-

The UK labor report showed a decrease in the unemployment rate, which fell to 3.8% from the previous 3.9%.

-

The payrolls report revealed a 6.5% increase in wages in April, surpassing expectations for 6.1%.

-

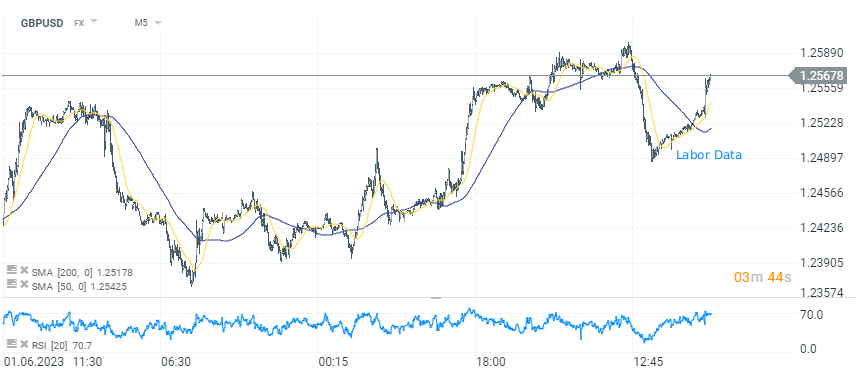

GBPUSD has risen from 1.2530 to a high of 1.2566 after the publication of the labor data.

Labor data

The UK labor report outperformed expectations, demonstrating the resilience of the labor market despite economic pressures. The unemployment rate dropped unexpectedly to 3.8% from 3.9%, propelled by a significant rise in employment, with a growth of 250K in the three months to April. The report also showed a decline in those seeking out-of-work benefits and a 6.5% increase in wages in April, exceeding market forecasts. However, gains may be limited due to ongoing concerns about inflation in the UK.

Economic outlook

The robust labor data suggest that the UK economy is doing better than predicted despite high inflation and rising central bank interest rates. The job report indicates that workers are demanding and receiving pay awards, which, coupled with businesses' higher pricing intentions, risk of a wage-price spiral. As such, the Bank of England may decide to continue raising interest rates to fight inflation.

GBPUSD

Post-publication of the labor data, GBPUSD has seen a modest rise. The pair is currently hovering near the highs, although the jump only roughly halves the losses from the previous day. Given that markets have already priced in about 100 bps worth of future rate hikes, this report doesn't significantly change that. Therefore, the gains for the pound may be more limited if solely reacting to the labor data. Additionally, GBPUSD performance will be highly reactive to the upcoming US CPI inflation report and the tone set by the Federal Reserve. The possibility of a future rate hike in July by the Federal Reserve may support dollar and could put a downward pressure on GBPUSD currency pair.

Post-publication of the labor data, GBPUSD has seen a modest rise. The pair is currently hovering near the highs, although the jump only roughly halves the losses from the previous day. Given that markets have already priced in about 100 bps worth of future rate hikes, this report doesn't significantly change that. Therefore, the gains for the pound may be more limited if solely reacting to the labor data. Additionally, GBPUSD performance will be highly reactive to the upcoming US CPI inflation report and the tone set by the Federal Reserve. The possibility of a future rate hike in July by the Federal Reserve may support dollar and could put a downward pressure on GBPUSD currency pair.

GBPUSD, M5 interval, source xStation 5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.