Oil is continuing its rally triggered by OPEC+ actions, especially supply cut extensions from Saudi Arabia and Russia. Both countries announced 2 weeks ago that they will extend output and export cuts through the end of the year, catching markets off guard as a 1-month extension was widely expected.

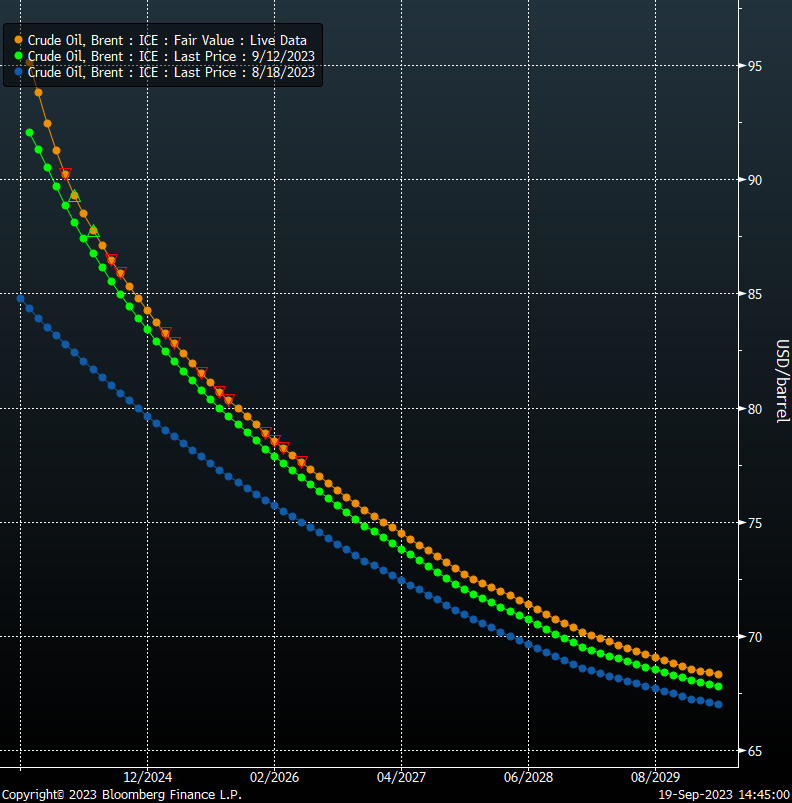

Changes in the crude oil futures curve highlight that the market may be undersupplied in the short-term and that the physical oil market is getting tighter. Taking a look at the chart below, plotting current futures curve as well as week- and month-ago curves, we can see a strong increase in the near-term contracts. Such a situation signals that either short-term demand is very strong, or short-term supply is constrained. The latter seems to be the case as there are still a number of questions around Chinese demand growth. Spread between 1st month Brent contract and 4th month Brent contract is approaching $4 per barrel - levels not seen since mid-November 2022.

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

Taking a look at Brent (OIL) chart at D1 interval, we can see that price is at daily highs, just a touch below $95.50 mark. Oil prices are up over 15% since late-August low and market analysts as well as oil industry insiders saying that $100 per barrel may soon be reached. However, while consensus seem to be build around forecast that $100 will be breached, it is almost equally accepted that any such breakout will be short-lived given how quick recent gains were, how strongly overbought the market is and how fundamentals does not justify such price levels. The near-term resistance to watch can be found in the $98 per barrel area - around 2.5% above current market price - and is marked with local highs from the second half of 2022.

Source: xStation5

Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Oil Under Pressure as G7 Decision Remains Pending

US Open: Oil too expensive for Wall Street!

OIL: Prices soar to $120 a barrel; Israel bombs Iran's oil facilities 📌

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.