Shares of Boeing (BA.US) are trading over 3% higher in premarket today after the company reported financial data for Q1 2023. Results turned out to be a positive surprise. While core loss per share turned out to be deeper than expected, the company managed to deliver a solid revenue beat. Moreover, cash burn at the company is not as intense as expected with operating and free cash flow beating expectations significantly.

Q1 2023 highlights

- Core EPS: -$1.27 vs -$0.97 expected

- Revenue: $17.92 billion vs $17.43 billion expected

- Operating cash flow: -$0.32 billion vs -$1.49 billion expected

- Adjusted free cash flow: -$0.79 million vs -$1.86 billion expected

Full-year guidance (unchanged)

- Adjusted free cash flow: $3.0-5.0 billion

- Operating cash flow: $4.5-6.5 billion

- Aircraft deliveries: 400-450

Boeing reported its seventh quarterly loss in a row as the company is yet to recover from damage caused by two deadly 737 MAX crashes and subsequent groundings. Boeing said that it is producing 787 planes at a rate of 3 per month and plans to increase it to 5 per month in late-2023. The company said that recent flaws found in its 737 planes will not dent its delivery and cash-generation targets but there are concerns that it may negatively impact delivery schedules.

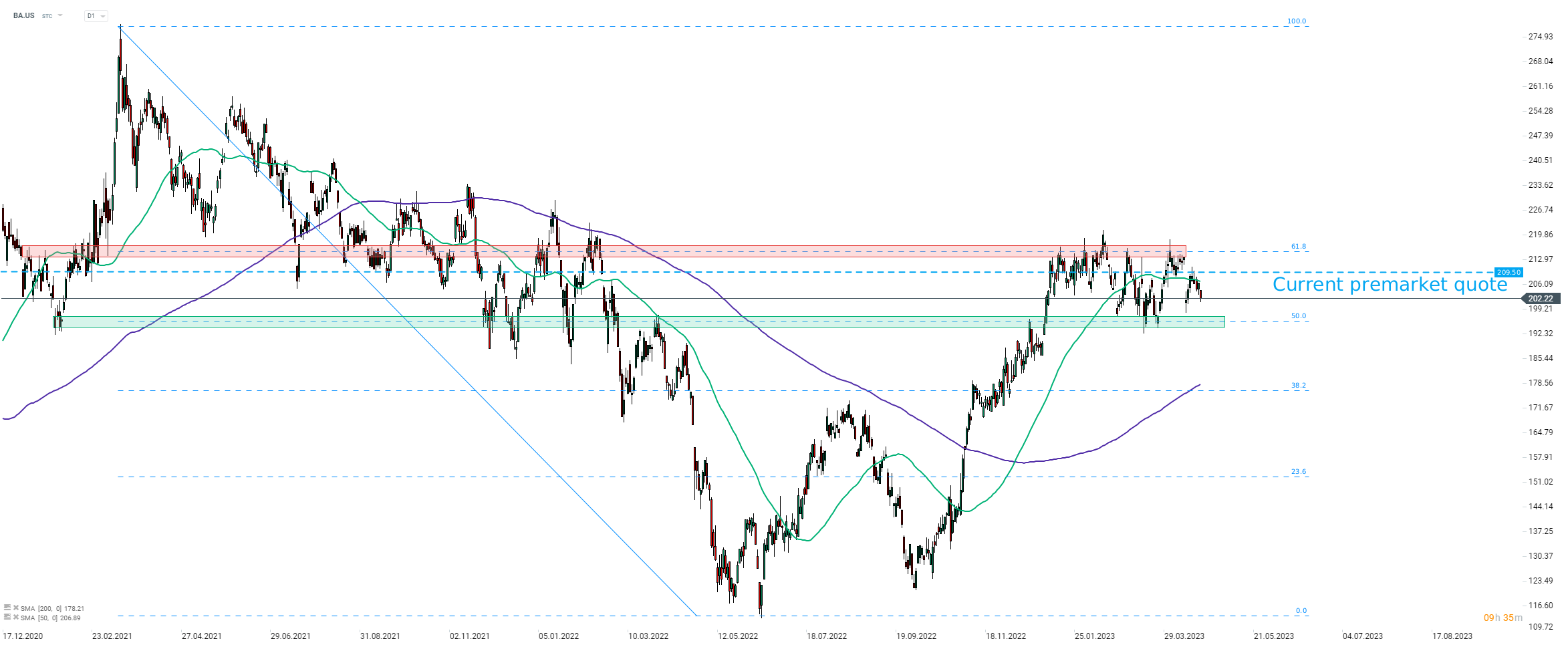

Boeing is trading over 3% higher in premarket today. Current premarket quotes point to opening of today's cash trading session near recent local highs. In such a scenario, overall technical picture for the stock would be left unchanged - price continues to trade in a range marked with 50% and 61.8% retracements and direction of a breakout would likely determine direction of the next big move.

Source: xStation5

Source: xStation5

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Largest in its class: What do BlackRock’s earnings say about the market?

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.