Another set of hawkish comments from two FED members Williams and Bullard caused some moves in the market in the evening. USD dollar strengthened, while US equities deepened downward move.

Fed's Bullard:

-

The markets are underpricing the risk that the FOMC may be more aggressive.

-

The Fed will have to continue raising interest rates until 2023.

-

The FOMC must reach the low end of the 5%-7% rate range.

-

We will have to maintain sufficiently high rates throughout 2023 and 2024.

-

Everything will go better if we reach the restrictive level sooner, making 2023 a year of disinflation.

-

The first 250 basis points of tightening were just getting to neutral.

-

The labour markets remain extremely strong and its response to inflation is not as strong as many people believe.

-

A recession is not inevitable.

-

Estimates for fourth-quarter US GDP are positive.

-

Continues to believe that growth will be below trend in 2023.

Fed's Williams:

-

Inflation remains far too high and will take time to fall.

-

The Fed has more work to do to reduce inflation.

-

The unemployment rate in the United States is expected to rise from 3.7% to 4.5%-5.0% by late 2023.

-

More interest rate increases will aid in the restoration of economic balance.

-

Noticed signs of moderating inflation amid supply chain improvement.

-

Inflation is expected to fall to 5.0%-5.5% by the end of 2022 and 3.0%-3.5% by late 2023.

-

The job market remains remarkably tight, with strong hiring and wage gains, while inflation expectations remain stable

-

The Fed's outlook is dependent on the data.

-

Economists do a bad at forecasting recessions.

-

There are several downside risks to the forecast.

-

The baseline forecast does not predict a recession for the US.

-

Fed could reduce rates in 2024.

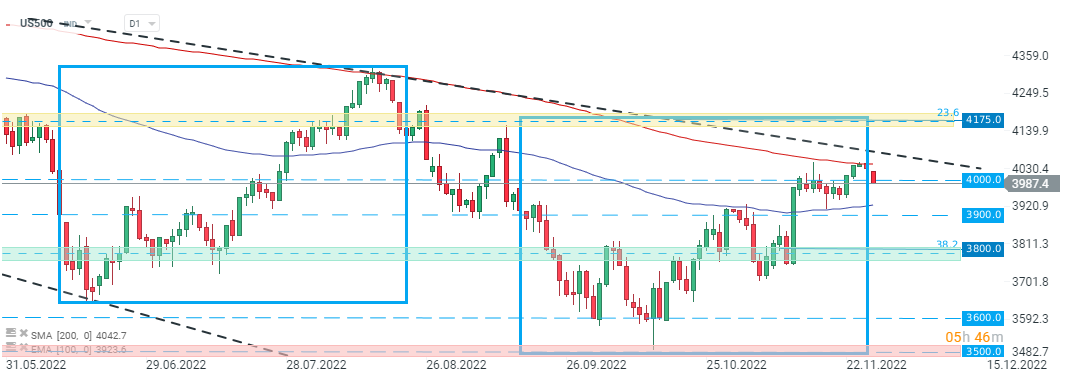

US500 failed to break above 200 SMA (red line) last week, and today's index returned below psychological 4000 pts level following Bullard and Williams comments. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.