Today as well as the next two days may be crucial for the US tech sector as 5 mega-tech companies are set to report earnings for calendar Q3 2022. First reports - from Alphabet (GOOGL.US) and Microsoft (MSFT.US) - will come after the close of the Wall Street session today. Meta Platform (META.US) will report tomorrow after the close of the session while Amazon (AMZN.US) and Apple will report on Thursday, also after close. Reports from this group of stocks may set the tone for a broader tech sector. Some of the reports already released, like the one from Snap, hinted that ad-related businesses may be struggling, meaning that Alphabet and Meta may be set for a poor quarter. News hit the markets yesterday saying that Apple will boost pricing of its services. When it comes to Amazon, the report will show how the consumer is holding up amid increased macroeconomic uncertainty and spiking inflation. Also, reports from Amazon and Microsoft will provide an outlook on the cloud sector.

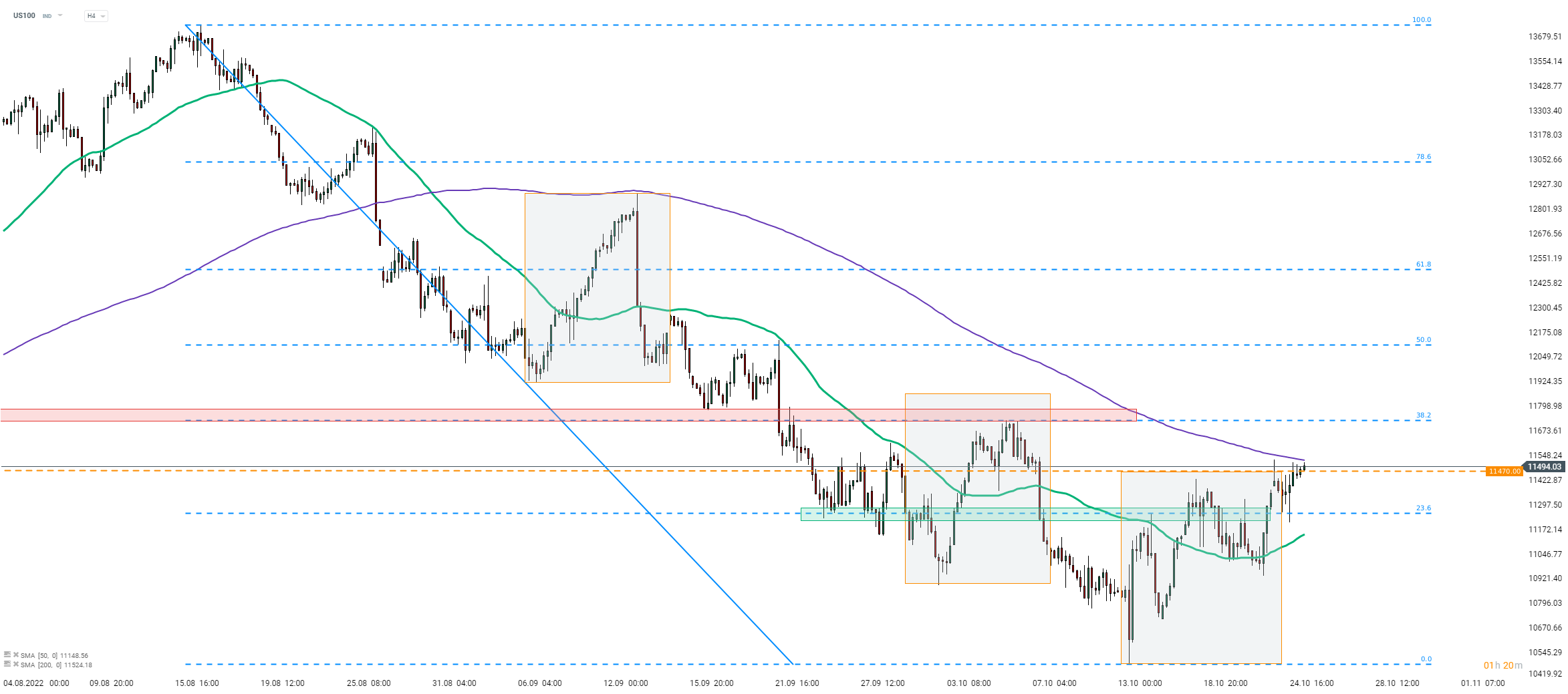

Taking a look at Nasdaq-100 chart (US100) at H4 interval, we can see that the index is making a break above the upper limit of a local market geometry. However, another important resistance can be found slightly above this hurdle - 200-period moving average (purple line). As a result, the whole area surrounding 11,500 pts handle can be seen as an important resistance. Should we see a break above it, the next target for bulls could be 38.2% retracement of the downward impulse launched in mid-August in the 11,725 pts area.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.