Oil prices make another jump today, following a break above previous post-pandemic highs at the end of the previous week. Brent (OIL) moved to a fresh 7-year high today and reached a daily high just slightly below $88 per barrel. Oil traders look past rising Omicron case count around the world and new restrictions being imposed. Goldman Sachs came out with a new forecast for Brent expecting price to average at $96 per barrel this year and $105 per barrel in 2023. Goldman sees Brent price surpassing the $100 mark in the third quarter of this year. Apart from that, supply disruptions in Libya and Kazakhstan have not been fully resolved yet, which is also boosting the fundamental outlook for higher prices. Last but not least, Houthi launched a drone attack on an airport in the United Arab Emirates, sparking fears that the situation in the Middle East, a key oil producing region, may get more tense soon.

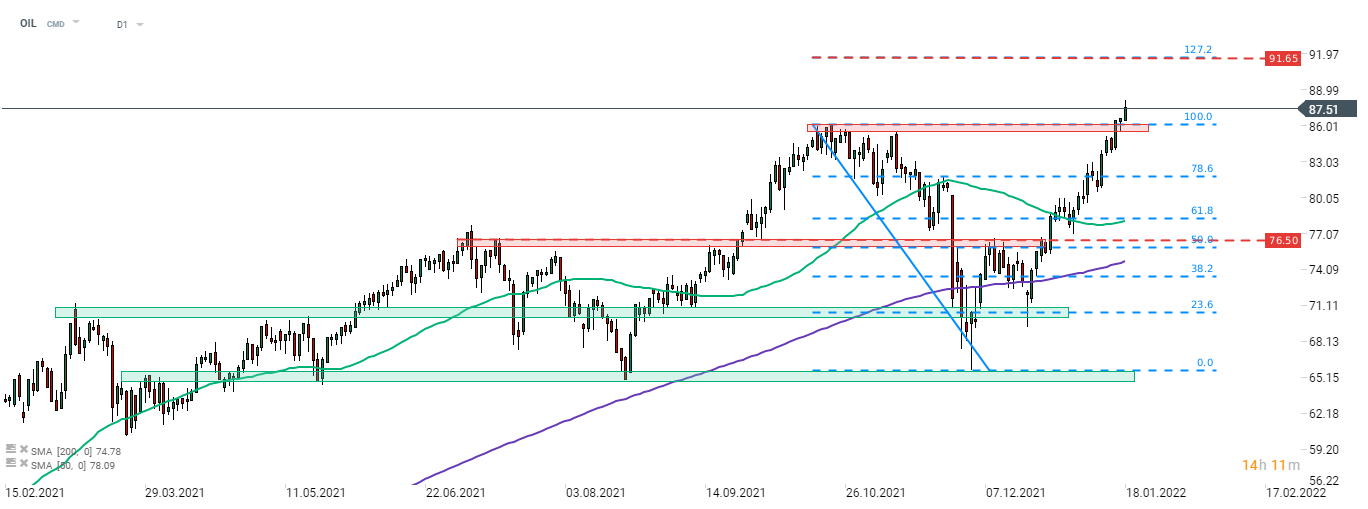

A look at the OIL chart shows a massive over-30% rally off the December lows. Price broke above the resistance zone in the $86.00 area at the end of last week and the upward move is being continued this week. The next support level to watch is marked with the 127.2% exterior retracement of a October-November 2021 drop ($91.65).

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.