The upcoming Federal Open Market Committee (FOMC) decision is poised to significantly impact Bitcoin's price. With the market pricing in a 67% probability of a 50 basis point rate cut, up from 35% a week ago, expectations are high for a substantial policy shift.

Bitcoin has historically performed well following Fed rate cuts, as seen after the March 2020 reductions. However, the current situation presents unique challenges. Bitcoin has retreated to around $58,000 from recent highs of $60,660, reflecting market uncertainty. A 25 basis point cut might be viewed as a measured approach, potentially stabilizing Bitcoin. However, a 50 basis point cut could be interpreted as a sign of economic concern, possibly negatively impacting risk assets like Bitcoin or provide higher upside based on the lower cost of capital.

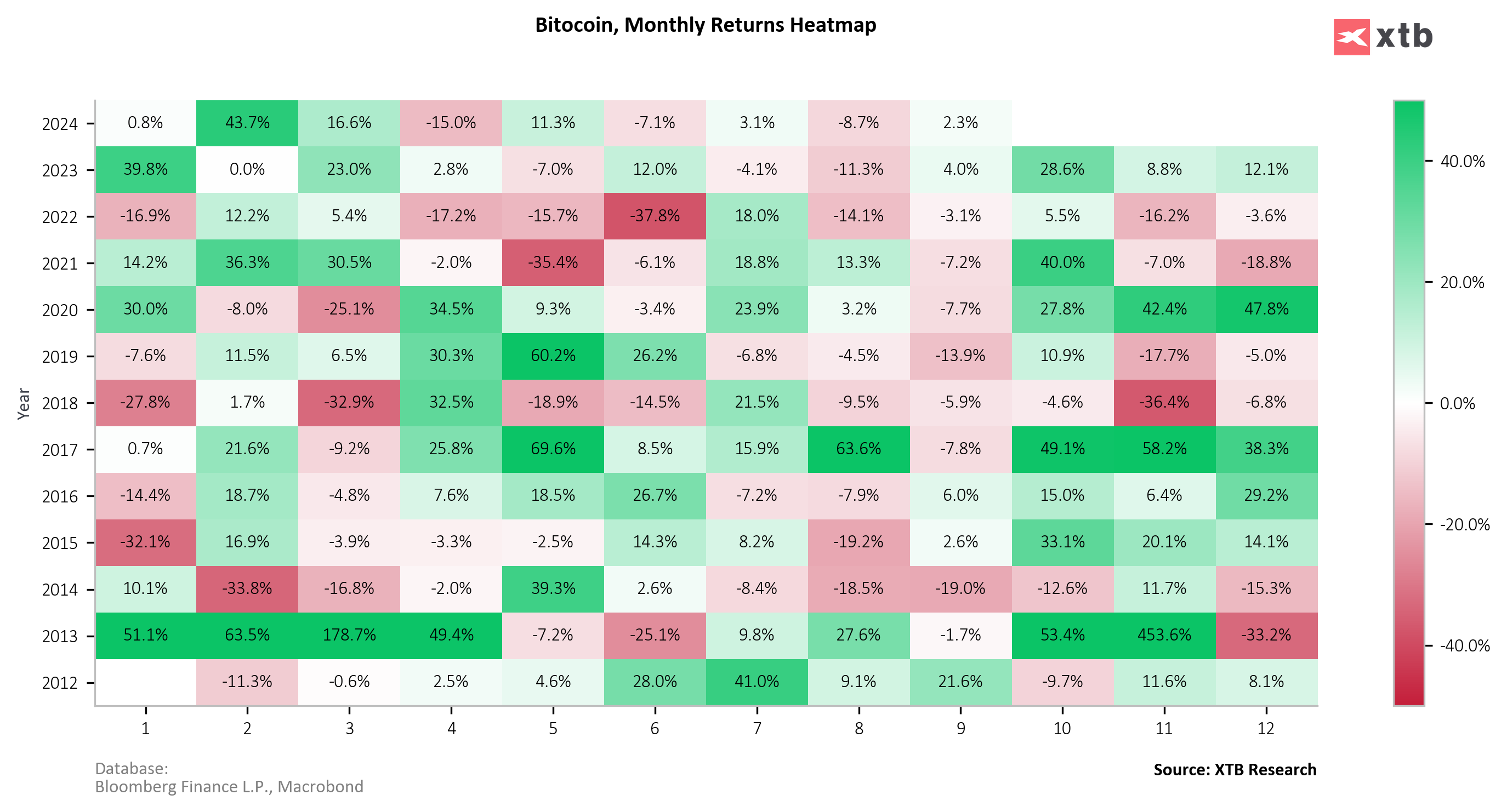

September has historically been a seasonally weak month for Bitcoin, with an average monthly return of -2%. However, October has been one of the best months historically, which could pair well with a potential softening of monetary policy.

Investors should prepare for increased volatility around the FOMC announcement and subsequent press conference. The Fed's forward guidance and updated dot plot will be critical in shaping market sentiment beyond the immediate rate decision.

Bitcoin (D1 interval)

The price of Bitcoin crossed the 50-day SMA yesterday and remains above this level today. Currently, the 50% Fibonacci retracement level is acting as support. For bulls, breaking the 100-day SMA at $61 237 would present a good opportunity to test the 61.8% Fibonacci retracement level. Beyond that, there is potential to retest the 200-day SMA. A clear bullish divergence began two weeks ago. The RSI is now in neutral territory, which, combined with positive price action, still offers upside potential. The MACD is also diverging positively. Additionally, the convergence of DI+ and DI- has typically signaled a potential trend reversal.

Source: xStation

Source: xStation

Crypto News: Bitcoin builds momentum 📈 Is a triangle pattern forming on Ethereum?

Morning wrap (09.01.2026)

Cryptocurrencies sell-off 📉Ripple loses despite Amazon partnership

Bitcoin slips below $90,000 📉 Is a broader sell-off ahead?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.