C3.ai (AI.US) stock jumped 30% on Friday after the tech company posted upbeat results for the third quarter, with CEO Thomas Siebel seeing a "dramatic change" in sentiment and sees the company becoming profitable in fiscal 2024..

-

The provider of artificial intelligence company recorded a narrower-than-expected loss of 6 cents per share ex-items, while analysts expected loss of 22 cent. Revenue of $66.7 million also beat market projections of $64.2 million.

-

Gross came in at 76%, down slightly from the 80% during the year-ago period

-

C3.ai had $790 million of cash/equivalents on the balance sheet at the end of third quarter, which is down from $859 million last quarter and may mean that the company is burning cash at a quick pace.

Company expects to reach non-GAAP operating profitability by FQ4'24, which would be a significant improvement compared to recent quarterly trends, including the non-GAAP operating loss margin of 23% during FQ3. Source: C3.ai

-

"As we enter Q4 FY 23, we are seeing tailwinds from improved business optimism and increased interest in applying C3 AI solutions to address an increasing range of applications across a broad range of industries," Chief Executive Thomas Siebel said in a release. "The overall business sentiment appears to be improving. This is a dramatic change from what we experienced in mid-2022."

-

"The company is starting to gain momentum in building significant enterprise opportunities in its pipeline with its suite of innovative enterprise AI solutions," said Wedbush analyst Daniel Ives.

-

Company expects fourth quarter revenue in the region of $70 million to $72 million in revenue, above analysts’ estimates of $69.9 million. Executives also anticipate a $24 million to $28 million adjusted loss from operations.

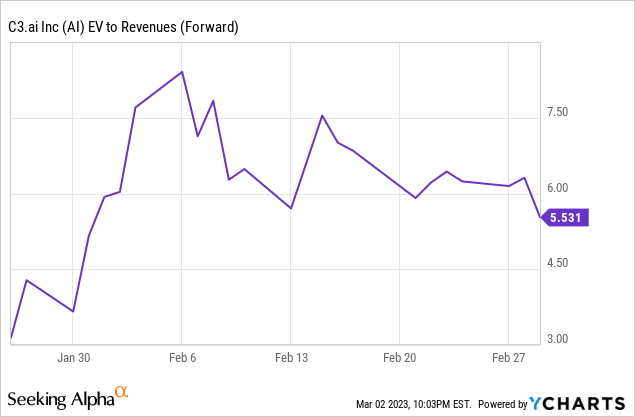

C3.ai's stock currently trades at 5.5x forward revenue, which is hard to quantify given the unclear revenue growth as the company is moving towards a consumption-based pricing model. However, even if the company were to grow consistently over 25% over the long term, the lack of profitability should be treated as a warning sign. Source: Seeking Alpha/ YCharts

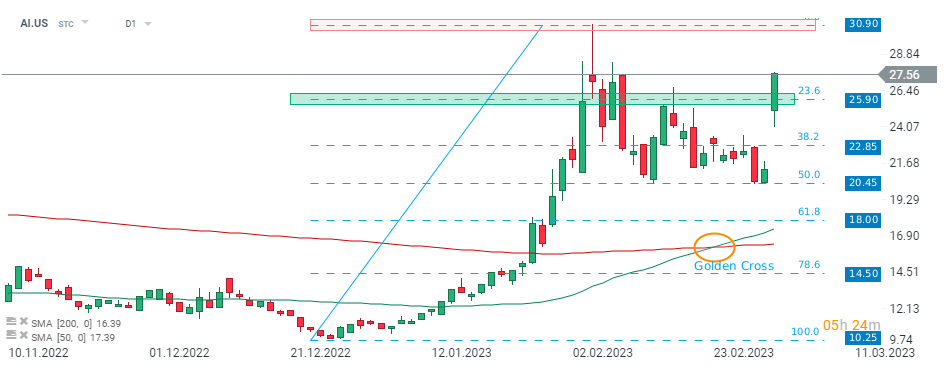

C3.ai (AI.US) stock launched today's session with a massive bullish price gap and easily broke above local resistance at $25.90, which coincides with 23.6% Fibonacci retracement of the last upward wave. If current sentiment prevails, the upward move may accelerate towards the recent high at $30.90. Also medium-term 50-day SMA (green line) crossed above the long-term 200-day SMA (red line). This formed a ‘golden cross’ formation, which supports market bulls. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.