The Reserve Bank of Australia announced a 50 basis point rate hike after a meeting today. This put the main interest at 1.35% - the highest level since mid-2019. This was also the first back-to-back 50 basis point rate hike in RBA's history as the Bank embarked on a record-paced tightening in an attempt to rein in inflation. Interest rate futures are now pricing in around 170 basis points of additional RBA tightening by the end of this year. However, economists say that a streak of recent upbeat data, like for example retail sales, makes it unlikely for the RBA to follow in Fed's footsteps and deliver a 75 basis point move. Instead, the Bank is expected to continue with 50 basis point rate hikes in the coming meetings.

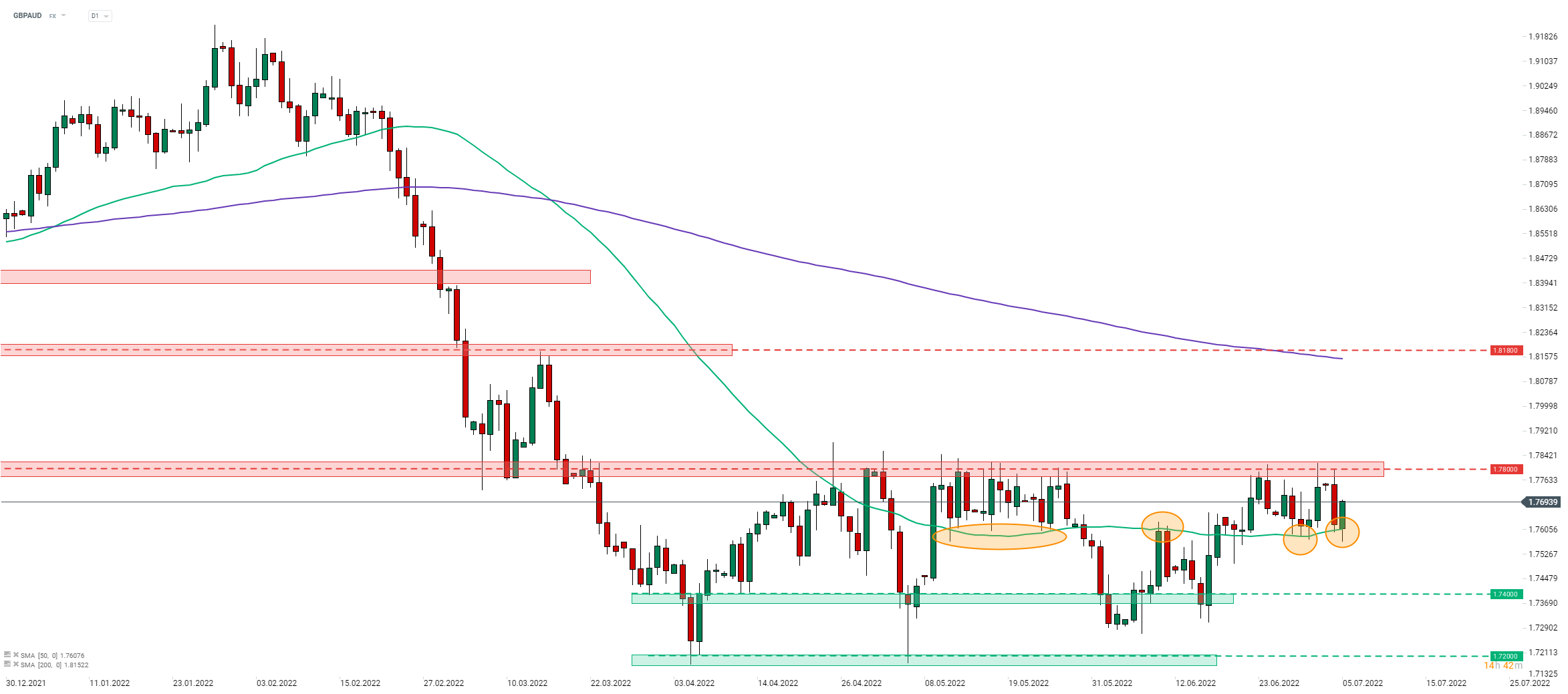

AUD barely experienced any reaction to the RBA decision as a 50 bp rate hike was expected and priced in. The Australian dollar has later lost some ground and is now one of the worst performing G10 currencies. Taking a look at GBPAUD at D1 interval, we can see that the pair made an attempt at breaking below 50-session moving average (green line) earlier today. However, bears failed to push the pair below and a recovery move was launched. Note that this moving average has served as a turning point a few times already (orange circles). Should the recovery move continue, a resistance zone in the 1.78 area will be the first target for buyers. The pair may experience some elevated volatility after 10:30 am BST as BoE is expected to release a financial stability report and remarks from BoE Governor Bailey will follow at 11:00 am BST.

Source: xStation5

Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.