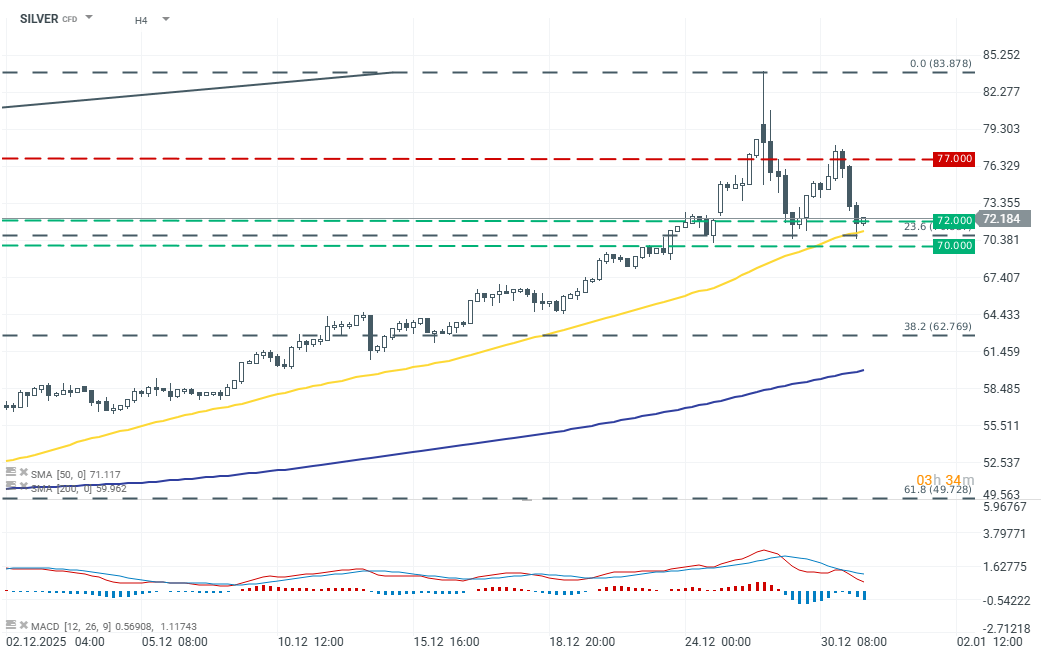

Silver is falling again after yesterday’s brief rebound. The price is currently down 5.30% to 72.130 USD, testing both the 23.6% Fibonacci retracement of the latest upward move and the 50-period SMA on the H4 interval. The pullback is a continuation of Monday’s sell-off linked to higher margin requirements — the increase in the maintenance margin on COMEX triggered a rapid decline of up to 15% from peak to trough. Despite elevated volatility, speculative positioning remains relatively limited, while both supply and demand continue to display high inelasticity. Structural demand from photovoltaics and electronics — including AI-related applications — remains strong. Estimates indicate that meaningful demand destruction in the solar sector would only emerge at prices above roughly 130 USD/oz. On the supply side, production growth is constrained, as silver is predominantly a by-product of mining other metals, and recycling is increasing only gradually.

From a broader market perspective, long-term fundamentals remain supportive; however, the latest upward wave was exceptionally steep, creating room for a deeper short-term correction alongside renewed testing of key technical levels. China’s decision to tighten export controls — effectively elevating silver to the status of a strategic commodity — increased interest in the physical market and contributed to earlier price gains, with buyers in Asia paying premiums above spot. At current levels, near key support, restoring bullish momentum would require a daily close above the 23.6% retracement; failure to defend this area — especially in combination with a test of the 50-SMA on H4 — may signal a short-term trend reversal.

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.