Oil price ticks higher due to a combination of factors impacting both supply and demand. Positive US economic growth and Chinese stimulus measures have boosted demand expectations. On the supply side, tensions in the Middle East, particularly the attack on an oil tanker in the Gulf of Aden and concerns over disruptions in oil supply, have added support to oil prices. Additionally, a significant drawdown in US crude stockpiles suggests tighter supply, further pushing up prices. This is also complicated by rising a geopolitical risk, following the drone strike by Iran-backed militants in Jordan, which killed three US troops and the strike of a fuel tanker in the Red Sea.

- Middle East tensions, particularly the Houthi military operation targeting an oil tanker in the Gulf of Aden.

- Three American soldiers were killed and more than 34 were injured in a drone attack on a US military base on the Jordan-Syria border. Biden stated that the attack was organized by "radical militant groups supported by Iran” and retaliatory actions are planned.

- Increase in US oil rigs as reported by Baker Hughes, indicating potential changes in oil production levels.

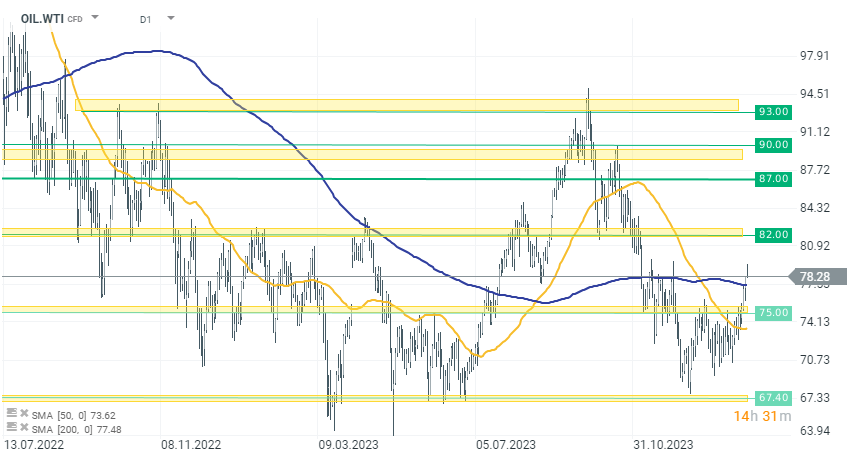

Looking at the oil prices (OIL.WTI), we observe a rebound in prices after the formation of a double bottom around $67.40 per barrel. After the breakout, the price surpassed another resistance at the $75 level, which is currently the nearest support zone. From below, oil quotes are still supported by the 200 SMA average. The nearest range or resistance of the current upward movement is the $80-$82 per barrel zone.

Source: xStation 5

Daily Summary: End of the week in the red, tech rally waning

🔝Silver Jumps 10% Weekly, up 120% YTD

Chart of the day - SILVER (12.12.2025)

BREAKING: UK GDP and manufacturing lower than expected 📉Final German CPI in line with expectations

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.