Weekend meeting of OPEC+ group was watched closely but was not expected to result in any changes to the level of agreed output cuts. This turned out to be partially true. While OPEC+ decided not to deepen output cuts, it has agreed to extend the current output cut agreement through 2024. However, Saudi Arabia announced that it will make a voluntary output cut of 1 million barrels per day. The cut was announced for July only but Saudi officials already warned that it may be extended if the situation requires it.

Baseline production levels were adjusted for 2024 and it could be seen as somewhat bearish. This is because production quotas were redistributed from countries that struggled to meet production targets to countries that have spare production capacity. As a result, it may lead to better compliance with production targets across the group and, in turn, to higher combined production.

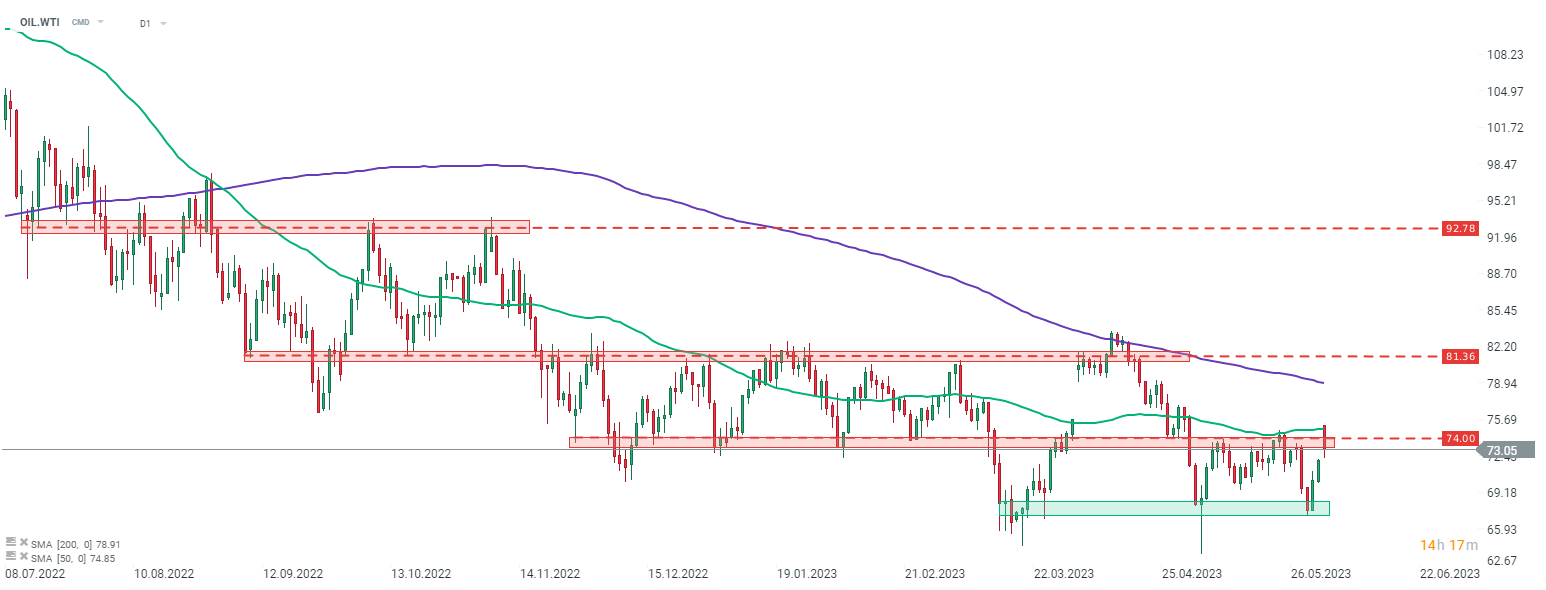

Taking a look at WTI chart (OIL.WTI) at D1 interval, we can see that the price launched a new week with a big bullish price gap. While Brent (OIL) jumped around 1.7% at the beginning of a new week, WTI opened with an around-4% price gap. OIL.WTI jumped above the $73-74 per barrel resistance zone and tested 50-session moving average (green line). However, bulls failed to break above it and gains started to be erased as the Asian session progressed. Price has almost completely filled the bullish price gap but has bounced off the daily lows since.

Source: xStation5

Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Oil Under Pressure as G7 Decision Remains Pending

US Open: Oil too expensive for Wall Street!

OIL: Prices soar to $120 a barrel; Israel bombs Iran's oil facilities 📌

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.