technology and financial stocks drop

Dell surges 12% amid AI driving 40% revenue growth 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.