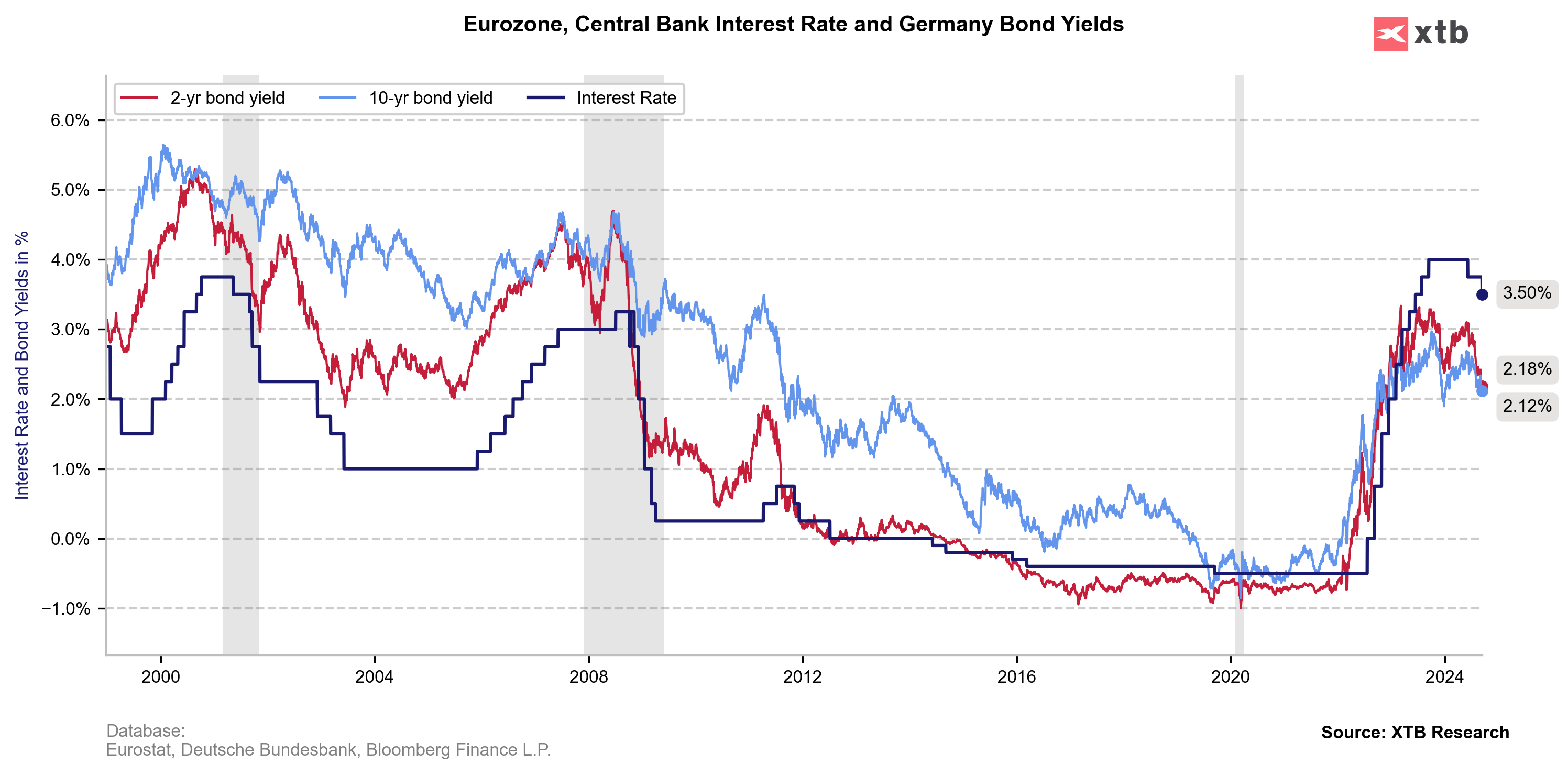

As expected, the European Central Bank decided to cut the key deposit rate by 25 basis points to 3.5%. Shortly after the publication, the euro gained in value against the US dollar. Investors will now focus on the press conference scheduled for 1:45 p.m. BST with President Lagarde, who will comment on the bankers' decision and hint at further plans for ongoing monetary policy in the eurozone.

Eurozone - ECB decision. Deposit rate: Actual: 3.5%. Expected: 3.5% Previously: 3.75%

ECB decision commentary:

- ECB will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration.

- The ECB is not pre-committing to a particular rate path.

- Recent inflation data have come in broadly as expected, and latest ECB staff projections confirm previous inflation outlook

- ECB cuts growth forecasts for every year through 2026

- Inflation is expected to rise again in the latter part of this year.

- Staff project that the economy will grow by 0.8% in 2024, rising to 1.3% in 2025 and 1.5% in 2026.

- Staff see headline inflation averaging 2.5% in 2024, 2.2% in 2025 and 1.9% in 2026, as in June projections.

- Traders trim ECB rate bets, price 36bps more cuts by the year-end.

Euro gained in value against the US dollar shortly after ECB decision.

Source: xStation

Source: XTB

Source: XTB

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.