The Chinese stock market is experiencing a notable rebound in recent weeks. After a period of struggle, key benchmarks like the Hang Seng Tech Index and the ChiNext gauge have surged almost 20% from their lows, signaling a potential shift from a prolonged selling pressure. This recovery is underpinned by improved sentiments, increased foreign inflow of capital, and stronger earnings, suggesting a possible end to the market's downtrend. The market's turnaround has been particularly noticeable in tech and renewable sectors, reflecting a positive change from the previous underperformance of Chinese shares. Investors, including institutional ones like abrdn plc and M&G Investment Management, are growing optimistic, seeing this as an indication of the market bottoming out.

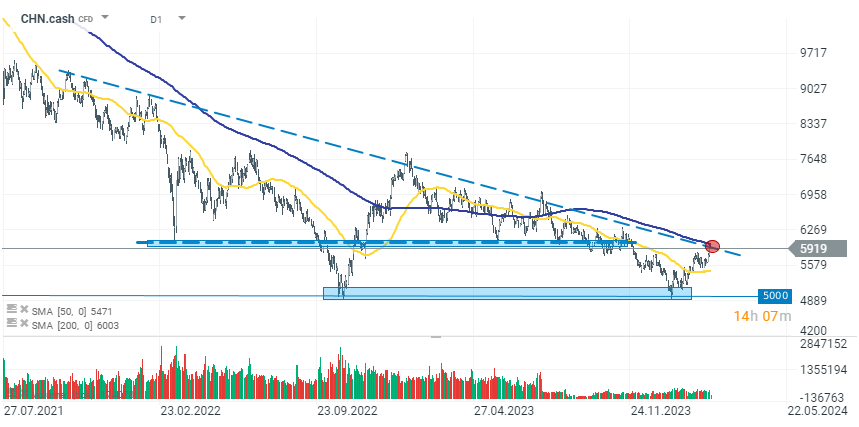

CHN.cash (D1 interval)

On the CHN.cash (HSCEI Index) chart, we can observe another day of gains, which have now recovered nearly +20% from the year's start low around 5000 points. Currently, the bulls are in a key zone that marks the upper limit of a long-term downtrend. If this is broken and the index returns above 6000 points, the HSCEI will enter a consolidation area, and the continuation of growth could even lead to the start of an uptrend. However, there are still many challenges ahead for China, so in the short term, it will be crucial to overcome the resistance at the 6000-point level.

Source: xStation 5

Morning Wrap - Oil price is still elevated (07.03.2026)

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.