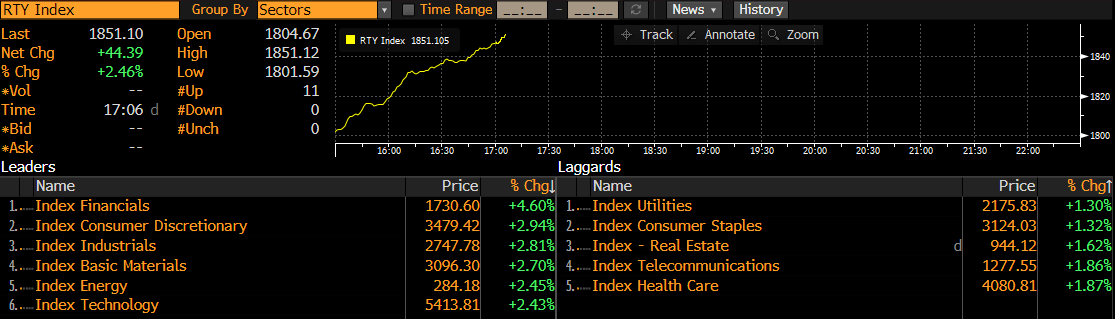

Wall Street indices managed to recover from early losses and are posting small gains at press time. Russell 2000 is an exception as the index is not posting a small gain but a massive one. The index is trading 2.5% higher at press time with all 11 sector groups trading higher. Biggest gains, however, can be spotted on Financials subindex. The move high in financials is driven by banks, with regional banking shares rallying today. The move is somewhat puzzling as there was no news that could justify outperformance of the sector. It looks like a relief rally following struggles of regional banks in recent months.

However, it should be said that banks have been underperformers on Wall Street yesterday and this underperformance was a result of WSJ report suggesting that US regulators are considering raising capital requirements for banks by 20%. This story has been neither confirmed, nor denied by US authorities but it looks like shares in regional banks are trying to erase part of recent weakness today.

Russell 2000 rallies 2.5% today, driven by solid performance of financial stocks. Source: Bloomberg

Russell 2000 rallies 2.5% today, driven by solid performance of financial stocks. Source: Bloomberg

Russell 2000 futures (US2000) rally today and has managed to climb above 1,845 pts resistance zone earlier during the session. The index is trading at a 3-month high. The next resistance zone to watch can be found in the 1,885 pts area. Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

📈Wall Street rebounds, VIX slips 5% 🗽What does US earnings season show us?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.