Uranium Crisis

The global uranium market has captured investor attention after Kazatomprom, the world's largest nuclear fuel producer, announced a reduction in its production targets for 2025. This decision has raised concerns about potential uranium shortages and led to a significant increase in the price of this commodity.

Kazatomprom, which accounted for about 20% of global uranium production in 2023, has reduced its production forecast for the coming year by approximately 17%. The company attributes this decision to uncertainty about sulfuric acid supplies and delays in mining from new deposits.

Nuclear Energy Revival Boosts Demand

The growing demand for cleaner energy sources is driving a global shift in energy policy. Governments around the world, including Japan and Germany, are revising their plans for the gradual phase-out of nuclear energy. The International Atomic Energy Agency predicts that demand for uranium from nuclear reactors will increase by 28% by 2030 and nearly double by 2040.

Cameco Leading the Gains

The promise of higher uranium prices has attracted investors, who have begun buying shares of North American uranium-related companies. Companies such as Cameco, Denison Mines, and NexGen Energy have seen a significant increase in their share prices.

Analysts believe that Kazatomprom's reduced production targets, although higher than in 2024, are lower than previously established levels. This creates excellent conditions for companies like Cameco and other North American uranium producers.

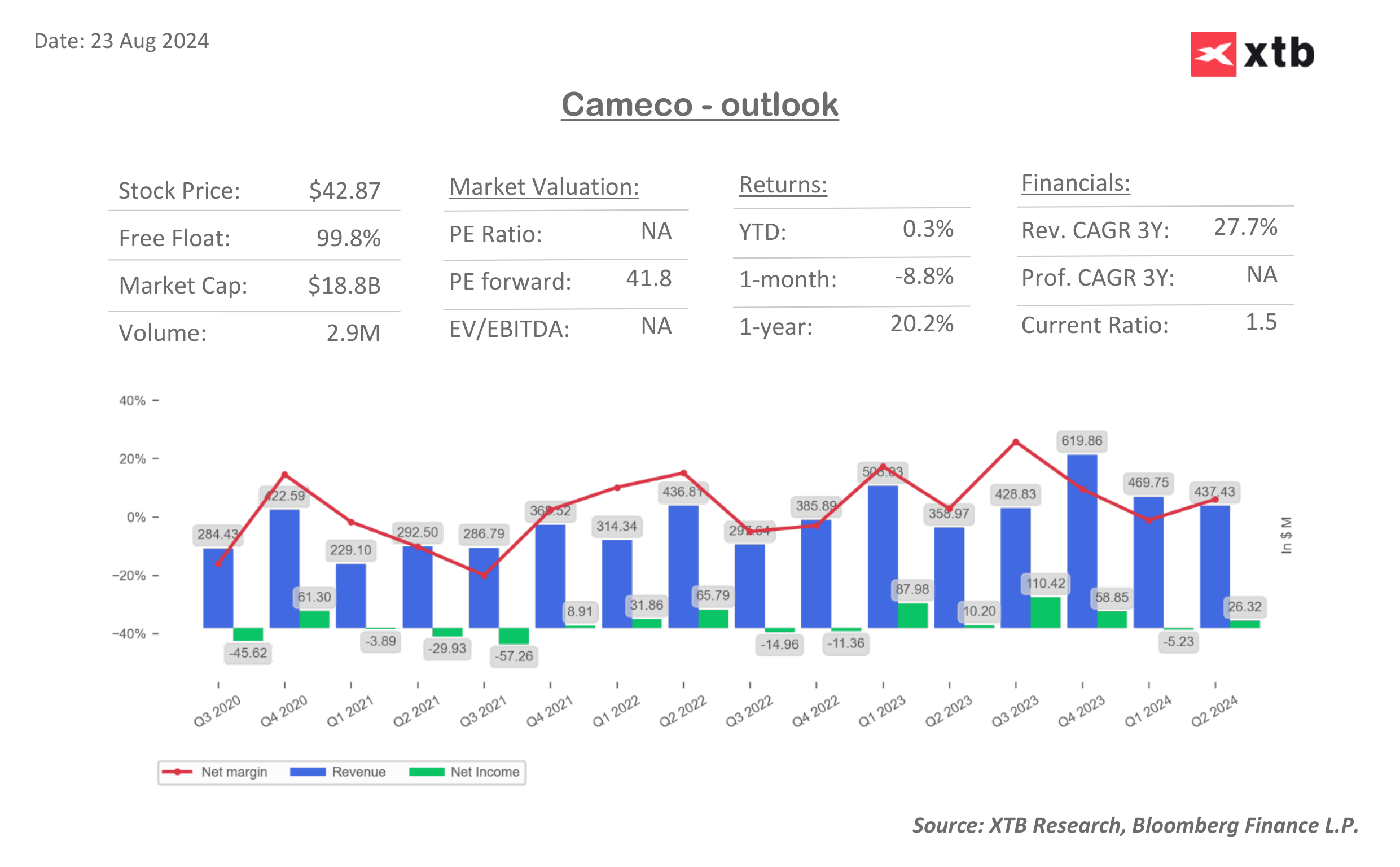

A Brief Fundamental Look

From a fundamental perspective, it is worth noting that revenues have been declining for two consecutive quarters, but due to the problems of the Kazakh producer, this situation may change. The company is valued relatively high, considering the forward P/E, but improving margins to last year's levels may change this situation.

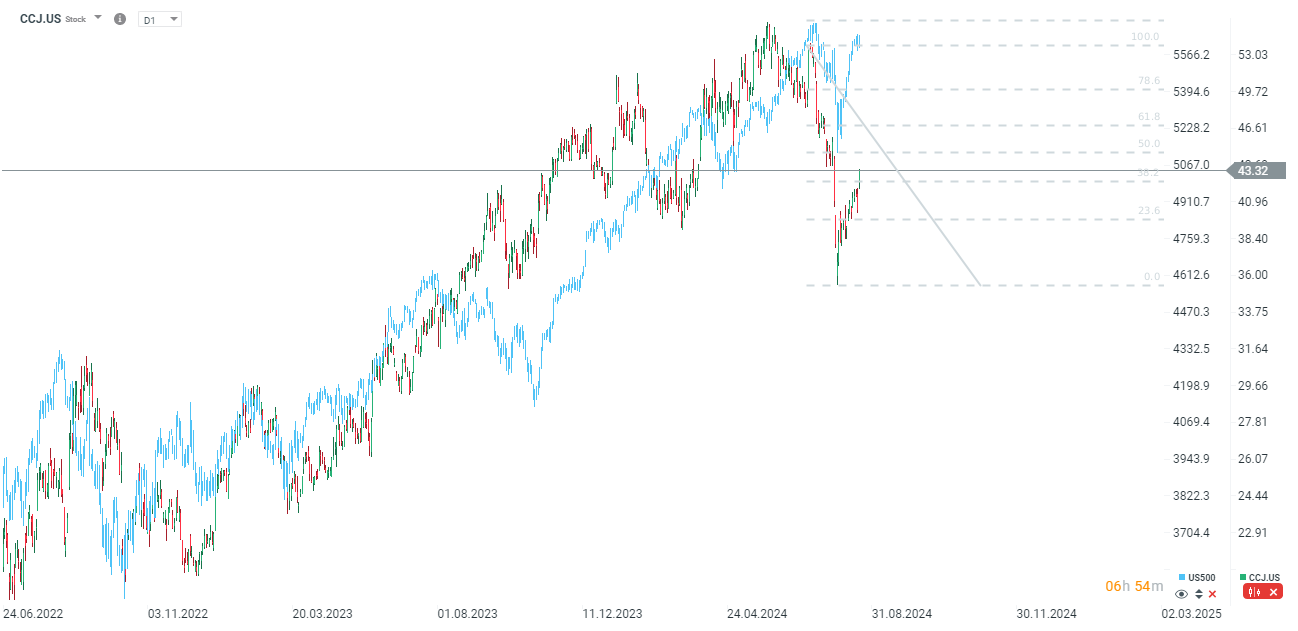

Looking at the Chart

Cameco shares have been under pressure from mid-July to early August and lost as much as 35% in value. The shares have already rebounded quite a bit from the local low around $36 per share, but are still about 28% away from historical highs. Moreover, it can be seen that Cameco seemed to rebound somewhat slower than the broader market in the form of the S&P 500 index. The outlook for the company seems to be solid, although it is important to remember the significant impact of the upcoming US elections. On the one hand, Donald Trump is betting on conventional energy sources, which do not include nuclear power. On the other hand, Kamala Harris is betting on green energy, so the impact of the election results on shares may be ambiguous. The nearest key resistances are $44.6 and $46.7.

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.