Nvidia (NVDA.US) fiscal Q1 2026 earnings report topped Wall Street estimates. Nvidia shares rise more than 3% in the first reaction to a strong quarterly report, signalling still rising AI demand.

Fiscal Q1 2026 earnings report

- Revenue came in at $44.1 billion, up 12% from Q4, 69% from a year ago and above $43.3 billion anticipated on Wall Street

- Earnings per share (EPS) non-GAAP came in at $0.81 well above $0.73 awaited by consensus on Wall Street

- Data Center segment revenue came in at $39.1 billion, up 10% from Q4 and up 73% from a year ago but slightly below $39.2 billion expected on Wall Street

- NVIDIA will pay the next quarterly cash dividend of $0.01 per share on July 3, 2025 (record date: June 11, 2025)

- Nvidia forecasts Q2 2025 revenue below estimates, however, the market didn't react to that fact.

The company reported that its GAAP and non-GAAP gross margins were 60.5% and 61.0%, respectively. However, if the $4.5 billion charge (less than $5.5 billion anticipated before by the company) were excluded, the first quarter non-GAAP gross margin would have been 71.3%.

As for earnings per diluted share, GAAP and non-GAAP figures were $0.76 and $0.81, respectively. Without the charge and related tax impact, first quarter non-GAAP diluted earnings per share would have been $0.96.

Nvidia business segments (ex-Data center)

- Gaming and AI PC: revenue was a record $3.8 billion, up 48% from the previous quarter and up 42% from a year ago.

- Professional Visualization: revenue was $509 million, flat with the previous quarter and up 19% from a year ago.

- Automotive and Robotics: revenue was $567 million, down 1% from the previous quarter and up 72% from a year ago.

The outlook

Nvidia expects Q2 2025 revenue of $45 billion, plus or minus 2% vs $45.90 billion estimated by LSEG analysts consensus. The forecast includes a loss in H20 revenue of about $8 billion (much higher than $4.5 billion in Fiscal Q1 2026) due to the recent export curbs. As for now, Nvidia expects a major hit to sales from tighter U.S. curbs on exports of its AI chips to key semiconductor market China.

- Q2 non-GAAP gross margins are expected to be at 72.0% level, respectively, plus or minus 50 basis points. The company is continuing to work toward achieving gross margins in the mid-70% range late this year.

- Q2 non-GAAP operating expenses are expected to be at approximately $4.0 billion. Full year fiscal 2026 operating expense growth is expected to be in the mid-30% range.

- Q2 non-GAAP other income and expense are expected to be an income of approximately $450 million, excluding gains and losses from non-marketable and publicly-held equity securities.

- Q2 non-GAAP tax rates are expected to be 16.5%, plus or minus 1%, excluding any discrete items

Source: Nvidia Fiscal Q1 2026 earnings report Non-GAAP

Jensen Huang commentary on Q1 earnings

“Our breakthrough Blackwell NVL72 AI supercomputer — a ‘thinking machine’ designed for reasoning— is now in full-scale production across system makers and cloud service providers (...) Global demand for NVIDIA’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate. Countries around the world are recognizing AI as essential infrastructure — just like electricity and the internet — and NVIDIA stands at the center of this profound transformation.”

Nvidia (D1 interval)

Shares rise above $140 in US after-market, signalling a potential of a breakout pattern, with a major resistance zone at ATH zone (February 2025). On the other hand, for the final reaction on Wall Street we have to wait until tomorrow session opening, as fiscal Q2 2026 revenue guidance missed estimates.

Source: xStation5

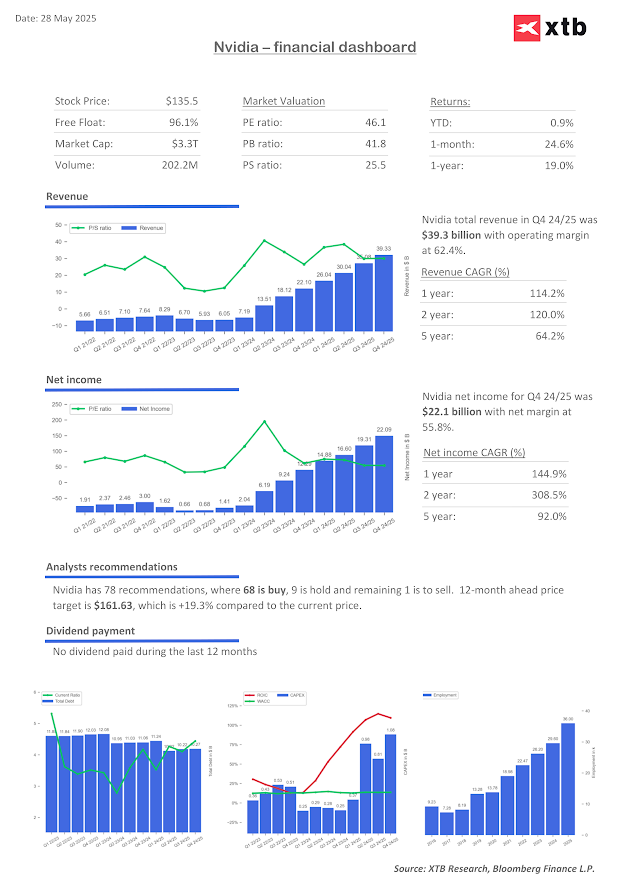

Nvidia financial dashboard

Source: XTB Research, Bloomberg Finance

Dailu summary: Sell-off on Wall street 📉 Bitcoin and Ethereum extend downfall in panic

Software stocks in panic mode 📉Will Anthropic AI disrupt tech valuations?

US100 loses 2% 📉

The launch of Xeon 600 and cooperation with SoftBank. Is this a breakthrough for Intel?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.