Platinum Slides 5% After Hitting All-Time High at $2,472 Amid Broad Precious Metals Sell-Off.

After breaking the all-time high at $2,472, the PLATINUM contract moved sharply into defensive territory. The decline found support at the 23.6% Fibonacci retracement level and is currently trading around the close on December 23. Source: xStation5Source: xStation5

From early December to mid-Asian session today, platinum futures surged a record 50%. The RSI indicator was already near overbought territory (70<) at the start of the last steep rally, when prices were flirting with the then-ATH near $1,700 (yellow zone). Concerns about overvaluation did not prevent further euphoria. Platinum gains were initially driven by broad bullishness in precious metals, fueled by expectations of further monetary easing. Lower interest rates would increase market liquidity, boosting broad demand and reducing the opportunity cost of holding commodities versus interest-bearing deposits or bonds. For platinum specifically, shortages played a key role, highlighted by strong industrial demand (particularly for automotive catalytic converters) and jewelry.

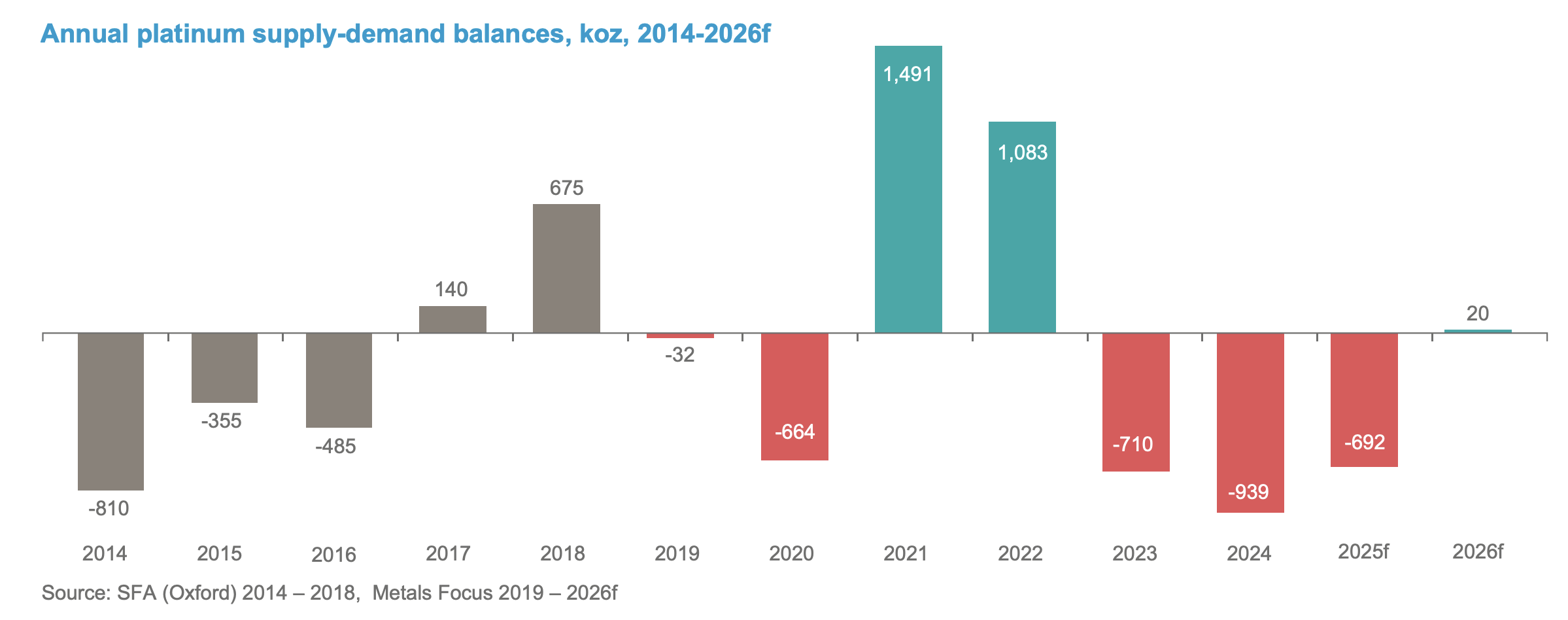

Platinum’s chronic deficit is expected to ease in 2026. Source: World Platinum Investment Council Q3 2025 Report

However, the safe-haven appeal failed to support precious metals at year-end. While the Trump-Zelensky talks produced no concrete peace breakthroughs on paper, hopeful narratives about the “war nearing its end” and “90% agreement on the peace plan” were enough for investors to take profits in overbought markets. Alongside platinum, GOLD (-1.4%), SILVER (-4%), and PALLADIUM (-12%) also declined.

The sell-off in precious metals was further supported by stabilizing expectations around the Fed’s January move (swap markets price an ~80% chance of rates remaining unchanged) and caution ahead of tomorrow’s FOMC minutes release. Platinum, however, faces supply-side pressures that are expected to normalize after years of deficits in 2026. The WPIC November report noted slightly lower industrial consumption in key sectors (catalysts and jewelry), and steeper declines in palladium may further encourage manufacturers to substitute platinum with a cheaper alternative.

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.