Oil is trading more or less flat at the beginning of a new week. Outlook for oil is unclear due and it can change any minute due to numerous factors involved. On one hand, there is a risk that OPEC+ does not have enough spare production capacity to keep boosting supply in-line with its agreement. On the other hand, production in Libya and Kazakhstan has been almost fully restored already. On top of that it should be noted that Iranian nuclear talks are still ongoing. If agreement with Iran is reached and Iranian oil is allowed back into international markets, risk of oversupply would arise that may have a potentially negative impact on prices. Nevertheless, talks with Iran seem to be going nowhere as the country wants the United States to lift economic sanctions before any concessions related to nuclear issues are made.

Speaking of oil, China will host oil ministers from Saudi Arabia, Oman, Kuwait and Bahrain. Talks are expected to center around security of supply amid the situation in Kazakhstan but discussions on the Iran situation as well as Gulf states over-reliance on the United Stated are also expected to be held.

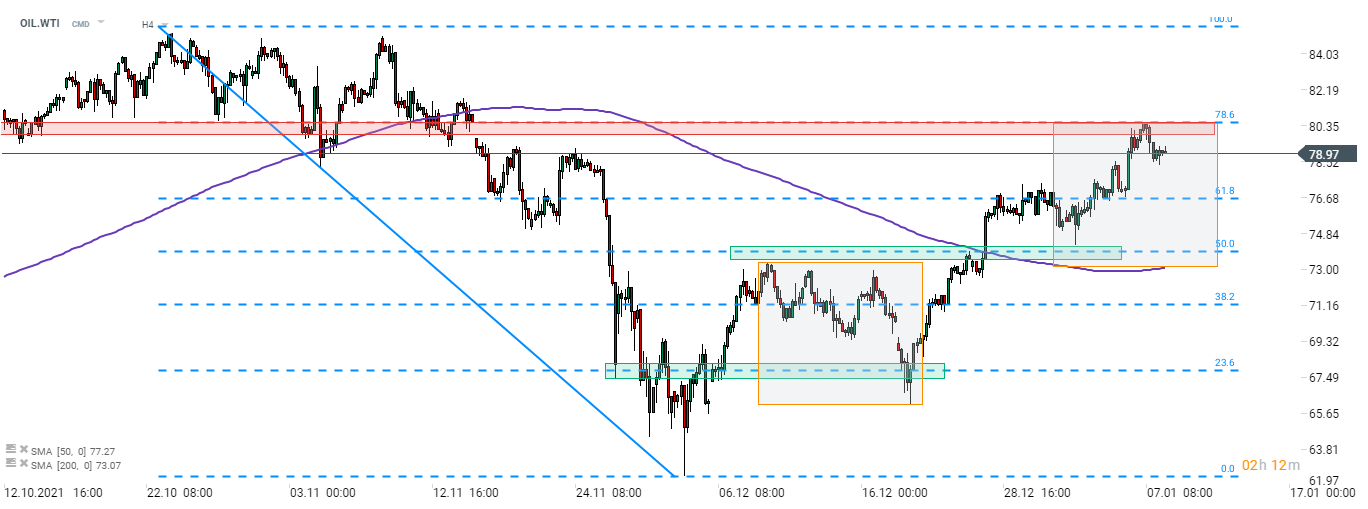

Taking a look at OIL.WTI chart at H4 interval, we can see that the recent upward impulse was halted after price reached 78.6% retracement of the downward move started in October 2021. After a brief pullback, OIL.WTI started to trade sideways near the $79 handle. The near-term resistance to watch is the aforementioned zone ranging below 78.6% retracement ($80.50) while the near-term support can be found at 61.8% retracement ($76.60).

Source: xStation5

Source: xStation5

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.