The UK jobs report for August released this morning turned out to be better than the market had expected. Unemployment rate dropped from 3.6 to 3.5% while the median consensus was for it to stay unchanged at 3.6%. Wage growth also surprised to the upside with headline wage growth coming in at 6.0% YoY (exp. 5.9% YoY) while wage growth excluding bonuses accelerated to 5.4% YoY (exp. 5.3% YoY). However, the release failed to support GBP with the currency being among G10 top laggards and GBPUSD looking towards 1.10 handle again.

The Bank of England continues to try to calm the situation on the UK bond market but it is starting to look somewhat strange. Announcement was made today saying that the Bank will also purchase inflation-linked bonds (so-called linkers) as those have seen significant repricing at the beginning of this week. Why is it strange? Firstly, it is unusual for the UK central bank to purchase inflation-linked bonds as it was not done in any of the previous rounds of QE. Secondly, UK fiscal authorities will auction 900 million GBP worth of inflation-linked bonds this afternoon. So… BoE is buying linkers in the market propping up demand while the government is simultaneously selling them increasing supply. BoE bond purchases are set to end this week but with no major relief in sight and a risk of massive spike in bond market volatility after that, there is a chance that they will be extended at least until month's end when the medium-term budget is announced and some concerns over financing of massive tax cuts are alleviated.

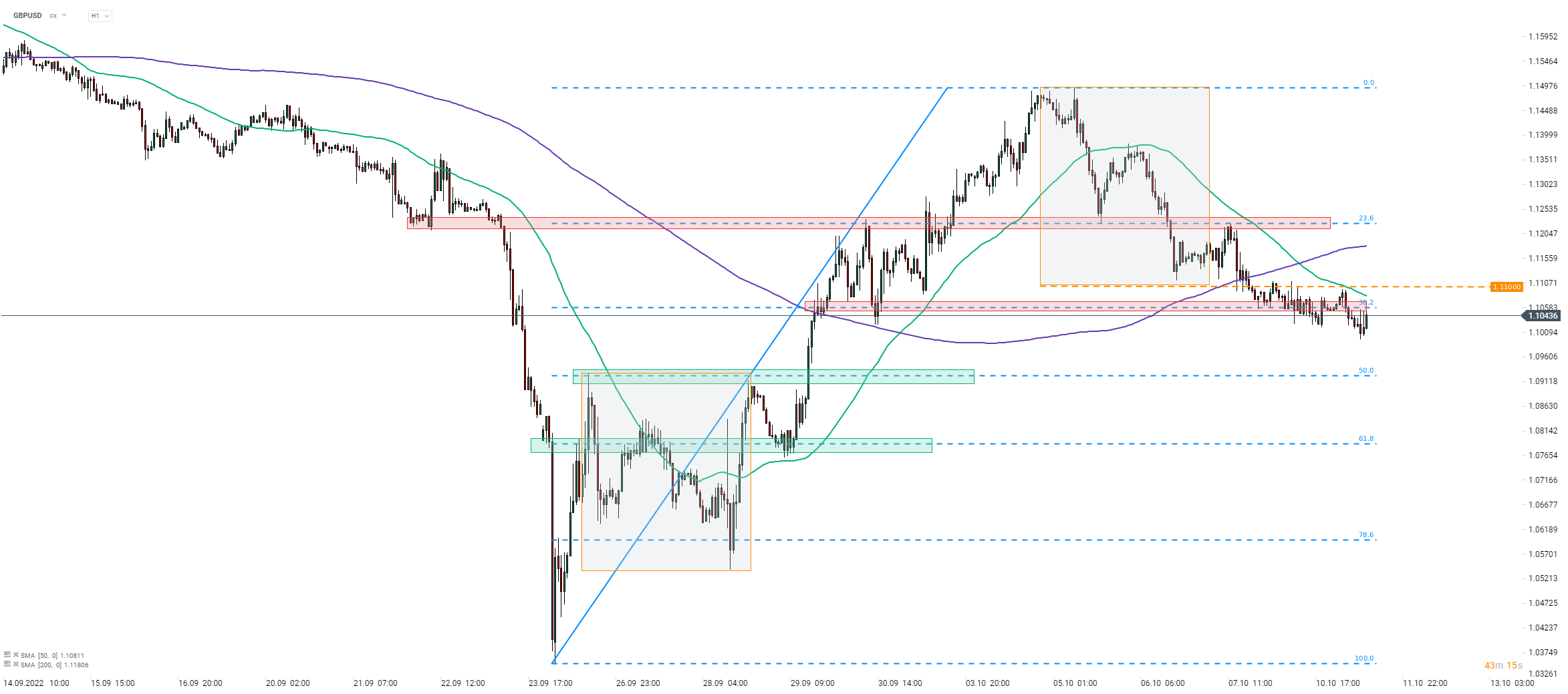

Taking a look at the GBPUSD chart at H1 interval, we can see that the pair seems to have ended the recent rebound. A drop below a 1.11 handle at the end of the previous week also meant a break below a local market geometry, signaling a potential end of a short-term trend. GBPUSD also broke below a swing level marked with 38.2% retracement of a recent upward impulse but attempts are made to climb back above. However, those were unsuccessful so far. Should a slide continue, the next support to watch can be found at 50% retracement in the 1.0925 area.

Source: xStation5

Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.