- Precious metals extend their deepest correction in months

- On a monthly basis gold still remains up 5.8%

- The closest historical parallel to the current situation was July–August 2011

- ETF funds continue to accumulate

- Precious metals extend their deepest correction in months

- On a monthly basis gold still remains up 5.8%

- The closest historical parallel to the current situation was July–August 2011

- ETF funds continue to accumulate

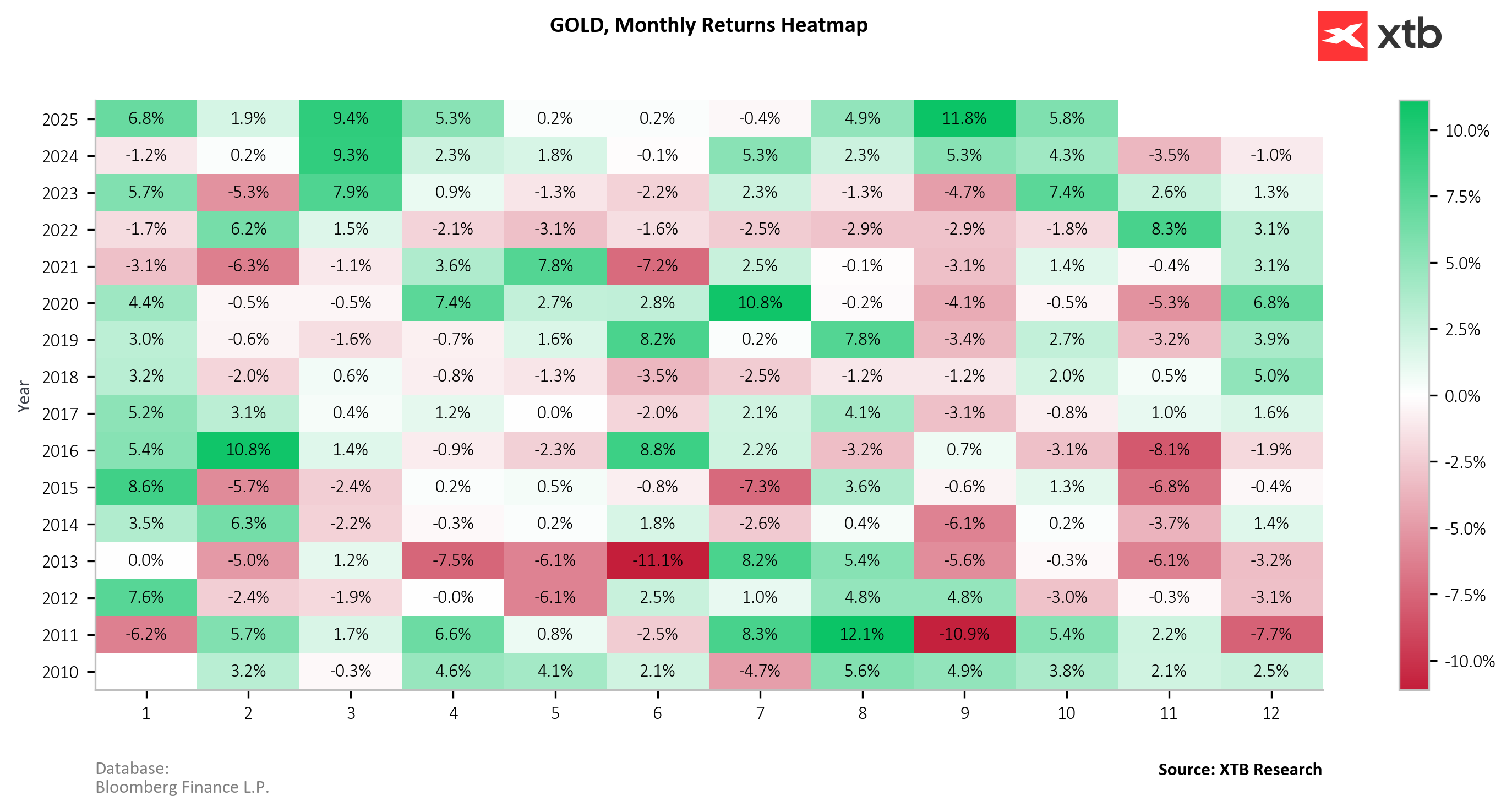

Precious metals extend their deepest correction in months. As of publication time today, gold is down another 1.00% to $4,085, silver falls 1.26% to $48.20, platinum declines 0.55% to $1,609, and palladium drops the most — 2.10% to $1,411. During the current correction, gold has lost a total of 6.50%, while silver is down 11.60%. Nevertheless, recent gains were so significant that on a monthly basis gold remains up 5.8%. Before the correction began, gold recorded two consecutive months of double-digit gains, a rare occurrence over the past 15 years of data.

The closest historical parallel to the current situation was July–August 2011, when gold rose 8.3% and then 12.1% month-over-month. In the following month — September — gold dropped 10.9%. The current setup is even more extreme, as gold has not only rallied sharply in the past two months but has also posted strong year-to-date gains. However, the macroeconomic and geopolitical environment is now substantially different.

Still, at levels above $4,300 per ounce, we observed a surge in retail buying, which may act as a contrarian signal. While long-term fundamentals remain supportive, seasonality and technical analysis point to a possible local top and a flat year-end performance. Meanwhile, ETF funds continue to accumulate, but on the Shanghai exchange, there has been a sharp reduction in long positions and a decline in silver inventories, which may suggest profit-taking.

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.